- In times of financial market anxiety, boring is good. The packaging services industry escapes some economic cyclicality while offering upside in international markets.

- Berry’s approach of consolidating fragmented markets along with funding organic growth has produced superior execution metrics.

- Wall Street analysts, quantitative valuation models, and a favorable Enterprise Value/Free Cash Flow comparison provide all the inputs needed for this manufacturer to appreciate.

Check out our H2 hedge fund letters here.

It Was the Best of Times, It Was the Worst of Times

The financial world is very anxious right now because the news has been so good. The U.S. economy is a year short of a record ten-year expansion. Jobless claims are at 49-year lows, hourly earnings increased at their fastest annual pace in eight years, consumer sentiment is at all-time highs, manufacturing expanded at the fastest rate in 13 years.

However, there is a dark side. The Federal Reserve is charged with keeping both unemployment and inflation low. With a mature expansion and stock markets that have roared since the presidential election, the Fed’s tone has been increasingly hawkish. The market has also become worried about the cost and scarcity of manufacturing inputs, including labor. The cherry on top came today with President Trump announcing that he will set new across-the-board tariffs on steel and aluminum; spooking investors with the specter of a trade war.

As investors look at where to put their money in a market like this, they tend to start thinking of “boring.” Not the Elon Musk kind, but no-nonsense industries that are the backbone of the economy. Packaging companies, while still affected by market cycles, are always in demand. Their customer segments can be broadly broken up into consumer, industrial, and hygienic. Industry research firm Smithers Pira expects consumer packaging services to grow at 9.5% a year through 2022. They also peg growth of the industrial packaging segment at 3.2%, and hygienic applications at 3.9%.

In these interesting times, investors should be focused on companies that aren’t locked into any particular niche. Berry Global Group Inc (NYSE: BERY) spreads is sales fairly evenly across all three segments, and through consolidation, has become the number one or two player in the majority of its markets.

Favor Diverse Packaging Services Companies

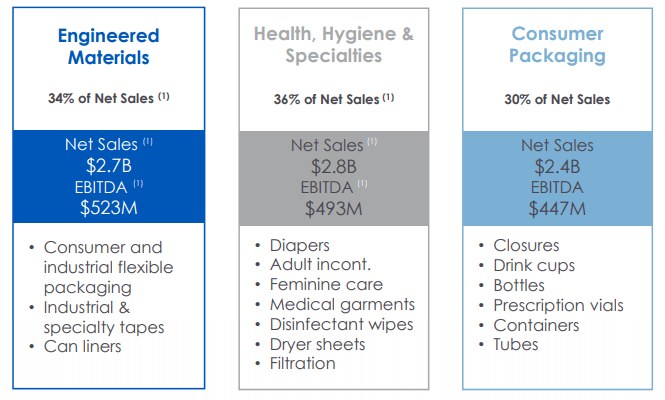

A few clicks through Berry’s products on its website is overwhelming. They pride themselves on being a one-stop shop with nearly 100,000 product SKUs. The graphic below shows how the firm breaks its sales in thirds across three major categories which are not perfectly aligned with the general industry segments noted in the previous section. Industrial products are spread between Engineered Materials and Health/Hygiene. Since the product catalog is so broad and deep, the image below is also helpful in detailing each segment’s general outputs. A number of these are consumer staples such as hygienic products and white label or generic packaging for grocery retailers, and unlikely to be as affected by economic pressures.

Source: Feb. 2018 Investor Presentation

Revenues are not spread so evenly regionally which the company is currently addressing. Management stated in its most recent 10-K:

“We believe there are long term growth opportunities within the health, pharmaceuticals, personal care and food packaging markets existing outside of North America, especially in Asia, where expected per capita consumption increases should result in organic market growth.”

In the industry forecast, industry expert Smithers Pira agrees: “Consumption increases will continue to be driven primarily by the faster-growing transition economies of Asia, Central & Eastern Europe and Africa, rather than the more mature advanced economies of Western Europe, North America and Japan.”

Berry’s sales are still heavily tilted towards North America, which grew 11.4% in fiscal 2017 (in part via acquisition). While South America and Europe shrank, the important Asia region grew by 9.9%. Berry’s largest penetration into Asia has been in the Health/Hygiene segment which stands at 9% of sales. Its Consumer Packaging revenues are still 100% sourced in North America.

Another view of revenue segmentation is positive: sales are not over-reliant on their biggest customers with the top 10 representing less than 20% of sales.

Part of sales growth in 2017 was due the acquisition of Clopay Plastic Products, a leader in the global supply of printed breathable films, which include everything from puppy house-training pads to medical gowns. The company believes in consolidating fragmented markets, and has made 44 acquisitions since 1988, and expects to continue to make strategic purchases where they can profit from synergies.

On the cost side, Berry should not be majorly impacted by the metal tariffs currently roiling the market but its main input (plastic resins) add a lot of variability into the outlook. Fifty percent of its COGS are due to cost of resin, and the market generally relies on pass-through contracts, where changes in prices are passed on to the manufacturer. Resin prices are tied to natural gas and crude oil prices.

Despite not being able to lock-in resin prices, the company has delivered stable net margin growth.

Berry’s dominance in North America has continued to fuel the company’s growth, but further penetration in Asia-Pacific and emerging markets is necessary to hit Wall Street’s targets. Despite expectations for higher resin costs and restructuring in South America, management increased its guidance for 2018, which they present in Operating and Free Cash Flow estimates in place of earnings. The chart below shows that Berry has been able to grow Free Cash Flow (after debt-related payments) despite its acquisitions.

Berry carries the second most amount of debt amongst its peers, and also has the second highest leverage as shown via Debt/Equity below. While this is not atypical of a manufacturing company, it does leave it more exposed to economic fluctuations. The company’s depdendend on the U.S. is a concern, but countering this issue is the fact that the company has deep roots in staples-type products, rather than a reliance on consumer discretionary offerings.

Wall Street Predicts Upside for Berry

Berry operates in a growing industry, rolling up fragmented markets, and has an established a history of growing margins and cash flow. Twelve of thirteen Wall Street analysts raised 2018 earnings estimates in the last month, and expect double-digit sales growth. As seen below in the graphic from finbox.io’s valuation dashboard, these Wall Street analysts are predicting nearly 30% upside. Confirmation via finbox.io’s quant-based Fair Value price of $72.25 per share offers 34.8% appreciation potential.

A peer comparison can help determine how Berry is priced relative to its competitors. The stock compares favorably in profit metrics as shown below. These metrics help establish the company is executing better than its rivals.

Price multiples aid in analyzing its relative valuation. Comparisons of sales and earnings multiples indicate the company's stock is generally valued in line with its peers. This means investors are getting added value for an average priced company with superior execution.

However, earnings can be managed so taking a closer look at EBITDA multiples is generally better for peer comparison. Notice how Berry’s EBITDA multiples generally trade below the majority of its peers in the chart below.

Berry Global Conclusion: Strong Company, Strong Industry, 30%+ Upside

Berry is set to continue to profit from an economic expansion, but its tentacles into staples products and focus on Asia should limit exposure to any downturn. Healthy margins and a history of Free Cash Flow growth while consolidating fragmented market segments are indicative of a well-executing management team.

Supporting management’s plan is Wall Street’s expectation for nearly 30% appreciation. Confirming and complementing the qualitative component of professional analysts is Finbox.io’s Fair Value price, derived from a quantitative model. Additional evidence of a stock in position to ascend is the wholistic EV/FCF multiple, indicating that Berry is undervalued compared to its competitors. Investors should take note, despite being a boring company, thinking outside the box should payoff.

Article by Matt Hogan, Finbox.io