You will not be surprised to learn, that one of the most insightful investment concepts I learned early on on my investing journey was about understanding a company’s earnings came from Warren Buffett.

In his 1986 Chairman’s letter to shareholders, he provided instructions to determine the true underlying earnings a business owner would actually receive in their pocket.

[Owner earnings] represent[s] (a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges….and less (c) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume. (If the business requires additional working capital to maintain its competitive position and unit volume, the incremental needs to be added to (c). However, businesses following the LIFO inventory method usually do not require additional working capital if unit volume does not change.)

Our owner-earning equation does not yield to the deceptively precise figures provided by GAAP, since (c) must be a guess-and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes-both for investors in buying stocks and for managers in buying entire businesses.

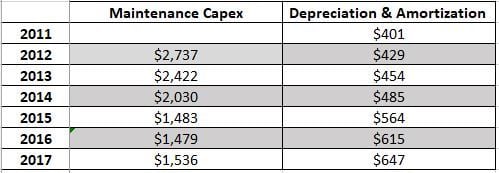

Applied to our Coles example for 2017 ($ in AUD).

(a) $1,609 million + (b) $647 million – (c) $1,948 million (6 year average)

= $308 million (EBIT)

Vastly lower than the reported $1.6 billion dollar (EBIT) figure.

Another important observation Buffett added to the above description is the following:

Most managers probably will acknowledge that they need to spend something more than (b) on their businesses over the longer term just to hold their ground in terms of both unit volume and competitive position. When this imperative exists— that is, when (c) exceeds (b) — GAAP earnings overstate owner earnings. Frequently this overstatement is substantial.

Look at the massive difference between the Maintenance Capex and Depreciation and Amortization, or (c) exceeds (b) by an average of 4X!

Does Coles, as Buffett pointed out, require large amount of capital expenditures just to hold off competition from Woolworths’ and other smaller competitors?

I suspect management are being conservative in their depreciation schedules to inflate earnings, as other informed investors have pointed out that, Wesfarmers return on equity has fallen from a high of 25% to 12% since the acquisition of the Coles Group.

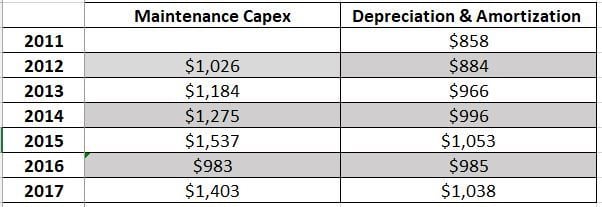

Let’s compare Coles to Woolworth’s.

Woolworth’s, 2017 ($ in AUD).

(a) $3,363 million (EBIT) + (b) $1,038 million – (c) $1,235 million (6 year average)

= $3,166 million

On a EBIT basis you’ll notice that the reported net income is similar to the Owner-Earnings, means that earnings aren’t highly overstated like Coles.

But does (c) exceeds (b)?

Nope. This highlights that Woolworths’ doesn’t need to spend as much to maintain their competitive position.

Buffett went on the write:

All of this points up the absurdity of the “cash flow” numbers that are often set forth in Wall Street reports. These numbers routinely include (a) plus (b)— but do not subtract (c) . Most sales brochures of investment bankers also feature deceptive presentations of this kind. These imply that the business being offered is the commercial counterpart of the Pyramids— forever state-of-the-art, never needing to be replaced, improved or refurbished. Indeed, if all U.S. corporations were to be offered simultaneously for sale through our leading investment bankers— and if the sales brochures describing them were to be believed— governmental projections of national plant and equipment spending would have to be slashed by 90%.

Keep these teachings in mind closer to the demerger in 6 – 9 months’ time, it could prove costly if you don’t

I do hope Wesfamers will release the last five years’ worth of financial statements for Coles, when it comes time to demerge, then we can update our numbers and see if our data is wrong.

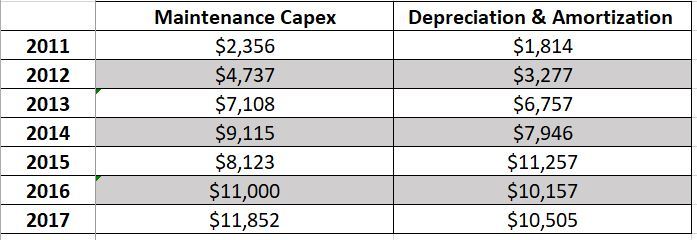

Let’s now apply Buffett’s owners-earnings to Apple Inc.

Apple, 2017 Annual Report ($ in USD).

(a) $48, 351 million + (b) $10,505 million – (c) $8,656 million (6 year average)

= $50,200 million

Right in the sweet spot.

Next does (c) exceeds (b)?

Nope.

I hope this post was insightful.

I want you to join the 10-week Investment Analysis Program, not for me but for you. But only if you believe that success requires a commitment to consistently learning and consistently putting into practice what you learn because that is what I believe. Join now

I believe that those two qualities will put you on the fast track to mastery. Mastery that catapults you into the top 5% of investors worldwide.

You probably got that friend who drives like a lunatic but thinks their a great driver. A study on drivers attitudes revealed that most people interviewed believed they were above average drivers but when tested, they performed to the average.

This applies to investors attitudes as well, when they think their good investors, than their below average (poor) investors, when they think their great investors then their average investors, when they think their master investors than their average to great investors, and when they think and say their geniuses, than they are charlatans with their hand on your wallet.

If you join the 10-Week Investment Analysis Program before the deadline this Saturday at midnight, I will coach you step for step conducting a thorough the investment valuation process. Join Now.

Thanks for reading.

– Adam

Article by Searching For Value