Summary from J Capital

Management seems to have given away Cynviloq (a generic Abraxane candidate), the only promising drug the company ever looked like it might commercialize, for a pittance.

Sorrento’s dilutive financing deals benefit a select group of investors close to the CEO.

Just this morning, Sorrento announced a $120.5 mln convertible note, ensuring at least an additional 20% dilution.

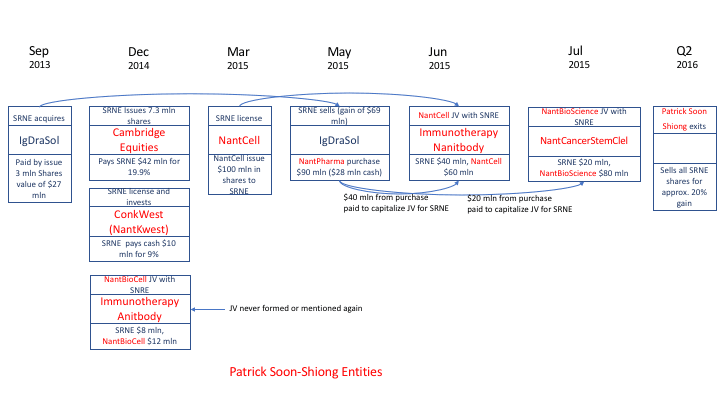

We have identified a pattern of circular transactions and capital-intensive joint ventures that never show results.

Sorrento does not have a single product on the market despite $168 mln spent on acquisitions and $170 mln on R&D through 2017.

J Capital thinks Sorrento Therapeutics is a zero. We think management is trying to pump up the share price and personally benefit from options at the expense of the company’s underlying value. We think that management’s focus on creating personal wealth has actually destroyed the potential that Sorrento once had.

You should assume that J Capital is short SRNE shares directly or indirectly and therefore may have a conflict of interest. We encourage investors to undertake their own investigation.

- Management seems to have given away Cynviloq (a generic Abraxane candidate), the only promising drug the company ever looked like it might commercialize, for a pittance. Sorrento not only sold the drug to its chief competitor but then turned around and gave the cash payment back to that competitor and, seven months later, BOUGHT back 40% of the drug! We calculate that Sorrento actually paid the Nant network of biotech companies $6 mln on net in the complicated set of transactions.

- Sorrento’s dilutive financing deals benefit a select group of investors close to the CEO. An investor group in 2016 took the company to court for dubious dilutive deals, and management had to give back options. But the company is continuing this pattern. It has just registered 34.2 mln shares and warrants for sale in two separate S-3’s filled on March 22, and we think management and financing partners will soon be dumping shares that could be as much as 39% of the company’s shares outstanding as of December 31. The HK/China-based investors close to the CEO will be able to realize gains of >300% in three months.

- We have identified a pattern of circular transactions and capital-intensive joint ventures that never show results. Many joint ventures have no clear purpose and have created no advancement in product development to date. JVs with the Nant network of biotech companies to which Sorrento contributed $60 mln and circular transactions with HK-based biotechnology companies are examples of such dubious spending.

- Sorrento announced a $120.5 mln convertible note this morning, ensuring at least an additional 20% dilution to shareholders who have already experienced >40% dilution in the last 6 months. Given the company’s track record of cash incineration and lack of focus with regard to drug development, we doubt this will be more than a stop gap and may even limit the company’s available options for fundraising further funding down the line.

- We suspect that finance managers may have disagreements with the company, as the company has lost a large number of CFOs, accounting directors, and audit committee heads, and Deloitte was replaced as auditor in March after only two years by relatively low-ranked Mayer Hoffman McCann.

- Sorrento does not have a single product on the market despite $168 mln spent on acquisitions and $170 mln on R&D through 2017. Yet the company still won’t rule out future acquisitions, and SRNE is still continuing to raise and squander money, over the vociferous objections of scientists who have associated themselves with the company. Sorrento has just one product, ZTlido, which received FDA approval a month ago. But management calls it “non-core,” and last week’s registration of shares in Scilex--the company responsible for ZTlido—may suggest that the Scilex founders have little confidence in the product.

- Management has a history of making highly promotional claims about its pipeline of drugs, calling its CD38 CAR-T, for example, “the most advanced” in development. This is clearly untrue. Sorrento has fallen far behind companies like Celgene in innovativeness and in progress toward commercialization.

- We are aware of one incident where SRNE executives asked Bioserv (a subsidiary) to disregard human safety and ship a contaminated product. Two former employees provided us with a detailed account of an incident in April 2017 when a senior member of management directed staff at the Bioserv subsidiary to ship an injectable drug even though the company knew it was contaminated with glass. Two executives quit in protest over the incident and at least one more was fired, apparently for resisting management’s pressure to ship. Fortunately, the company never shipped the contaminated medicine.

- We believe Sorrento is a zero. Even if you think that Sorrento’s antibody library and other assets have scientific merit, each requires tens of millions of dollars and, more importantly, clear strategic focus to commercialize. Given the perilous condition the company finds itself in financially, it is hard to understand why any potential acquirer would pay more than fire-sale prices.

Anne Stevenson-Yang

We believe there is ample evidence to show that management at Sorrento Therapeutics is taking money out of the company that should belong to public shareholders. We encourage investors to undertake an investigation and to reach their own conclusions.

An unparalleled ethical breach that we were told took place in April 2017 illustrates what we believe are consistently low ethical standards at Sorrento.

“I resigned my position with Sorrento” after being asked to engage in “morally objectionable” behavior.

Former Bioserv executive

Sorrento’s Bioserv subsidiary fills small batches of capsules and vials with pharmaceuticals for clients in phase 1-2 testing. Based on conversations with two former Sorrento managers who are familiar with the situation at Bioserv, we have learned that the company undertook a rush job for a Chinese client in April 2017. To meet the deadline, Bioserv agreed to use vials supplied by the client.

But the solution reacted with the glass, which may have been damaged during shipping, and glass flaked off and fell into this injectable pharmaceutical.

The Bioserv managers stopped all processing and provided documentation to Sorrento management. But the former employees said that management’s response was to yell at the Bioserv team and insist that they must complete the run. Two top managers of Bioserv resigned in protest. At least one more employee was fired in May, apparently for opposition to management on this issue.

To the extent that this account is accurate, it betrays a lack of ethics in Sorrento. We think that an excessively aggressive corporate culture permeates senior ranks of the company and extends to a get-rich-quick attitude that is toxic to Sorrento as a company. IR has as yet not responded to a query about the incident.

How the money leaks out

Our investigations indicate that there are three principal channels through which money leaves the company and could possibly get redirected to management: the China businesses, transactions with the Nant network of biotech companies, and acquisitions and financings.

To and from China

Sorrento China has spent at least $25 mln on Chinese joint ventures, minority stakes in other companies, and its own operating subsidiaries, but it has no research results to show and is no nearer to commercialization of any drug. Several of the transactions are circular, and none appears to make sense for the research agenda.

For example, Sorrento’s partner 3SBio contributed $10 mln to a joint venture, then the joint venture bought $10 mln in Sorrento shares.[1] The Hong Kong-listed Lee’s Pharmaceutical (950 HK), bought shares in Sorrento rather than paying the company for technology.[2] A cooperation with Lee’s on the ZKAB001 oncological antibody has not advanced in nearly four years. Nothing has been heard from Mabtech Ltd., to which Sorrento paid $10 mln in 2015, or Yuhan Corp., with which Sorrento has had a cooperation for two years. Since Henry Ji is constantly seeking investment from Chinese sources, we cannot rule out that the ventures may be used as sweeteners for potential investors by providing capital or fodder for press releases. At any rate, it is difficult to determine what Sorrento wants to achieve for shareholders.

The same focus on insider benefits is in evidence in the Chinese financing deals. The December financing raised $50 mln from five BVI companies that IR told an investor are close to CEO Henry Ji and come from his “very extensive network of potential investors in China.”[3] These financiers stand to gain as much as 308% at the Friday, March 23 closing price on an investment made in December.

Gain on Investment in Convertible Securities

| Promissory note | Shares | Conversion Price | Price 3/23/2018 | Column1 |

| $ 50,000,000.00 | 22,038,567 | $ 2.27 | $ 6.90 | $102,066,115.70 |

| Warrants | Conversion Price | Price 3/23/2018 | ||

| 12,121,210 | $ 2.61 | $ 6.90 | $ 51,999,990.90 | |

| Return | 308% |

Source: Company S-3’s March 22, 2018, J Capital

Sorrento’s Chinese businesses themselves seem to create opportunities for management enrichment at the expense of shareholders.[4]

- Who owns the China businesses? Sorrento acquired Concortis Biosystems in December 2013 from David Miao and Gang Chen, who became the company CTO and senior scientist, respectively. Chinese records indicate that David Miao maintained personal ownership until November 2016 even though Sorrento had bought it three years earlier, raising questions about whether any profits in those years may have gone to him personally. As part of the Concortis deal, SRNE issued 1.33 mln shares, and it appears that Concortis shareholders have sold out.[5]

- And now, another insider: Richard Hui Li, head of China operations, is currently personally an equity owner in the Concortis Biosystems China sub, according to Chinese records, which also indicate that Sorrento has injected RMB 50 mln (almost $8 mln). Li’s share means that he benefits personally from the company’s injection of capital and other resources.

- Undisclosed management stake: David Miao, who was CTO from 2013-16, is 40% owner of a company that Sorrento reported controlling, Jiangyin Kangnuotai Biotech.[6] The reference is buried in an exhibit attached to an 8-K filed November 14, 2013. That company was capitalized at RMB 5 mln (about $800,000) two months before the 8-K, suggesting that Kangnuotai had only just been established and could even have been just a mechanism to convey that $800,000 to private parties. The 40% equity also could have conveyed profits to Miao, if there were any.

- Another company in the group, Jiangyin Concortis is 45% owned by David Miao’s brother, named Miao Zhenlang,[7] This company received RMB 3.2 mln in capital investment from Jiangyin Kangnuotai, a Sorrento sub.[8] It is unclear why David Miao’s brother should have been involved in a Sorrento-invested company. Personal benefit for David Miao is one possibility.

- Business on the side: David Miao in March 2014 founded a company called Hangzhou Yingbai Rui Biopharmaceutical Technology Co. Ltd.[9] David Miao is also part of the “core technology team” of Ruida Health Group based in Anhui Province and is legal representative of a drug manufacturing subsidiary called Hefei Daruijing. All this indicates that Miao has been actively engaged in operating businesses that ostensibly conflict with the interests of Sorrento China.

- The official Sorrento office, in Shanghai, is not actually there. When we visited the registered address of Sorrento Therapeutics (Shanghai) Co., Ltd., an unrelated company was operating on the premises, raising questions about how substantive the China operations really are. We spoke with employees at the company operating at Sorrento’s registered address, and they had not heard of Sorrento. Notwithstanding, TnK Therapeutics on March 25, 2016 injected $607,000 into the apparently phantom China company.

An unrelated company is operating at the reported address of Sorrento Shanghai. Photo by J Capital.

- In its Q1 2016 report, Sorrento mentioned that it had controlling interest in Zova Biotherapeutics Inc. In 2014, Sorrento put RMB 27 mln, worth about $4 mln, into Zova Biotherapeutics for 30% of the company but never explained the purpose of the investment or provided the number to investors. This is another investment that has no obvious benefit for Sorrento and could benefit insiders who sit on the Zova board.

None of these ownership stakes or capital injections is very big. But they suggest that Sorrento may be conveying benefits to individual managers without telling shareholders.

Circular transactions with the Nant Network

The second major sluice gate for assets out of the company has been the network of companies sometimes called the “Nant network.” Sorrento did a dozen deals with the Nant network in 2014-15 that culminated in what amounts to the giveaway of what arguably was Sorrento’s most valuable asset, the drug Cynviloq.

Cynviloq is a cancer drug that competes with Abraxane. Celgene had bought Abraxane for $2.9 bln in 2010, and the drug is expected to achieve at least $1 bln in sales by 2020, triggering a royalty to Patrick Soon-Shiong—who was behind Abraxane.

Vuong Trieu, the co-developer of Abraxane along with Soon-Shiong, formed a company called IgDraSol in May 2012 specifically to create a Gen 2 version of Abraxane called Cynviloq. IgDraSol partnered in March 2013 with Sorrento. In September 2013, Sorrento acquired IgDraSol in a deal valued at $29.1 mln.[10]

In May 2015, Sorrento announced positive results from the “Tribeca trial” of Cynviloq. Then, on May 15, Sorrento sold IgDraSol and Cynviloq to NantWorks for $90.5 mln plus potential royalties on sales.

A scientist we spoke with who is deeply familiar with Cynviloq believes that it had promise. The drug is made with chemical polymers instead of the albumin that Abraxane requires, making Cynviloq cheaper to manufacture, more environmentally friendly, and potentially able to deliver a higher dose of the critical drug. But NantWorks had no incentive to develop the drug. Said a former executive of Celgene, “Celgene has a lot of investment in [Nant network companies]. It was probably just taking out a competitor.”

Indeed, as of Q1 2018, no sales of Cynviloq have appeared. The sales agreement has been given confidential treatment. According to a public letter to the Sorrento board sent by Wildcat Capital Management in 2016, Soon-Shiong publicly stated that there had been no progress on Cynviloq since the sale and that all data required for regulatory approval would need to be redone.[11]

In sum, Sorrento sold its one shot at a billion-dollar drug for just $60 mln more than it had paid to acquire the company.

But the deal was even worse than that. Sorrento ended up paying to the Nant network almost exactly what it had received from Nant for Cynviloq.

Right around the time it sold IgDraSol (the Cynviloq company) to NantWorks, Sorrento made three deals with NantWorks-related companies:

- On April 11, 2015, Sorrento agreed to contribute $40 mln to a joint venture with NantCell to develop CAR-T products. It paid the $40 mln on July 8.[12]

- On April 29, 2015, Sorrento paid $10 mln to a different Nant network company, NantBioScience, in return for 1 mln shares of common stock in this unlisted company, whose activities and assets were undisclosed.[13] A week earlier, NantCell had agreed to pay Sorrento a $10 mln up-front royalty on the licensing of immune-checkpoint antibodies.

- On July 2, 2015, Sorrento agreed to contribute $40 mln for 40% of another joint venture with NantWorks called NantCancerStemCell LLC. The company paid $20 mln in July 2015 and, in October, apparently strapped for cash, was relieved of its commitment to the rest, and its equity was reduced to 20%.

In total, Sorrento paid to the Nant network a net $60 mln of the $90 mln that Sorrento was supposed to receive for IgDraSol. In the 2017 10-K, the company reports:

“Pursuant to the agreement, NantPharma paid the Company an upfront fee of $90.1 million, of which $60.0 million was required to be used by the Company to fund two joint ventures, as described below. “ (page 107)

So Sorrento had managed to clear $30 mln—less than $1 mln more than it had paid for IgDraSol in the first place. But then, last summer, Sorrento lost out even on this $30 million. Sorrento admitted that its joint venture with NantWorks spent $90 mln to buy back Cynviloq! Since Sorrento owns 40% of that joint venture, the company declared an impairment of $36.5 mln.

Not only that, but Sorrento agreed it would pay any licensing fees on future sales: “As part of the sale, we agreed with NantPharma to be responsible for and pay all milestone and license fees required to be paid to Samyang under the Exclusive Distribution Agreement following notification from NantPharma when such milestone and license fees become due and payable. If such milestone or licenses fees become due and payable, the payment thereof could materially harm our business and financial condition.”[14] (Sorrento had acquired a critical ingredient of Cynviloq from Samyang.)

In the end, Sorrento PAID money[15] to the Nant network and gave it majority control of Cynviloq. We’re not sure what Sorrento received in return. Because NantWorks has no incentive to develop Cynviloq, we are skeptical that Sorrento will ever receive royalties.

In fairness, Sorrento undertook so many deals with Nant network companies in 2014-16 that we wonder whether an enterprising university might offer a degree specifically in reading the Sorrento disclosures. Most deals were revised at least once after the initial announcement, and there was almost no information provided on what the purpose of the cooperation was or what the money would be used for. It is easy to miss things in all the announcements. But maybe that’s the point.

The Nant relationship

The transfers of Cynviloq back and forth between Nant network companies and Sorrento are not the only instances of Sorrento’s strange and seemingly circular deal making. Some examples:

- On March 1, 2015, the company received a commitment of $10 mln from NantCell, a Nant network company, in return for licensing CAR-TnK products. (10-Q May 5, 2015 page 6)

- On March 16, 2015, the company paid $10 mln to Conkwest Incorporated, another Nant company, as part of an investment in Conkwest equity. (2014 10-K page 2)

- In transactions on December 23, 2014 and March 1, 2015, SRNE agreed to sell shares to Soon-Shiong vehicle Cambridge Equities for $41.7 mln. (8-K 12/23/2014)

- SRNE then agreed to pay $40 mln to capitalize its share of a Nant company called NantCell.[16]

Virtually no cash appears ever to change hands. For example, in the complex 2015 transactions with Nant, ostensibly yielding $90 mln cash to Sorrento, Sorrento booked an additional 1) asset: $89 mln in investment in common stock 2) asset: $10 mln in cash 3) liability: $99 mln in deferred revenue.

Sorrento did emerge from a blizzard of transactions with the Nant network with a solid asset: shares in the newly listed company Nantkwest (NK NYSE). But on July 1, 2016, Sorrento inexplicably swapped its NK stake for the SRNE shares owned by the Nant Network (8-K 7/72016). In a 13G filed in February 2017, Sorrento reported having no ownership in NK. (13G/A, 2/1/2017)

Nant Network Transactions 2013-16 (simplified)

Source: Company filings

So why did Sorrento sell IgDraSol?

Some say that Henry Ji desperately wanted to be associated with the successful biotech group Nant network, and indeed, the company issued many 8-Ks boasting of the cooperation with NantCell.

Some say that Soon-Shiong outwitted Ji. Others have said it might have been an urgent need for cash. “Maybe it was the best they could do at the time,” said a former executive. Sorrento has increasingly negative free cash flows, but it has raised enough financing that it should not face intense pressure to sell assets.

Dealmaker

Sorrento managers were challenged in 2016 for awarding themselves big chunks of company equity and were forced to give it back. But enrichment of insiders at the expense of public shareholders continues.

In 2016, the WLA group filed a complaint in the. Delaware Court of Chancery against the board of directors for forming random subsidiaries, stuffing them with company assets, then handing out options in the subs to management.

The WLA complaint said: “[T]he Company has been acquiring and/or transferring assets to newly created wholly-owned subsidiaries and then issuing significant amounts of those subsidiaries' shares back to the Company's executive officers and Directors through significant grants of options, and warrants for Class B super-voting stock, all exercisable for nominal consideration, thereby engineering a personal benefit for such officers and Directors at the direct expense of the Company and its shareholders.” In March 2017, the company had to agree to cancel all the options and warrants granted to directors in subsidiaries and reimburse $400,000 to WLA for their expenses.

We are not privy to Wildcat’s long-term motives, but the investor’s Q4 2017 sale of shares indicates that they may believe that Sorrento has not changed its ways.

We believe there is evidence that the self-dealing had been a pattern for Henry Ji. A Former SRNE director alleges that Henry Ji deliberately misled the board with respect to a contentious option package that he awarded to himself in 2012. He alleges that Ji changed the 10-K filing after the board had signed off on it, upping his own compensation. We are unable to corroborate the story, but the actions described in the 2016 WLA complaint give the story credence.

Giving away equity

Sorrento continues to give up its shares cheaply and to dilute shareholders for dubious benefit.

- For example, in November 2016, Sorrento agreed to acquire Virttu Biologics for $25 mln in shares of Sorrento and TNK Therapeutics for unclear reasons.

- When Sorrento signed a term sheet to acquire Scilex in August 2016, company executives Henry Ji and George Ng were among the sellers. Considering that the ZTlido product appears to be of low value, the deal, which could cost anywhere between $47-100 mln, looks expensive.

- The deal to acquire Semnur Pharmaceuticals, struck in August 2016, was canceled 14 months later, but not before Sorrento paid $6.9 mln in expenses.

It’s almost as if, once WLA forced the option scheme to end, management found new ways to capture value for themselves.

Again, in December 2017, the financing created massive dilution for what looks like a very low price. Over 2017, Sorrento expanded its share count from 50.9 to 87.4 mln shares, or by 72%.

Former executives of the company with whom we have spoken are brutal in their condemnation. Six executives we spoke with complained that there is no research focus and that resources are wasted on non-core activities. One former executive echoed the general view when he said: “Looking at their program, there’s really no focus. Things just come into the company on a whim.”

Another said that Sorrento acquired assets with “absolutely zero expertise in these areas.” He called the acquisitions “pretty crappy stuff.”

With a burn rate of more than $20 mln per quarter, Sorrento goes through a tremendous amount of capital, considering that the company has no product to manufacture, promote, or sell. Much of the money goes into opaque ventures that regularly get revalued. In 2017, for instance Sorrento reported non-cash income on cost-method investments of $116.2 mln. To achieve that, the company revalued Nant network investments from $112 to $237 mln. That means that substantially all the revenue for the year was non-cash based and could easily be manipulated.

“Not much reason to call themselves a biotech company”

In its focus on dealmaking, Sorrento has lost any scientific edge it had.

Sorrento’s biggest promise to investors is built around a pipeline of pre -Phase 1 CAR-T therapies targeting multiple myeloma. In reality, the only CAR-T the company is developing is the CD38 for myeloma, and in that, Sorrento is far behind the competition and seems not to understand what’s at stake.

In the slide below, Sorrento makes the preposterous argument that its CD-38, so named because it binds to a particular type of cell, is somehow as good as two CD-19s.

Source: 2017 corporate presentation

“CD” is an abbreviation for cluster of differentiation and names cells according to antibodies that bind to them. The idea that CD-38 is greater than or equal twice CD-19 is like stating that five times yellow equals pizza.

If we overlook this promotional slide and focus of the intrinsic merits of CD-38[17], we find that it is indeed a good target for the treatment of multiple myeloma. So good, in fact, that Johnson & Johnson already has a drug approved to treat it called Darzalex. The Darzalex data on Progression-Free Survival (NYSE:PFS) are quite impressive.

Source: The Daily Med, National Institutes of Health

The Darzalex data did not escape the attention of the industry. At least 20 companies are developing other CD-38-directed treatments, including antibody drug conjugates, bispecific antibodies, and CAR-T approaches. An incomplete list of competitors is shown below.

With at least 17 competitors, we question why the company would describe itself as having the “Most Advanced CD38 CAR-T program in Development.” Is the company really “industry-leading,” as the corporate presentation says?

Source: Company presentation

This slide does a better job explaining what SRNE really want investors to focus on, the stock price.

No relief – the $50 mln band aid

As if the Cynviloq story weren’t proof enough that this company is going nowhere, Sorrento managed to get its first product ever approved in February this year—and then turned out to have no plan for getting it to market. A former executive said that most companies would have prepared a marketing and distribution plan six months before FDA approval, yet ZTlido was approved in February, and there is still no plan to manufacture or sell it, a point IR confirmed to an investor. The company told this investor that ZTlido is “not a core strategic asset” and that the company will be looking to fund it independently or to divest.

Some might argue that SRNE was waiting for approval. But pre-approval, SRNE was indicating a 95% probability of approval, rendering that explanation moot.

The product itself, ZTlido, takes lidocaine, a drug that’s been around for 70 years, and delivers it on a skin patch. But even this modest achievement is a me-too: we count at least 10 commercial lidocaine patches, and they deliver more pain medication than does ZTlido, which has a 1.8% concentration. IR says that the superior adhesive enables the patch to deliver lidocaine more efficiently. CEO Henry Ji calls the lower dose an advantage for ZTlido, because the patch is safer for children and animals who might eat it if they find it discarded. Oh, and the ZTlido patch sticks better to the skin. Whatever the case, these are minor advantages.

The market-dominant lidocaine patch is called Lidoderm and has been sold by Endo International plc (ENDP NASDAQ) since 1999. Challenged by ever-more generics, Lidoderm saw its revenue fall in 2017 from $88 mln to $57 mln, and Endo warned of further competitive challenge: “Our revenues from LIDODERM ® have been negatively affected by Actavis’s September 2013 launch and Mylan’s August 2015 launch of their lidocaine patch 5%, generic versions of LIDODERM ® , and we anticipate that these revenues could decrease further should one or more additional generic versions launch,” Endo warned in its 2017 10-K (page 19).

Other popular brands of a lidocaine patch include Xylocaine, Recticare, Anecream, Akten, Xylocaine-MPF, Topicaine, Eha, Lidocaine Viscous, and Endoxcin.

In other words, Sorrento’s single marketable product is a Band-Aid with some analgesic cream.

These bandages retail for $2.79.

The problem is that Sorrento has no imminent roll-out plan. “I’m not aware of any sales force that’s been built to sell that drug or any partners to sell the drug,” said a former executive. We confirmed with IR that there are unlikely to be any sales in 2018.

Not much science

The rest of the company is a grab bag of biotech ideas without a development focus. There is a pain medication idea based on chili peppers called Resiniferatoxin (RTX). Sorrento announced it would spend $60 mln in cash and stock for a company called Semnur Pharmaceuticals to help develop that injectable pain medication then it terminated a year later. A former executive expressed dismay that Sorrento had pursued this distraction instead of focusing on Cynviloq. The company also has a strong library of human antibodies and some G-MAB technology, based on the use of RNA transcription for amplification of the antibody variable domains.

Ji does have credentials as a scientist, but not really in biotech. His PhD is in animal physiology. He has only an undergraduate degree in biology and no record of published research papers in peer-reviewed journals. Even the highly promotional Chinese program “Chinese People Abroad” reports that the full extent of Ji’s research career consisted of a few years when he did his own research out of a garage and “read a large number of books on financial investment and acquired self-educated financial knowledge.”[18] His former colleagues all seem to share the same view: Ji wants to make deals, not do research.

In general, Sorrento has a deep bibliography of company presentations, many of them dangling the idea of massive deal values. It has no manuscripts in peer-reviewed journals.[19]

Sorrento was launched on the basis of an antibody library. But in nearly a decade as a public company, no one has figured out how to commercialize it.

“Unfocused,” said a former executive. ”Sorrento doesn’t “have much reason to call themselves a biotech company,” said another.

A former executive said it best: “They’re selling hype, a dream that something will happen.”

Building crisis

Now, senior managers are leaving so fast that Sorrento can hardly issue the 8-Ks. Asked if he thought there was any value in the company at all, one former executive said no. Another said he congratulated himself for having sold out long ago. A third? “I wouldn’t put my money in this.”

Two highly placed executives have told us they were forced out by the CEO when they demanded internal investigations or expressed opposition to acquisition deals Ji had proposed—and did anyway. Resignations just since 2014 include:

- January 8, 2014: David Webb, director (8-K January 9, 2014)

- January 30, 2014, Ernst-Guenter Afting, director (8-K February 3, 2014) [20]

- March 7, 2014: Scott Salka, Director (8-K March 7, 2014)

- January 30, 2015: Richard Vincent, EVP and CFO (10-K/A April 29, 2016)

- June 23, 2015: Mark Durand, EVP, CFO, chairman of the audit committee, member of the compensation committee[21]

- March 15, 2016: Mike Royal, EVP of clinical and regulatory affairs (10-K, March 15, 2016)

- January 16, 2016: David Miao, SVP (10-K/A April 29,2016)

- August 1, 2016: Douglas Ebersole, Director (8-K, August 1, 2016)

- June 2017: Jeffrey Su, COO[22]

- Vice President of Finance Douglas Langston was terminated on September 15, 2016, only nine days after a new auditor had been appointed. The most recent CFO, Kevin Herde, left in May 2017 after a scant year on the job, and was only replaced on March 19 after Dean Ferrigno, the chief accounting officer, had also resigned. The new CFO, Jiong Shao, is a lifetime investment banker who does not have an accounting degree and is not a CPA. Shao’s principal qualification, according to the company, is that he “helped to raise billions of dollars from investors.”

- The company has employed at least three quality assurance officers/quality VPs since 2015 who must ensure that submissions to the FDA are accurate and complete. Losing such officers can be as concerning as losing financial control officers.

We spoke to six former C-Suite executives, all of whom painted Sorrento as a petrie dish for deceit and self-dealing, a company that encourages its employees to hug the line of legality and sometimes even cross it.

That makes the departure of Sorrento’s auditor all the more suspicious. Sorrento appointed Mayer Hoffman McCann as auditor in March 2018 after Deloitte had audited the company for just two years. MHM was fined $675,000 by the SEC in May 2015 for violating professional standards. The appointment came just two days before the resignation of accounting chief Dean Ferrigno. The company had been without a CFO for nine months, since the last CFO, Kevin Herde, resigned, and only recently appointed Jiong Shao, who is a banker rather than a CPA. This is a company in which whistleblowers get fired or resign, and we think the chances are good that accountants left under protest.

After speaking with a half dozen former executives and directors of Sorrento, we have not found a single one who had a positive word to say about Henry Ji or company management generally. Terms used included "morally objectionable," “self-dealing,” “my worst professional experience,” and Sorrento itself as “a "House of Cards." We asked a former board member whether he knew of anyone who would say anything positive about Sorrento. He said: “I seriously do not know anyone, and my network here in San Diego is pretty extensive.”

After careful work on this company, we are frankly shocked at the cynicism and the high-handed actions of management. Sorrento has squandered its potential on get-rich-quick schemes that don’t even work. Whatever the few scientific assets may be left in the company cannot be salvaged unless the company is dismantled and sold for its parts.

[1] 10-Q/A 2/27/2018

[2] 8-K, 10/6/2014

[3] The BVI companies are Magnum Opus2, Famous Sino Limited, Top Path Asia Limited,

Hongguo International Holdings Limited, and China In Shine Investment Limited

[4] All the Chinese-language registration records of these companies can be downloaded here.

[6] 8-K 11/14/2013

[7] Interviews confirm that Miao Zhenlang is David Miao’s brother. By Chinese convention, the names also strongly suggest that the two are brothers.

[8] Kangnuotai is identified as a subsidiary in Sorrento’s 8-K filed November 14, 2013 page 8. Ownership is reported in Jiangsu government Administration of Industry and Commerce records.

[9] The New Drug Founders Club website

[10] 8-K, September 11, 2013

[11] PR Newswire: Wildcat Capital Issues Letter to Board of Sorrento Therapeutics

[12] 8-K 3/16/2015

[13] “On April 29, 2015, the Company entered into a common stock purchase agreement with NantBioScience, Inc., or NantBioScience, pursuant to which the Company purchased 1,000,000 shares of NantBioScience common stock for an aggregate purchase price of $10 million. As part of the agreement, the Company became a party to a right of first refusal, co-sale and drag along agreement with other stockholders of NantBioScience as well as an investor rights agreement with certain stockholders of NantBioScience.” 10-Q filed May 5, 2015

[14] 2017 10-K page 43

[15] Net cash cost to Sorrento of the transaction, by our calculation, was $5.5 mln, representing the $60 mln payments plus the $36 mln write-off that Sorrento recognized when the joint venture company repurchased Cynviloq.

[16] For a detailed list, see the company 10-K 2014 pages 2-3: https://www.sec.gov/Archives/edgar/data/850261/000156459016014768/srne-10k_20151231.htm

[17] CD38 is also known as BCMA

[18] See the article published on May 5, 2016: Chinese Overseas: Ji Hongjun, American Chinese: The Meaning of Life and the television feature: Chinese Overseas - Lu Lingxue, Ji Hongjun - Programs - Hong Kong TV

[19] See Elsevier.com and Omicsonline

[21] https://www.sec.gov/Archives/edgar/data/850261/000119312515239439/d949459d8k.htm

[22] https://www.sec.gov/Archives/edgar/data/850261/000114420417034814/v470046_8k.htm

Disclosure: I am/we are short SRNE.

Additional disclosure: Readers should be aware that we are short SRNE directly or indirectly and stand to benefit if the company's share price declines.

Article by J Capital Research