Bluelinx Holdings Inc. (NYSE:BXC) is a leading distributor of building and industrial products in the US. We started tracking the company in late 2016 as an asset sale put them ahead of schedule in their restructuring efforts. We disclosed our long position on August 4th, 2016 as we internally calculated an EPS number that was much higher than the company reported in its Q2 financial report:

Check out our H2 hedge fund letters here.

You can learn more about how we exploit differences between company reported EPS (GAAP) and a more operational EPS (non-GAAP) that dictates the true earnings power of a company here.

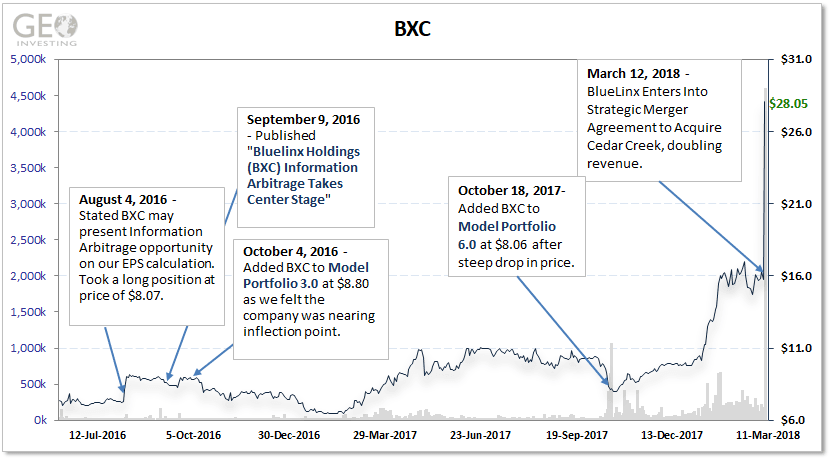

We later put out a series of updates on BXC for our Premium Members while the stock continued a largely sideways to slightly upward trend, even adding it to a few of our contrarian model portfolios designed to take advantage of pullbacks and/or muted reactions to news that we feel at times is misunderstood. These portfolios are fittingly named “Pullback Portfolios”.

Major Legacy Shareholder Sells Stake Through Underwriter at Big Discount: Made for Attractive Entry Point

During our due diligence process, we learned that Private Equity firm Cerberus Capital was a long-time investor in the company. Cerberus’ overhang in the stock suppressed the stock price but speculated they would look for an exit soon. In September 2017, we observed weakness in the stock, and anticipated that Cerberus would soon try to sell its stake because Cerberus’ fund, which invested in BXC, was winding down. The shares were sold in a non-dilutive secondary offering through an underwriter, BTIG LLC, at $7.00 per share. No new shares were issued. Cerberus just opted to sell its stake through an underwriter.

Not only was there an opportunity to get a great return on a sizable number of shares in a trade, but we also believe opportunities like this can enable investors to build sizable positions in quality companies to hold longer term. BXC stock never reached the offering level price of $7.00 in open market trading.

Below represents the chronology of events and research leading up to the company’s March 12, 2018 announcement that it “entered into a strategic merger agreement to acquire Cedar Creek.”

Monday, June 27, 2016

BXC ($7.20) – We are considering constructing Reasons for Tracking on Bluelinx Holdings. BXC distributes building products in North America. The company distributes products in two principal categories, structural products and specialty products. This $7.20 company is taking steps to improve margins and reduce its mountain of debt. If successful, there could be massive incremental gains in EPS and EBITDA. We encourage our members to review the company’s conference call transcripts for more information while we continue our research.

Thursday, August 4, 2016

BXC ($7.34) – On June 27, 2016 we stated we are watching BXC closely due to the company taking steps to improve margins and reduce its mountain of debt. If successful, there could be massive incremental gains in EPS and EBITDA.

This morning, BXC reported Q2 2016 results and more importantly reported progress on debt reduction plans:

- Sales of $509.0 million vs $515.6 million in the prior year

- Non GAAP EPS of $0.43 vs $0.08 in the prior year

Quotes from management:

“As previously announced on April 21st, our primary focus is on deleveraging the balance sheet. We have decreased our debt principal by $63.6 million and our net working capital by $64.5 million when compared to the same period a year ago primarily through our inventory and facility rationalization. In addition, we are currently under contract to sell several of our closed facilities and are actively marketing certain operating facilities for sale leaseback opportunities.”

Monday, August 22, 2016

Will Look To Add to Our Long Position In BXC

BXC ($8.73) – In our June 27, 2016 morning premium member email we stated we were taking closer look at BXC due to recent steps to improve margins and reduce its mountain of debt. On August 4, 2016, BXC reported strong Q2 2016 results showing that the steps they are taking are beginning to pay off. We disclosed our long position on August 4th.

Further due diligence strengthens our bullish assumptions on the BXC story. More details to come.

Thursday, September 1, 2016

BXC ($8.87) announced it has completed the sale of 3 facilities for net proceeds of ~$1.9 million. The Company also announced it has 6 other non-operating facilities under contract which will generate ~$30 million in net proceeds by year end which it intends to use to pay down its debt burden which we discussed in our original note from June 27, 2016.

If the Company uses the full $30 million to pay down its debt, we calculate the interest savings to add ~$0.20 (non-taxed) EPS on an annual basis. We used non-taxed for our calculations because the Company has a large amount of NOL’s ($267 million) that should shelter the tax burden for a prolonged period.

We initiated our long position on August 4, 2016 on the heels of BXC’s strong Q2 2016 results. See earnings recap here.

Friday, September 9, 2016 Email – BXC Information Arbitrage

Today we have published two articles, one on Bluelinx Holdings Inc. (NYSE:BXC), and the other on [premium only]. We have covered both stocks in recent research, releasing a “Reasons For Tracking” analysis on [premium only], and mentioning BXC as a compelling case based on potential margin improvements and company actions to reduce its mountain of debt.

You can read our articles at the following links:

We are long BXC.

Thursday, November 10, 2016

BXC ($7.59) reported Q3 2016 results:

- Sales of $476 million vs $517.8 million in the prior year

- Non-GAAP sales of $469.7 million vs $453.2 million in the prior year

- Non-GAAP EPS of $0.14 vs $0.07 in the prior year

Quotes from management:

“Our performance this quarter confirms that we continue to make good progress on our key strategic initiatives of monetizing our real estate and deleveraging the balance sheet. We have successfully extended our asset-based credit facility, prudently managed our working capital, and sold several of our unoccupied facilities which have enabled us to significantly reduce our debt from 2015 third quarter levels. In addition, we continue to focus on our customers through our local market emphasis as we improve our operational efficiencies and bottom line,” said Mitch Lewis, President and Chief Executive Officer.

We are still trying to determine what the sales and EPS run rate will be once restructuring initiatives are complete. We will be on the conference call later this morning to see if management provides color on this and on its industry outlook (housing starts)

Thursday, March 2, 2017

BXC ($6.90)reported Q4 2016 results:

- Sales of $421.7 million vs $428.2 million in the prior year

- Non-GAAP loss per share of $0.27 vs loss of $0.87 in the prior year

Management stated:

“We are pleased to share the strong finish we had in 2016 which demonstrates our continued focus on our key strategic initiative to deliver the Company through monetizing our real estate and improving our working capital. The successful execution of this strategy enabled us to improve our financial performance while significantly reducing our debt from prior year levels. We continue to evaluate alternatives to reduce the Company’s leverage and enhance liquidity,” said Mitch Lewis, President and Chief Executive Officer.

Susan O’Farrell, Senior Vice President and Chief Financial Officer added, “Since announcing our deleveraging plan, we have sold eight unoccupied properties during fiscal 2016, which generated gross proceeds of $36.4 million. Furthermore, we have successfully reduced our debt principal by $84.0 million from this time a year ago.

We were hoping the company could maintain profitability even in its seasonally weaker quarters (Q4 and Q1), but it appears for the time being (until gross margins and operating margins improve), the company will have to drive higher revenues and/or continue to reduce its debt. Fortunately, these are two important goals the company has set for 2017. Until the company’s restructuring efforts are fully completed, it looks like adjusted EBITDA growth will be the valuation metric we use.

Monday, March 20, 2017

BXC ($8.28) shares have been trending up the past week in sympathy with some other building supply stocks like Huttig Building Products, Inc. (NASDAQ:HBP), which hit a new high on Thursday. We initiated our long position in BXC on August 4, 2016 on the heels of strong Q2 2016 results and restructuring efforts playing out (shares opened at $7.50 on Aug 4th). See our initial recap here. It’s been a bit of a roller coaster ride. Shares reached a new 52 week high of $9.70 just days after our original note, then retraced to the sub $7 level before beginning this recent uptrend.

Friday, March 24, 2017

BXC ($7.88) completed the sale of 3 properties, stating the following:

“With these property sales and all others incurred since April 2016, BlueLinx will fully satisfy its July 2017 CMBS mortgage payment obligation of $60 million three months ahead of schedule.

Less than a year ago we announced our initiative to reduce the Company’s financial leverage and are delighted to share that we continue to successfully execute on our strategy to deleverage BlueLinx. We are exploring additional sale and leaseback transactions, alternative refinancing options as well as other real estate optimization strategies to continue to improve the Company’s leverage and financial strength,” said Mitch Lewis, President and Chief Executive Officer.

Susan O’Farrell, Senior Vice President and Chief Financial Officer added, “We are thrilled with the property sales we completed in the first quarter of 2017, enabling us to satisfy our July 2017 mortgage obligation ahead of schedule. The substantial remaining real estate portfolio value, which is well above our outstanding mortgage, should enable us to continue to deleverage our balance sheet, while providing us with potential future opportunities to extract that value for the benefit of our growth strategies.”

As we stated in our March 20, 2017 update, we initiated our long position in BXC on August 4, 2016 on the heels of strong Q2 2016 results and restructuring efforts playing out (shares opened at $7.50 on Aug 4th). See our initial recap here. The stock has been on a bit of a roller coaster ride. Shares reached a new 52 week high of $9.70 just days after our original note, then retraced to the sub $7 level before beginning this recent uptrend.

Wednesday, April 26, 2017

BXC ($10.33) shares have been strong the last several weeks, reaching a new 52 week high of $10.46 on April 24, 2017. We initiated our long position in BXC on August 4, 2016 on the heels of strong Q2 2016 results and restructuring efforts playing out (shares opened at $7.50 on Aug 4th). See our initial recap here. The stock has been on a bit of a roller coaster ride since, dipping to the low $6 level before regaining its footing and now hitting new highs.

An added caveat that we have been tracking is that Cerberus Capital, a household name in the private equity industry, still holds a 52% position in BXC. Cerberus will eventually liquidate this position and we are watching closely how minority shareholders will be treated.

We are no strangers to Cerberus Capital. In a similar ownership situation involving Blue Bird Corporation (NASDAQ:BLBD), we spoke out in a Barron’s interview about what we perceived as a bad deal for shareholders. The fact that the bad deal was refused, and the stock is now trading near all time highs, gives us more confidence that the ownership situation in BXC can be resolved.

Friday, May 5, 2017

BXC ($9.23) – Yesterday we highlighted BXC’s Q1 2017 results. Shares traded down nearly 12% on the results. We encourage investors to read the conference call transcript as the Company discusses the positive business trends it is seeing:

“The first quarter of 2017 continues the positive trend we’ve enjoyed now for almost two years. And yet the BlueLinx team remains motivated by the tremendous opportunities that lie ahead for our organization or improving but we have a long way to go…

…there were a couple of things going on in the first quarter this year while the winter across the country obviously was generally mild, for us we have a good strong presence for example in New England in the Buffalo market in that area of the country which relative to a very mild 2015 was worse.We’re starting to see significantly improved performance relative to the first quarter in those areas of the country.”

Tuesday, October 10, 2017

BXC ($10.27) a leading distributor of building and industrial products in the United States, announced that Cerberus Capital Management has commenced a secondary offering of 3,863,850 shares of BXC common stock.

We initially discussed our bullish thesis on BXC as a restructuring play in June 2016. We initiated our long position in BXC on August 4, 2016 on the heels of strong Q2 2016 results and restructuring efforts playing out (shares opened at $7.50 on Aug 4th). One caveat we had mentioned in our early note was that Cerberus Capital, a household name in the private equity industry, held a 52% position in BXC. We stated, Cerberus will eventually liquidate this position and we are watching closely how minority shareholders will be treated.

We will look to see what the offering is priced at in the coming days.

Thursday, October 19, 2017

**Buy On Pullback Mock Portfolio Updates

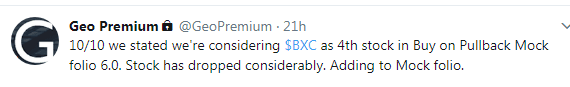

We have added Bluelinx Holdings Inc. (NYSE:BXC) ($8.11) to our Buy on Pullback Mock Portfolio 6.0. It joins [premium], [premim], and Eastern Company (the) (NASDAQ:EML). Yesterday during the trading day, we issued the following premium Tweet:

The Company’s shares have been under pressure after announcing a secondary offering on October 10, 2017. At that time, we stated we were considering adding BXC to our Mock Portfolio 6.0 once the offering was priced. Yesterday after the close, BXC announced the pricing of the offering at $7.00. While this is a much steeper discount than we initially anticipated, investors should note that this is a non-dilutive secondary with Cerberus Capital Management, a private equity fund who owns roughly 50% of the shares outstanding. In our April 26, 2017 research note we stated shares of BXC had attained a new high of $10.46. Commentary in our note also included:

“A caveat that we have been tracking is that Cerberus Capital, a household name in the private equity industry, still holds a 52% position in BXC. Cerberus will eventually liquidate this position and we are watching closely how minority shareholders will be treated.

We are no strangers to Cerberus Capital. In a similar ownership situation involving Blue Bird Corporation (NASDAQ:BLBD), we spoke out in a Barron’s interview about what we perceived as a bad deal for shareholders. The fact that the bad deal was refused, and the stock is now trading near all time highs, gives us more confidence that the ownership situation in BXC can be resolved.”

While this is certainly a temporary setback, with no fundamental change in the business, we feel shares should recover and possibly reach new highs in time, similar to BLBD.

Thursday, November 2, 2017

Bluelinx Holdings Inc. (NYSE:BXC) ($8.82; market cap $80.2m), a leading distributor of building and industrial products, announced its Q3 2017 results:

- Sales of $479.3 million vs $476.0 million in the prior year

- Non-GAAP EPS of $0.65 vs $0.12 in the prior year

- Adjusted EBITDA of $14.0 million vs $10.6 million in the prior year

Quotes from management:

“We are pleased to report continued improvement in our financial performance from the second quarter of 2017 which resulted in increased net income for the third quarter and our highest third quarter Adjusted EBITDA since 2007. These results, coupled with the new five year revolving credit facility that we closed on October 10, 2017, and the successful completion of our secondary offering last week, provide an inflection point for BlueLinx as we move forward into the next phase of our recovery,”

On October 19, 2017 we added BXC to our Buy on Pullback Mock Portfolio 6.0 as we felt the share sell off based on the non-dilutive financing was overdone. BXC is also part of our Buy on Pullback Mock Portfolio 3.0 since October 2016.

Thursday, March 1, 2018

Bluelinx Holdings (NYSE:BXC) ($15.12; $137.5M market cap), a building supply company, announced Q4 2017 results:

- Sales of $433.6 million vs $421.6 million in the prior year

- Non-GAAP EPS of $0.27 vs a non-GAAP net loss of $0.27 in the prior year

Quotes from management:

We are pleased to share our 2017 results, including our best full year gross margin and net income on record and our best full year Adjusted EBITDA since 2006. These results, coupled with the four sale-leaseback transactions we completed on January 10, 2018, position us well to capitalize on our anticipated continued strength in the markets we serve,” said Mitch Lewis, President and Chief Executive Officer.

Susan O’Farrell, Senior Vice President and Chief Financial Officer added, “2017 was exceptional for BlueLinx. Our continued focus on deleveraging the business led to one of the best years in Company history as we improved our financial results and significantly reduced our debt.”

With the majority of cost restructuring initiatives behind them, BXC has now reported two straight quarters of top and bottom line improvements and seems well-positioned to continue this trend in 2018.

We initially took our position in BXC in August of 2016 when the stock was trading at ~$8.00. BXC has been part of our “Buy on Pullback Mock” Portfolio 3.0 since October 2016. On October 19, 2017 we also added BXC to our “Buy on Pullback” Mock Portfolio 6.0 on a selloff that was based on the non-dilutive financing.

Friday, March 2, 2018

Bluelinx Holdings (NYSE:BXC) ($16.12; $146.6M market cap), a building supply company, reported its Q4 2017 results yesterday pre-market, highlighted here. We stated with with the majority of the cost restructuring initiatives behind them, BXC has now reported two straight quarters of top and bottom line improvements and seems well-positioned to continue this trend in 2018. We encourage you to read the conference call transcript which offered more color on the Company’s future outlook. Notable exerpts from the call include:

“As we discussed our last call, we are now pivoting to focus on many of the sales growth objectives we identified in our strategy session in the fourth quarter of 2017. We are making investments in equipment, inventory and new sales team members in areas of the business where we feel we have significant market share opportunities.”

“As I mentioned on our last call, these organic growth initiatives to enhance our market share will take time. While we are making good progress executing on many of these initiatives, I still do not anticipate that the organic growth initiatives we established during the fourth quarter will result in meaningful market share improvement until the second half of this year.”

“We estimate that our remaining owned real estate, which is currently unencumbered, is in the $150 million to $160 million range. This value is based on independent third-party real estate appraisals that were conducted on all of our properties. The aggregate value of these appraisals is consistent with the fair market value we have estimated in the past. We continue to view our real estate as a valuable resource for additional capital, liquidity and potential strategic initiatives for the company.”

And lastly, in the Q&A, when asked about how far along the company is with the EBITDA margin improvement initiatives, CEO Mitch Lewis stated he thinks of them as in the third inning and sees further opportunities to improve.

The full transcript can be read here.

Monday, March 12, 2018

Bluelinx Holdings (NYSE:BXC) ($15.79; $144.3M market cap), a building supply company, announced a strategic agreement to acquire Cedar Creek, a leading building products wholesale distributor.

“The combination of BlueLinx and Cedar Creek will create a leading building products wholesale distributor with one of the largest product offerings in the building products industry, including over 50,000 branded and private-label SKUs, and a distribution footprint of 70 national locations servicing 40 states.”

This development only confirms our belief that BXC is in the early innings of its come back story and that shares should move much higher from current levels. If consummated, the deal almost doubles the size of the company in terms of revenue and results in immediate $2 in EPS accretion , from our first look at the details. But the accretion could be meaningfully higher moving forward. As far we can tell, the acquisition will be funded by cash on hand and new revolving credit facility . But we would not rule out an equity raise in the near future, given the large amount of earnings potential from the deal. This means that increased earnings would still occur if the company were to effect a small equity raise. One thing we want to look into is how much of Cedar Creek revenue is generated from new construction vs. the remodeling market. BXC currently has minimal exposure to the less cyclical remodeling market.

Highlights from the acquisition announcement:

- Creates Diversified Two-Step Distributor with $3.2 Billion in Revenue

- Enhances Position as a Leading Building Products Wholesale Distributor with Expanded Offerings, Capabilities and Geographic Reach to Accelerate Growth

- Expects to Generate At Least $50 Million of Annual Cost Savings Within 18 Months

- Significantly and Immediately Accretive to Earnings

Quotes from management:

“We are pleased to announce the combination of Cedar Creek and BlueLinx,” said Mitch Lewis, President and Chief Executive Officer of BlueLinx. “Cedar Creek’s commitment to organic growth and its customers as well as its track record of successful acquisitions make it an ideal partner for BlueLinx. The combination will significantly enhance our product portfolio by providing greater breadth and depth of building products and services for our customers and suppliers across our markets. This transaction will create a leading U.S. wholesale distributor of building and industrial products, and significantly enhance the value that we can deliver to our customers, as well as our supplier partners, and end-market consumers.

Pro Forma financials for 2017:

BlueLinx and Cedar Creek’s combined revenue was $3.2 billion in 2017 and its pro forma LTM Adjusted EBITDA for 2017 would have been approximately $154 million including at least $50 million of annual cost savings.

The transaction is expected to close within 45 days.

We initially took our position in BXC in August of 2016 when the stock was trading at ~$8.00. BXC has been part of our “Buy on Pullback Mock” Portfolio 3.0 since October 2016. On October 19, 2017 we also added BXC to our “Buy on Pullback” Mock Portfolio 6.0 on a selloff that was based on the non-dilutive financing. And most recently, BXC was added to our Favorite stock list on December 4, 2017 and highlighted by Maj as one of the 4 stocks in his latest March 7, 2018 article , “Insiders Are Betting Big On These 4 Stocks, and So Am I. The article highlighted how a combination of insider buying and information arbitrage provided solid clues on the strength of investments in 4 stocks:

Seeking Alpha has published a version of the article this morning, with MHH and EML being explicitly mentioned. The extended research on BXC and TSSI is still only available at our pro portal.

Article by Geo Investing