Bitcoin opens doors to a lucrative future for small business. Over 100,000 industry leading companies are already accepting Bitcoin, and other cryptocurrency, as a form of payment. They have primed the pump for new profitable opportunities for small business owners.

“The currency's digital format also makes for faster, cheaper, easier exchanges of cash, from which many small businesses may benefit,” Jared Hecht, CEO of Fundera said in an Entrepreneur article.

The big issue for many small business owners is that they just don’t know enough about Bitcoin. More importantly, how it can benefit small business practices. But luckily, we have compiled all the information you need.

Let’s take a deeper look at what cryptocurrency is, how it benefits small business, potential risks, and how you can accept Bitcoin starting today!

What is Cryptocurrency?

Cryptocurrency, like Bitcoin for example, is a digital currency that is supported by blockchain technology. Blockchain is a public ledger of all cryptocurrency transactions.

It uses cryptography to track purchases and transfers on the blockchain. It is a secured decentralized currency that is not governed by any central authority, like banks or governments.

The decentralized nature of cryptocurrency has led to some missteps in the digital currency’s mainstream adoption. However, many global companies, financial institutions, and governments are beginning to see the benefits of the currency and the blockchain technology that supports it.

Bitcoin is Not the Only Cryptocurrency On the Block (Pun Intended)

Bitcoin may be the most popular and well known of all the cryptocurrency out there. But it is definitely in good company. There are currently over 1,000 cryptocurrency types available.

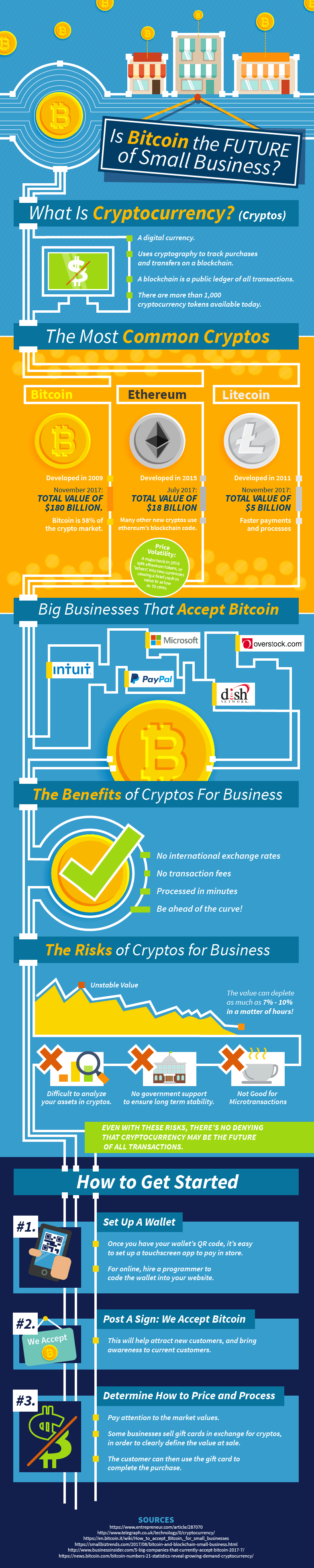

The three most common types of digital currency available today are Bitcoin, Ethereum, and Litecoin.

Here’s a little background on all three . . .

- Bitcoin: Bitcoin was developed in 2009 and has risen to the top of all cryptocurrency. It represents 58 percent of the market with a value is $180 billion.

- Ethereum: The second biggest cryptocurrency is a definite contender to Bitcoin. It was developed in 2015 and its blockchain supports many new cryptocurrency types. It has a market value of $18 billion and has many utility features like DAPPS and smart contracts.

- Litecoin: The third most popular cryptocurrency is Litecoin with a market value of $5 billion. It aims to be faster than any other cryptocurrency with quick transaction times.

How Does Cryptocurrency Benefit Small Business?

This is the million dollar question for all small business owners. Sure cryptocurrency is trending. Global companies, such as Microsoft, Overstock.com, Expedia, PayPal are accepting crypto-payments. But what about small businesses are using it?

Here are a few Bitcoin benefits for small businesses:

- Low to no transaction fees. The processing fees set by Visa, MasterCard, and American Express can eat away at small business profits. However, Bitcoin, and other cryptocurrency types offer a profitable alternative. Due to the decentralized nature of Bitcoin, fees are much lower than the traditional financial systems in place.

- No more chargebacks. Speaking of traditional means of payment, chargeback fees can eat away at small business revenue in a huge way. By accepting Bitcoin, you can eliminate chargeback fees for good. Once a transaction is finalized on the blockchain, there is no way to undo the payment. This can keep fraud to a minimum as well for small business owners.

- Payments are processed much faster. Bitcoin, and other cryptocurrency offer far faster payment processing than the tradition systems currently in place. The blockchain is a peer-to-peer network that cuts out the middleman (financial institutions). Payments hit your digital wallet fast, and you can transfer Bitcoin to the fiat currency of your choice in minutes.

- Global transactions made easy. One of the current issues small businesses experience is heavy international fees and currency exchange. Bitcoin and cryptocurrency make global payments fast and without interference from financial institutions and government regulations.

- You can tap into a new market. Why are large global companies accepting cryptocurrency? There are plenty of customers who want to pay with digital currency. By accepting Bitcoin, you are opening your business up to a whole new market and audience. For instance, Millennials are the consumers of the future. And guess what? Millennials want to use Bitcoin to make purchases. Not to mention that your business will look future savvy and forward thinking.

Cryptocurrency Risks for Small Business

All good things do come with a bit of risk, and cryptocurrency is no exception. The volatile nature of cryptocurrency, like Bitcoin, is one risk that is on everyone’s mind. For instance, Bitcoin was circling the $20,000 per coin mark earlier this year, but suddenly the cryptocurrency crashed, along with others.

The volatility of cryptocurrency often relies on the coverage it receives on social media and in the press. Predicting anything can be challenging, if not impossible.

Another big pitfall associated with cryptocurrency is the push back it is receiving from governments around the world. The decentralized ledger cryptocurrency is supported by is somewhat frightening to many governments and financial institutions.

However, crypto and blockchain technology testing is currently happening. For example, JP Morgan is working with Ethereum technology. Ripple is being analyzed by financial strongholds, like American Express and Banco Santander.

Mainstream adoption of Bitcoin may not be right around the corner, but it is in the works. As more governments and financial institutions see the benefits and utility, things will change.

How Your Small Business Can Accept Bitcoin

There is a clear call to action for accepting Bitcoin, and other cryptocurrency for your small business. Despite the potential risks, digital payments are predicted to reach $142 billion by 2019. How can your small business start accepting cryptocurrency? Here’s how:

- Get a digital wallet. There are plenty of online crypto-platforms and exchanges where you can get a digital wallet for your business. This will give you a QR code for customer payment. You can use an app or get it implemented into your website.

- Let your customers know. After you set up your digital wallet and get your QR code, you can proudly share that you accept Bitcoin with your customers. Put this front and center on your website. Your digital wallet exchange probably has a button code you can use.

- Watch the market value. Since the market value can shift daily, you should watch the value of your accepted cryptocurrency to ensure pricing is correct. Many small businesses use gift cards to set the prices in exchange for Bitcoin payments.

Become a Small Business of the Future!

Accept cryptocurrency, like Bitcoin will rocket your small business into the future. You will enjoy the benefits and attract new customers eager to pay with crypto. You will also be a step ahead of your small business competitors if they haven’t already adopted digital currency as a payment option. How will you use Bitcoin to grow your business?

Article by Nick Rojas

Nick Rojas is a business consultant and journalist who lives in Chicago and his hometown Los Angeles with his wife. His work often discusses social media, marketing, and branding in regards to small and medium enterprises (SMEs).