As Indian equities have come off the peaks from the start of the year, some emerging-market investors may be feeling a little cautious. Despite this pullback in stocks, Sukumar Rajah, Senior Managing Director and Director of Portfolio Management, Franklin Templeton Emerging Markets Equity, thinks the current investment environment, coupled with some homegrown drivers, could spur on the Indian equity market to provide even more opportunities than before.

[REITs]Check out our H2 hedge fund letters here.

There are plenty of reasons to be sceptical about the prospects for Indian equities, but we remain resolutely positive, based on India’s compelling growth prospects. India’s projected economic growth of an average 7.3%1 in 2018-2022 would indicate the country’s growth story shows no signs of slowing down.

We see the Indian economy able to shake off the negative effects of the recent global equity selloff, the Goods and Services Tax (GST), introduced in 2017 and the demonetisation in late 2016. These developments had temporarily affected cash-intensive industries and supply chains—especially with small traders supplying to larger manufacturing companies—as they found it difficult to meet the paperwork required.

As we see these effects likely wearing off, we think there is more room for Indian equities to potentially appreciate. Despite some outflows from the global equity selloff and the Punjab National Bank (PNB) scandal, we believe India’s favourable demographic backdrop could lead to more growth in the equity market, particularly in large-cap stocks.

Homegrown Factors

Domestic demand now accounts for the largest proportion of the Indian economy and is driven by the burgeoning middle-class population.

It’s not the first time we’ve noted the rise of the middle-class, and it won’t be the last—the population expansion is only in its initial stages and some estimates projected it to double in size within the next eight years.2

In our view, favourable macroeconomic and demographics factors should lead to income growth, which should help further drive domestic demand. We also see savings likely to grow. We’d expect companies in the consumer discretionary sector to thrive on the back of India’s growing middle-class population, with people striving to upgrade items such as cars, jewellery and designer clothing. And with this, upgrading non-essential items, such as air conditioning units and electronic gadgets, may become consumer priorities as disposable incomes rise.

Given rising disposable incomes among the country’s rising middle class, we anticipate a growing demand for credit and investment services and as such, see potential investment opportunities within the private retail banking industry, since public-sector banks have been focusing on improving asset quality, which has restricted their ability to compete in the retail space.

As state-owned banks have found themselves weighed down by debt and the alleged PNB scandal, it has highlighted the deficiencies in how state-owned banks are managed. We believe real improvements in public-sector banks have yet to be seen, which will likely accelerate the shift in market share towards private-sector banks. We think investors are realising that strong balance sheets and the adopting advances in technology could help private banking gain an even larger share of the market.

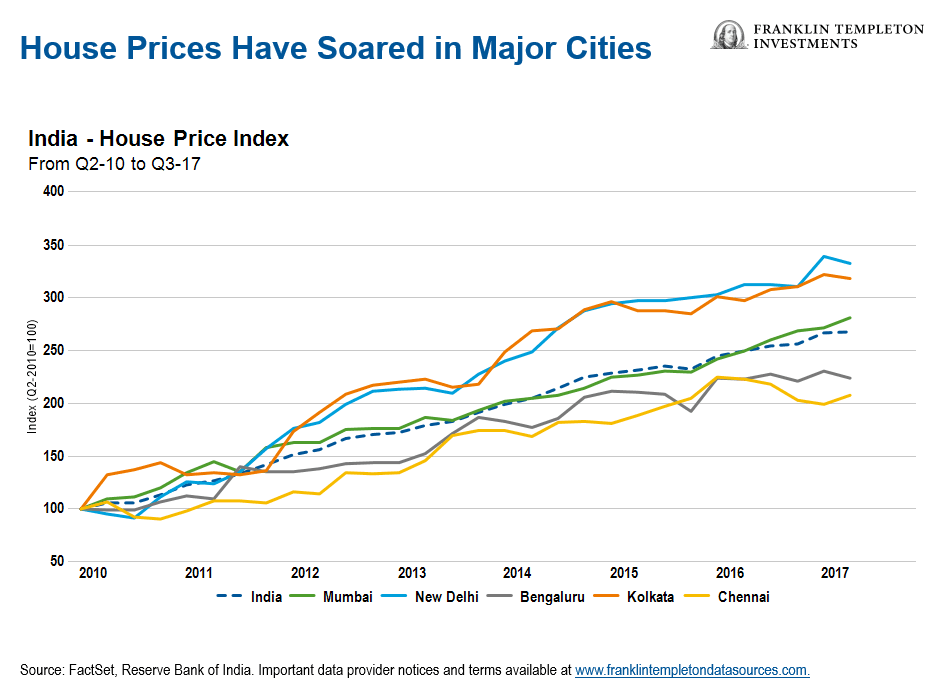

Likewise, the middle-class population has boosted demand for better quality housing, which we expect should be positive for housebuilders and real-estate management companies. These companies tend to be positioned in the mid- to large-cap area of India’s equity market.

Regulatory changes implemented in May 2017 have begun to transform the property development sector, but we think there’s more to come.

In the 2018-19 February Union Budget, Finance Minister Arun Jaitley suggested that an affordable housing fund would aim to provide housing for all by 2022 and allow better access to major cities through the availability of urban properties.

We feel this initiative is welcome, but we think the government left the door open to supporting the urban middle class. That said, if additional incentives were implemented it might accelerate urban home construction and kick-start growth in jobs in the semi-skilled sector.

Despite this, we’d still expect to see a pick-up in capital expenditure (capex), particularly in India’s real estate sector. We’ve been seeing for some time a downtrend in capex, but expect to see growing demand for better-quality housing and goods spark a rebound.

The government also announced it would reintroduce a 10% long-term capital gains tax and apply to any sale of equity shares over 100,000 rupees. The change, in our view, should not present a kneejerk reaction in Indian equities due to the clause that exempts capital gains tax on sales up to January 31, 2018.

In our view, there’s more to come for the Indian equity market as it adjusts to the effects of the Union Budget. Despite some investor trepidation on India’s equity market run, we believe a combination of favourable macroeconomic and demographic factors could make room for higher valuations.

The comments, opinions and analyses expressed herein are solely the views of the author(s), are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Get more perspectives from Franklin Templeton Investments delivered to your inbox. Subscribe to the Investment Adventures in Emerging Markets blog.

For timely investing tidbits, follow us on Twitter @FTI_emerging.

What Are the Risks?

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets.

1. Source: OECD Economic Outlook, India, November 2017. There is no assurance that any estimate, forecast or projection will be realised.

Article by Sukumar Rajah, Franklin Templeton Investment