Article by RCM Alternatives

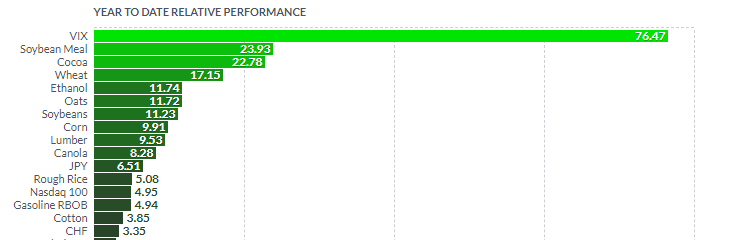

Don’t look now, but some grown in the ground commodities not named Oil have been rallying pretty strong the past month and a half amidst the sell off in most other risk assets. Here’s the top futures market performers YTD – with 13 of the top 16 spots occupied by commodity markets like Wheat, Corn, and Cotton.

[REITs]Check out our H2 hedge fund letters here.

(Disclaimer: Past performance is not necessarily indicative of future results)

Right on cue (and perhaps talking up his book, always a favorite pastime for billionaire investors); Hall of Fame investor Paul Tudor Jones is out saying he wants to own hard assets and commodities, via CNBC:

“We’re in the third-longest economic expansion in history. Yet we’ve somehow managed to pass a tax cut and a spending bill, which together will give us a budget deficit of 5% of GDP—unprecedented in peace time outside of recessions … I think the recent tax cuts and spending increases are something we will all look back on and regret.”

“I want to own commodities, hard assets, and cash. When would I want to buy stocks? When the deficit is 2%, not 5%, and when real short-term rates are 100bp, not negative. With rates so low, you can’t trust asset prices today.”

“Let me describe to you where I think Jerome Powell is right now as he takes the reins at the Fed. I would liken Powell to General George Custer before the Battle of the Little Bighorn, looking down at an array of menacing warriors. On the left side of the battlefield are the Stocks—the S&P 500s, the Russells, and the NASDAQs—which have grown, relative to the economy, to their largest point not just in US history, but in world history. … Look to the middle and there waits the army of Corporate Credit, which is also larger than ever relative to the economy, as ultra-low rates have encouraged it to gain in size, stature, and strength. … And then on the right are the Foreign Currency Fighters, along with the Crypto Tribe, an alternative store of value that only exists because of the games central banks are playing. … All of these forces have been drawn to the battlefield because of our policy experiment with sustained negative real rates. So Powell looks behind him to retreat. But standing there is none other than Inflation Nation, led by the fiercest warmongers of them all: the Commodities.”

Paul Tudor Jones looking at commodities is newsworthy itself, but it also comes on the heels of another famous prognosticator- Jeff Gundlach – having said commodities would “outperform stocks” way back when the world was still flat and there wasn’t a whiff of volatility in the room – January 31st. His reasoning? The relative value performance of the S&P 500 compared to a Commodity Index hasn’t been this wide since the dot com bubble via MarketWatch:

That call sure looks like one of his best at face value, but it’s worth noting Oil is actually down even more than the S&P over the past month (about -7% to -5%), and that the index Gundlach used for his comparison above was actually the GSCI – the commodity index with the most energy exposure. Meaning, unless you’re in a more ag focused index with meaningful exposure to Wheat, Corn, and Cocoa – his call hasn’t been all that great…yet.

Which is all to say, this commodity stuff is hard. There’s the commodity ETFs, which are nearly as good at separating investors from their money as the VIX ETFs, with a near constant roll yield sapping away returns every month/quarter. There’s the concept of seasonality, where it’s not just what price you buy commodities at – but when in the year. And there’s the little fact that commodities have a doubly dubious distinction among asset classes – being both the worst performer and most volatile.

On the positive side, there’s professional commodity traders who structure their trades and market concepts into investment strategies that incorporate all those issues, shorter term systematic programs which don’t care if it’s Soybeans or Swiss Francs – as long as its moving and providing trading opportunity, trend following types who more than welcome a nice up trend in Ags, and of course, real life farmers who utilize the futures markets to lock in these rising prices.

We wouldn’t argue against these two legends being right on their call given all the factors they’ve outlined. But it’s not as easy as just clicking on that commodity ETF. If commodities are back and you’re getting ready to ride the wave, make sure the undercurrent doesn’t suck your portfolio under.