Original article at UpFina

In a previous article, we discussed some of the benefits of renting a house compared to buying it. We presented the argument as to why renting is better than buying while filling in the gaps which are counterpoints as to why buying might be better. While most of the arguments made can apply to people of all ages, in particular points are made from a millennials’ perspective. The reasoning behind this is that the millennial generation is changing the narrative baby boomers took as gospel which was that buying a house is the American dream which gives you a ticket to financial freedom.

Working From Home Versus At An Office

One of the most important benefits of renting is the ability to quickly leave at the end of the month. Obviously, some details are different for each renter. For example, some people sign a 1 or 2 year lease. In that case, you can sublet an apartment when you’re gone. The point is that if you need to move somewhere for a new job, you can leave much easier if you rent than if you own a house. It can take months to sell a house and it can take months to buy a house which are both stressful processes. Finally, closing costs are expensive.

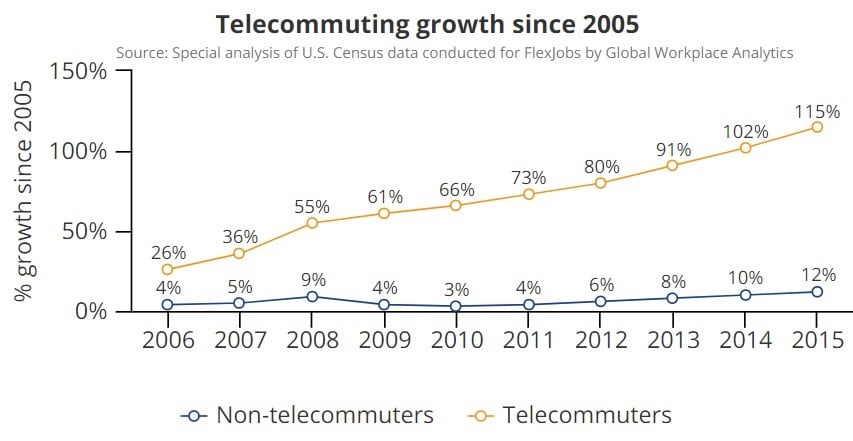

There are a couple of aspects to review with this benefit because you need to know if it’s useful enough to justify renting over buying. One relevant trend is that more people are working from home through the power of the internet. As we detailed in another article, The Future Is Freelance, Not 401k’s. As you can see from the chart below, the number of workers who exclusively telecommute is up 115% from 2005 to 2015 while the number of non-telecommuters is up 12%.

Working From Home Is A Mega Trend

This means the majority of new jobs created in that 10 year period were telecommuters. In 2015, there were almost 4 million workers who worked from home at least half the time. That’s about 3% of the workforce. If you are working from home, then it doesn’t matter if you have the flexibility of renting which allows you to move out easily. You can work from wherever you want when you telecommute, meaning you can live wherever you want.

Surprisingly, this telecommuting trend is mostly affecting older workers. This is because skills requiring experience are needed to work from home which young people don’t have. The average person who works from home is 46, has a bachelor’s degree, and has median salary of $41,705 which is $4,048 more than the median salary of workers who travel to their jobs. The chart below shows the breakdown of workers by age between those who travel to work and those who work from home. As you can see, workers 16-34 only make up 27% of telecommuters; they make up 37% of non-telecommuters.

Older People Work From Home

This show that this issue isn’t specific to millennials. Keep in mind, the percentage of workers who work from home has increased in the past 3 years since this survey was done, so about 5% probably work from home. That number will only grow in the next few years, making it relevant to the discussion about renting versus buying a home.

Job Switching

The other aspect to how valuable the ability to quickly move is whether you are likely to switch jobs. The more often a worker switches jobs, the more likely a person will need to move to get closer to work. There are a few caveats to this: the business can move, the worker can be transferred to a new division in a new location, and a person can switch jobs without needing to move. Renting gives you the freedom to work anywhere you want. For job switchers, that’s a big deal.

The chart below gives the historical percentage of 22-29 year old workers who have changed jobs in the past 12 months.

Young People Switch Jobs A Lot As Usual

As you can see, this segment is only about 3% of the population. Also, this trend is cyclical as it falls during recessions because people are afraid to quit their job and find a new one. It is also in a secular decline as it has been falling for the past 20 years. Workers in their 20s are more likely to switch jobs than older workers, but millennials are only continuing the trend which has existed for generations. If you hear about millennials switching jobs at excessive historical proportions, that’s a mistake.

Personal Preferences

We provided data on a personal judgment call which will help you determine whether renting or buying a home will be better. In the end, it comes down to how much you value living where you do. Some people love to travel and are adventurous. In that case, you should rent. If you have a family you want to stay near, have health restrictions which force you to stay in the same location, or you work from home, it would be better to buy a house.

Property Tax

Another aspect of the pros and cons when it comes to buying or renting is property taxes. This is a bit controversial because some people say that although renters don’t pay property taxes like buyers, the property tax is implied in the rent cost since the owners must pay it. Either way, the chart below shows the average effective property tax rate of owner occupied housing in each state.

Map Of Property Tax Rate

One new aspect to keep in mind is that state and local sales, income, and property tax write-offs are limited to $10,000 starting in 2018. That will probably sway some middle class people to rent instead of buy.

If you are interested to read further about housing, here are some recent articles:

- The New Trend In Housing

- Housing Market Leverage

- Buying/Renting Home vs Investing In Stocks

- The American Dream Is Now Tiny

Disclaimer: Before making any investment decision you must read and accept our full disclaimer at www.upfina.com/disclaimer