With so many months of consecutive gains for the hedge fund industry, it almost seemed it would not end. While of course it had to end at some point, there are many investors who are likely wishing the streak did not have to end quite so abruptly.

Check out our H2 hedge fund letters here.

Volatility has returned to various hedge fund strategies in 2018 at a level not seen since 2011. While there were segments receiving large allocations recently which have faired relatively well (large macro) this year, other segments have not. Allocations, however, are not made to last months, but hopefully years. While 2018 may be a rocky start for many hedge funds, the road ahead appears paved, at least, for the industry to distinguish the value it can bring when universally positive periods come to an end.

Highlights

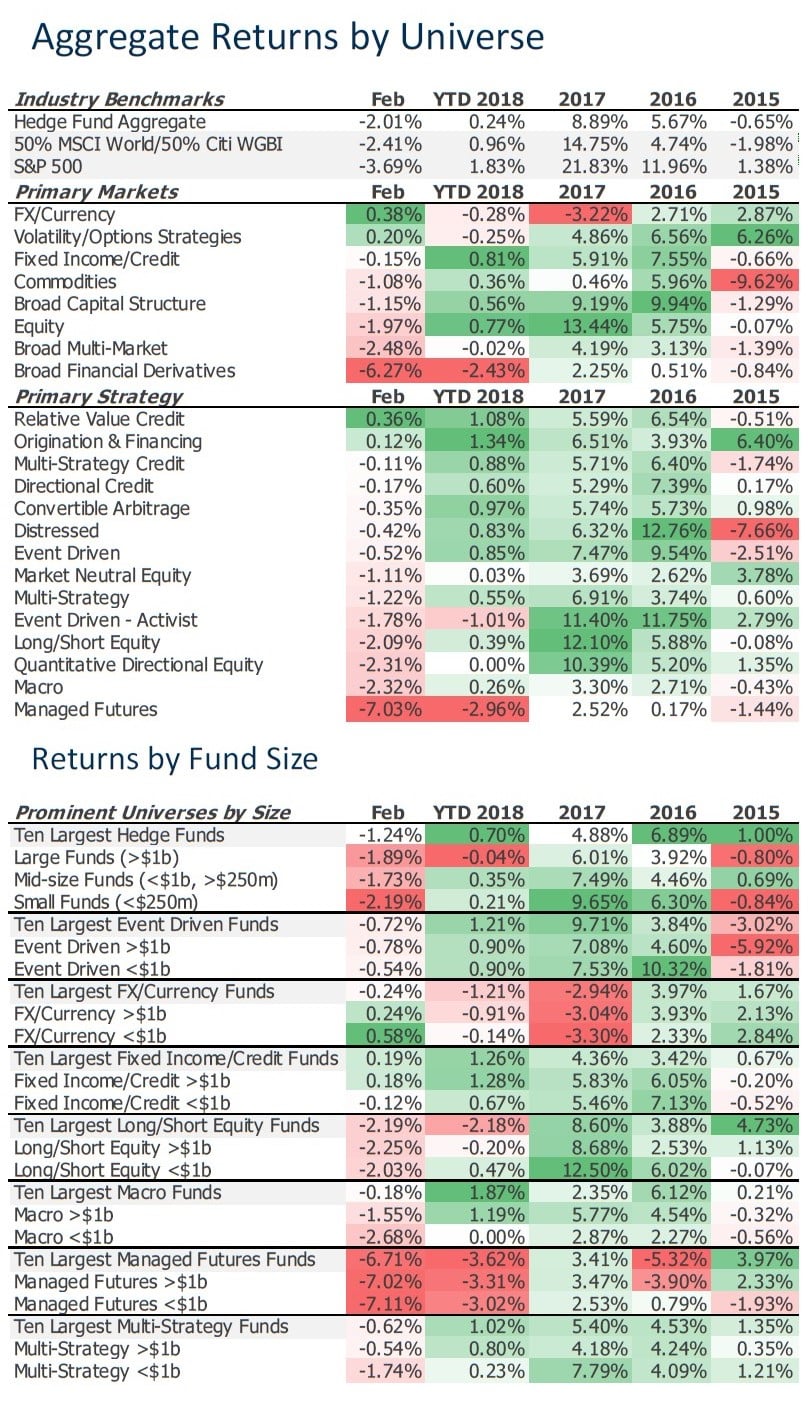

- Hedge funds declined an average of -2.01% in February, ending their longest aggregate streak of gains since 2004.

- Managed futures produced their largest monthly loss in over twenty years in February.

- Macro posted a decline, but the largest funds faired relatively well in February, and are leaders in 2018.

- Long/short equity produced some elevated losses in February, and for some large funds, YTD losses as well.

Industry Declines on the Back of Dismal Managed Futures Results

Hedge funds declined an average of -2.01% in February 2018, the industry’s lowest monthly return since January 2016. February’s decline marked the industry’s first monthly loss in the last sixteen months, ending its longest positive streak since 2003/2004.

Key Points

- Huge reversals the norm so far in 2018.

After the industry was its most broadly positive in four years to start 2018, in February it was its mostly broadly negative in over two years, since January 2016. Not since 2011 have the industry’s aggregate returns varied so much from one month to the next. Aggregate returns were -4.99% in 2011. - Managed futures returns in February were the lowest in over 20 years.

Superlatives in this industry rarely stretch back more than ten years. With the Financial Crisis surpassing that milestone, eleven years is the new-norm max. However, it was in 2008 when managed futures products likely shone their brightest, so we must to go back to 1992 to find a more difficult month for the group. There are many details from the month which could illustrate this point, but listing would be too long. Perhaps most importantly, investors had begun to reallocate to the universe in Q4 2017, and into January 2018 after a year of negative investor sentiment. Perhaps one positive would be that the universe has a history of producing good annual returns in years which contain returns like those seen in February. Of course, you’d have to go back to 2008 to find the most recent example of that. - Macro remains positive in 2018, despite large losses in February.

Macro funds also attracted a lot of new money entering 2018, and have thus far likely pleased investors. The ten largest macro strategies lost very little on average in February, and are the best performing non-EM-focused segment of the industry in 2018. - Long/short equity, the overarching winner from 2017, shows mixed results in February.

The plus side is that the universe is still positive in 2018, and that’s about the best recent investors in the space will read. Nearly three-quarters of products declined in February, and among the largest products, returns were not better, and are much worse for the year. While two months does not a year make, expectations are likely very high.

Emerging Markets Show Volatility, But (mostly) Continue to Outperform in 2018

Key Points

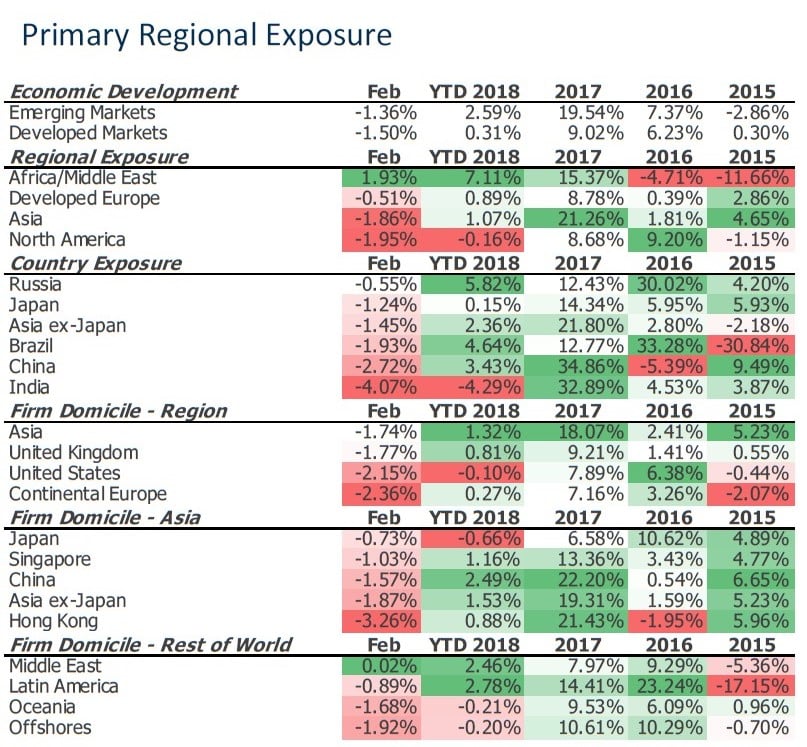

- All emerging market exposures are positive in 2018, with one exception.

Despite almost universal declines in February, losses mostly did not offset EM products’ January gains. The only exception was for funds targeting India, which were flat in January and down over 4% in February. - MENA products lead in 2018, followed by Russia and Brazil.

In 2017, industry-wide leading gains came from emerging markets exposures, and that has continued into 2018. Funds investing in Africa and the Middle East followed big gains in January with a relatively very positive month in February. Russia and Brazil funds are also performing well YTD, followed closely by those focused on China.

Article by eVestment