An op-ed from Robert C. Pozen highlights an interesting side effect of the new tax law that restricts federal deductions for state and local taxes (SALT) to $10,000. This provision includes local property, sales taxes, and local income taxes. According to Mr. Pozen, the new restriction will have an unintended consequence for states with massive unfunded pension liabilities like Illinois, Kentucky, Connecticut and New Jersey.

[REITs]Check out our H2 hedge fund letters here.

The reason for this is that if states do not find a way around the SALT restriction, then they will face “political barriers” to pushes for tax increases to meet pension shortfalls. The only other option for states would be to “severely cut spending” on public services or attempt pension reform measures.

State’s usually possess payment obligations from three primary sources- interest on outstanding bonds, unfunded pension benefits, and unfunded liabilities for healthcare payments to state retirees (before Medicare at age 65). The interest on outstanding state bonds usually is listed on the annual state budget. New accounting rules are forcing the state also to record their unfunded pension liabilities and health care liabilities.

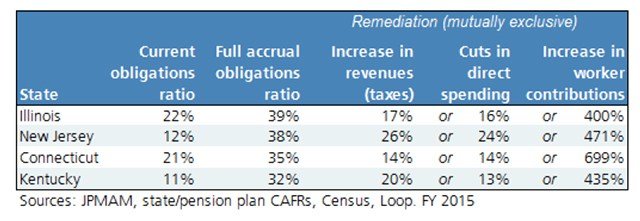

Mr. Pozen explains that if current obligation ratio for states like Illinois grows, funding sources to make payments on obligations will become increasingly challenging to obtain.

The “current obligations ratio” is the percentage of state revenues that is devoted to paying down unfunded pension liabilities and retiree health care obligations as well as interest on bonds. As unfunded pension liabilities and health care obligations increase, the state will become hard pressed to find new revenue sources. Compounding this issue is the new federal restriction on SALT deductions. As citizens begin to feel the sting of this cap on deductions, they will inevitably start crying out to the state legislator to reduce taxes. This will put state leaders in a bit of difficulty. They will either have to reduce public services like education, police or transportation or make much-needed pension reforms. The public will undoubtedly bulk at the suggestion of cutting public services which leaves the only other alternative- pension reform.

Even credit rating agencies are not buying it…

Moody's issues statement on #NewJersey revising its #pension rate of return up to 7.5% from 7% #muniland pic.twitter.com/EAHAhHBJy8

— Moody's US Public Finance (@MoodysUSPubFin) March 5, 2018

Full article here.