Last week we had the opportunity to sit down with author Daniel Pink before he addressed a jam-packed theater at the University of Denver about his new book, When: The Scientific Secrets of Perfect Timing, now in its 8th week on the New York Times best-seller list. We asked Dan how financial advisors specifically can benefit from the science of timing, whether Dan considers intentionality to be an intangible asset for companies, and how innovative firms are executing on his research to improve productivity. Below are excerpts from that conversation.

Check out our H2 hedge fund letters here.

KLC: Welcome to Denver. Tell us about the book --why the science of timing?

Daniel Pink: I wrote Whenout of both frustration and curiosity. I was making decisions in my own life about when to do things … when should I start a project? When should I abandon a project? When during the day should I exercise? I was making decisions in what I thought was an intellectually sloppy way, and that bothered me. I looked around for some guidance, and it didn’t exist, so I began to dig deeper.

There’s been an extraordinary amount of research on the science of time in fields like economics, social psychology, linguistics, molecular biology, and there’s a whole field called chronobiology. All these scholars have been asking questions like: what’s the impact of time of day on how we feel and work? What’s the impact of beginnings or midpoints or endings in how we behave? And the truth is we believe timing is an art, but it’s really a science. There is data to help us make smarter, shrewder, more evidence-based decisions about when to do things … about why you’re less likely to become a CEO if you graduate from business school during a recession, or why you should never schedule surgery in the afternoon. The truth is, the hidden patterns in timing profoundly affect our performance.

KLC: Many of our readers are financial advisors running businesses and engaging in long-term relationships with clients based on trust. What are your recommendations for them?

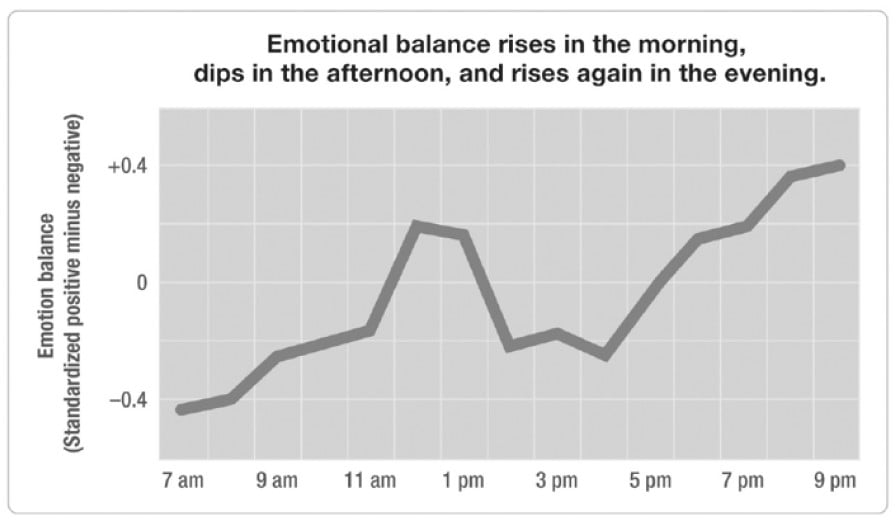

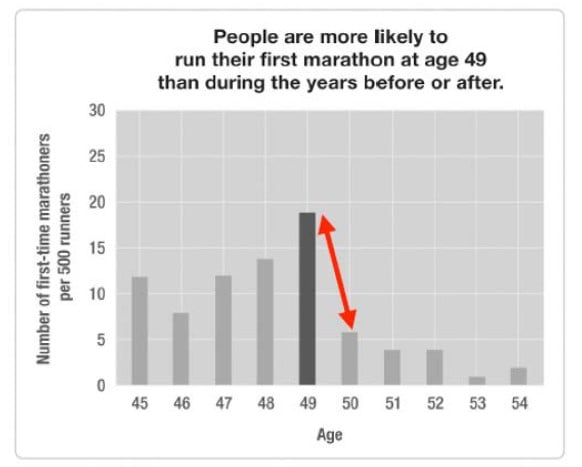

Daniel Pink: There are a number of ways financial advisors can apply the science of timing in their own practices and with their clients as well. First, research shows that each day all of us experience a peak, a trough and a recovery in our work cycle. For most of us, that means we should take on our analytic work in the morning, our administrative work during the early-to-mid-afternoon trough, and our creative insight work in the later afternoon and early evening, when our mood is higher and we’re a bit looser. In addition, clients’ lives are a series of episodes. All lives have beginnings, middles and ends, and we can be intentional about those phases. For instance beginnings play a big role in savings. Financial advisors can employ the fresh start effect. If you want a client to make a change in behavior, use a fresh start date, like the first of the month rather than on the 13th of the month. You also have people that haven’t started saving for retirement, so they are at a mid-point in their career. Advisors can use that mid-point to galvanize people to work toward their financial goals. Being intentional about endings can be just as important. I don’t think people know how to end their careers. Advisors can be intentional in helping clients to configure a career ending that is meaningful. We also know that hitting the end of a decade can spark different kinds of behavior, so reaching out to clients on a “9” birthday – 29, 39, 49 – to inspire new behaviors can allow advisors to use the science of timing to teach their clients how to be much more intentional about managing their financial lives.

Interestingly, the research also shows that savings behavior is related to how we think about the present and the future. Different languages represent the divide between the present and the future in differing ways –as in the present tense, “I am eating” or the future tense, “I will eat.” Data shows that people who speak a language with a strong divide between the present and the future –like English --save less for retirement. It’s hard for a 35-year-old American to get his head around being 65 or 75. These language differences are one of the reasons a 35-year-old from Hong Kong is going to have a different view on saving money.

KLC: In our investment research, we measure and identify highly innovative companies. Do you see certain companies applying behavioral intentionality like the science of timing more than others?

Daniel Pink: Absolutely. You see companies like Zappos, Uber and Ben & Jerry’s that understand that human beings are not meant to power through the day so have changed the internal architecture of their companies, with nap pods, for example. CBRE is asking its employees to get up and leave their desks for lunch. The innovative companies looking for greater productivity have begun to implement flexible scheduling so that everybody doesn’t have to be at their desks at 8am. They realize people have different chronotypes and may work better with different hours. It comes down to the question of: are we measuring employees based on their results – outputs – or are we measuring employees on their inputs, whether everybody is at their desks? Dr. Till Roenneberg, a chronobiologist in Munich, is working with auto factories and steel plants to reconfigure and optimize production processes based on human circadian rhythms. But the reality is the majority of companies are still scheduling meetings based on availability, completely neglecting time of day as a factor. The companies that have more enlightened business practices, like the Googles and Morningstar Farms Foods of the world, will have a first mover advantage. And we’re starting to see results in corporate performance.

KLC: Do you think optimizing for greater human productivity could impact company financial results and contribute to stock price?

Daniel Pink: Yes, I do. We know from this research that time of day explains 20% of the variance of how people perform on the job. That means that 80% of the variance is explained by other factors – talent, opportunity, education, etc. If you’re able to get people at your firm doing the right work at the right time, you’re going to see an increase in performance. In an efficient market, that’s going to be reflected in stock price. One could even apply a screen to measure workplace practices. What we know from the evidence is that when you have workplace practices that offer autonomy and where people are getting feedback, people are more likely to be satisfied in their work (Drive: The Surprising Truth About What Motivates Us by Daniel Pink). Companies that are intentional about the future very often also are highly intentional about their hiring practices, about meeting social and environmental standards, about providing autonomy, mastery and purpose. These companies have a first mover advantage, and there’s a whole line of research on the competitive advantages for innovation leaders. Some companies are inadvertently offering flexible schedules, and they are probably allowing people to do their best work at the best time. But if you are intentional about that, you ask your people to observe their own behavior for two weeks, we look at the results and then reconfigure your schedule based on the results. As a result, we see a boost in retention, productivity and performance, which will absolutely contribute to stock price. This is one way market leaders are differentiating from their competitors.

KLC: In our process of identifying Knowledge Leader companies, we adjust companies’ financial results to capitalize investments in 5 categories: R&D, brands, IT, human resources and organizational capital. Would you consider the intentionality you write about to be an intangible asset?

Daniel Pink: Absolutely. I think timing and motivation (Whenand Drive) impact the last two categories you identify. This goes straight to a company’s employee assets. If I look at the balance sheet for Google, I don’t see a line item for sense of purpose, but we know from a whole rash of research that people perform at a completely different level when they have a sense of purpose. You won’t find a fast feedback culture on the balance sheet. Time is one of the most intangible aspects of life. Human beings have struggled for millennia trying to control time because it makes a difference in performance. If there is a way to take the intangible elements of workplace practices, whether it is making progress, sense of purpose, autonomy, sense of fairness, allowing people to do the right work at the right time --it’s a great way to find undervalued companies, because no one can see these assets on a company’s balance sheet –they’re intangible –they’re empowering the overall value and performance of the companies.

KLC: How are companies adopting these practices?

Daniel Pink: It’s easier for leaders than followers to implement intentionality practices, but there are some companies that are beginning to change. Absent a near-death experience, the way organizations change is slowly and invisibly. You can only see it over time. One of the principles from Driveis the idea of getting better at your job over time and making progress. However, you can’t make progress unless you’re getting feedback on what you’re doing. Annual reviews are the number one reason people aren’t getting feedback, and this is a place we’re starting to see progress in companies implementing purpose and the way they give feedback. Big companies are getting rid of annual reviews, companies like Adobe, GE, Microsoft and Whole Foods. Last week I visited Qualcomm –a company that has a huge store of intangible assets in its extensive patent library –and I was there to talk about the science of timing. I visited a large insurance company yesterday. They were interested in how to reform workplace practices. Insurance is competitive and has become a commodity. Every insurance firm is going to run the same actuary process, so how does an insurance company differentiate itself? If they can be intentional about their business practices, they are using that knowledge to create an edge over their competitors.

Daniel H. Pink is the author of six books including the New York Times best seller A Whole New Mindand the #1New York Times best sellers Drive and To Sell is Human. Pink’s TED Talk on the science of motivation is one of the 10 most-watched TED Talks of all time, with more than 19 million views. London-based Thinkers 50 named Pink, alongside Michael Porter and Clayton Christensen, as one of the top 15 business thinkers in the world.

Charts and slides courtesy of Daniel Pink.

Article by Knowledge Leaders Capital