Paul Tudor Jones is known in systematic trading circles for his somewhat mathematical approach to markets before computers were prevalent.

Also, see

- PTJ Explains What He Learned From A Lifetime Of Studying Bubbles And Crashes

- PTJ “ Cry ‘Havoc!’, and let slip the dogs of war” seems an apt description for this moment.”

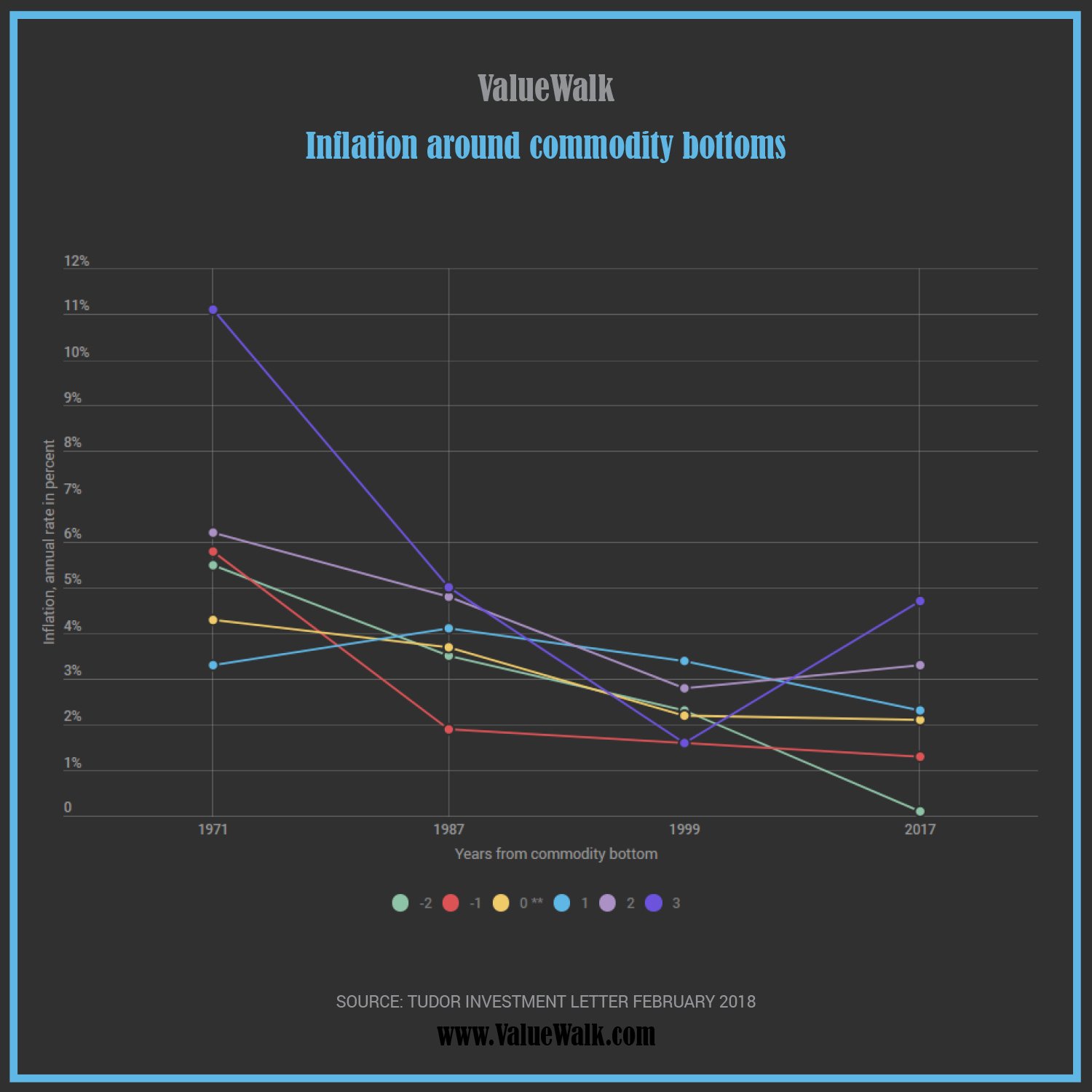

Along with Peter Borish, Tudor Investments navigated a wide variety of market environments, famously calling the 1987 “Black Monday” market crash, sees another disaster on the horizon.In joining with Ray Dalio and Bill Gross, all of whom see a recession on the horizon, he thinks that inflation is going to surge as bond yields spike. But does the mathematical thinker’s math correlate with statistical history? In a February 27 research piece, PowerShares Source multi-asset research notes different truths that point to a positive correlation between rising rates and the stock market – to a point.