Co-CIO Francis Gannon talks about why he thinks select small-cap cyclicals looks so well positioned to lead in the months ahead.

[REITs]Check out our H2 hedge fund letters here.

Which small-cap areas are you most wary of?

There are certain parts of the small-cap asset class that I think increasingly represent more risk. Obviously, the defensive area has been an area of the market where people have tried to hide over the past several years to benefit from bond-like proxies, in a low interest rate environment, and I think that’s not the focus of the market, that’s not where we should be focusing.

Cyclicals are Cheaper

As of 12/13/17

Enterprise Value (EV) is calculated by adding a company’s market capitalization, long-term debt, preferred stock, and minority interest, then subtracting cash. EBIT is earnings before interest and tax. EV/EBIT is a harmonic weighted average. Cyclical and Defensive are defined as follows Cyclical: Consumer Discretionary, Energy, Financials, Industrials. Defensive: Consumer Staples, Health Care, Real Estate, Telecommunication Services, Utilities.

We live in an environment, I think, where you’re seeing better economic growth domestically in the United States, you’re seeing better economic growth outside of the United States, and economically sensitive and cyclical areas that will benefit from those growth trends, both domestically and internationally, are an interesting area to focus on.

Do investors appreciate the size and diversity of the small-cap universe?

The beauty of the small-cap asset class is that it is a highly inefficient asset class that is quite large, that has very little research coverage, and it’s what makes our job exciting on a day-to-day basis. I think investors tend to just focus on 2000 stocks within the Russell 2000, when in reality it’s a much larger universe, that is, for all intents and purposes, evergreen. We see a lot of businesses being spun out of larger corporations. We see IPOs, limited, but yet we are seeing IPOs, and it’s an interesting area for us to apply our trade on a daily basis.

Why do you think quality is so important in the current environment?

Quality and value to me are two perhaps of the most overused words in the investment world today. Everybody has a definition of what quality is, everybody has a definition of what value is. We’re pretty specific in terms of what we’re looking for, in terms of quality in a business.

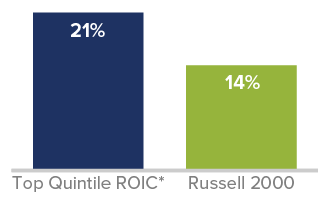

High Quality Outperformed

Total Return as of 12/31/17

*Return on Invested Capital is calculated by dividing a company’s past 12 months of operating income (earnings before interest and taxes) by its average invested capital (total equity, less cash and cash equivalents, plus total debt, minority interest, and preferred stock).

Past performance is no guarantee of future results.

Historical market trends are not necessarily indicative of future market movements.

Increasingly, in the environment that we are in, high-quality businesses should outperform, based on a couple of things. One is their ability to actually have earnings growth, which is increasingly more important, in an expensive environment, from a valuation standpoint that we live in. Two is balance sheets are going to become increasingly more in focus. Many small-cap companies will be benefiting from some of the tax treatment from an accounting standpoint, on their balance sheets, which I think is going to be significant, but under leverage, finding companies that are going to benefit from operating leverage, not financial leverage, is key, I think, in the environment that we’re living in today.

What do you think investors should be focused on?

There are three things I think investors should focus on, in terms of selectivity within the small-cap asset class this year. One is profitability. Strange statement to say, but I think you have to focus on profitable businesses that are going to benefit from increased earnings growth, throughout the year.

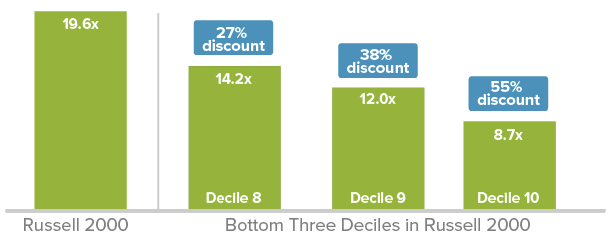

Even in a High-Priced Market, There Are Opportunities

Many Small-Caps Sell at a Significant Discount

Bottom Three Deciles in Russell 2000 Median LTM EV/EBIT ex negative EBIT as of 12/31/17

*Last Twelve Months Enterprise Value/Earnings Before Interest and Taxes.

The second thing would be focusing on valuation disparity within the asset class. One would be focusing more on economically sensitive and cyclical businesses, and not on the defensive areas of the market, which from our perspective look quite expensive. And last but not least, I think in the environment that we live in look to focus on companies benefiting from increased economic growth domestically in the United States, as well as better economic growth outside of the United States. We’re hearing more and more anecdotal evidence about a synchronized global economic recovery. Better small-cap companies benefit from that, because they benefit from revenue growth outside of the United States, or revenue generation outside of the United States. And then that’s going to be a significant factor going into 2018.

Article by Francis Gannon, The Royce Funds