Tyler here with this week’s Macro Musings.

Macro volatility continues to rage on. Fed chair Powell has a tough job ahead of him. If he makes one wrong move, the bond/stock bubble will burst and ruin all the passive ‘hodlers’ with it. We’re leaving the era of buy and hold and entering into a trader’s market. The best way to keep pace with fast markets is to have a copy of our Macro Intelligence Report delivered straight to your inbox each month. Each issue is packed with our favorite trade ideas. We have a 60-day money-back guarantee, so there’s no risk for you to take a look at our hottest trades. Subscribe to the MIR by clicking here.

Check out our H2 hedge fund letters here.

Recent Articles/Videos —

The Good, The Bad, And The Middle – Alex completes a scenario analysis on the current macro landscape. It’s a race between reflation, deflation, and muddle through. Check this out — it will keep you prepared for whatever hits us going into March.

Article I’m reading —

An Apocalyptic Paul Tudor Jones Warns The Fed Is About To Lose Control – Zerohedge recently published an interview Goldman Sachs had with the legendary Paul Tudor Jones. PTJ lays out the case for higher inflation, an imploding bond market, and a booming commodity market.

He also has an entertaining description of what Fed Chair Jerome Powell is up against going into 2018. Here’s an excerpt:

Let me describe to you where I think Jerome Powell is right now as he takes the reins at the Fed. I would liken Powell to General George Custer before the Battle of the Little Bighorn, looking down at an array of menacing warriors. On the left side of the battlefield are the Stocks—the S&P 500s, the Russells, and the NASDAQs—which have grown, relative to the economy, to their largest point not just in US history, but in world history. They have generally been held at bay and well-behaved, but they are just spoiling to show their true color: two-way volatility. They gave you a taste of that in early February. Look to the middle and there waits the army of Corporate Credit, which is also larger than ever relative to the economy, as ultra-low rates have encouraged it to gain in size, stature, and strength. This army is a little more docile right now, but we know its history, and it can be deadly when stressed. And then on the right are the Foreign Currency Fighters, along with the Crypto Tribe, an alternative store of value that only exists because of the games central banks are playing; the opportunity cost of Crypto is so low, why not own some? The Foreign Currency Fighters have strengthened by 10% over the past year. Compounding the problem, they have a powerful, ascending leader, the renminbi, to challenge the US dollar’s hegemony as the reserve currency. All of these forces have been drawn to the battlefield because of our policy experiment with sustained negative real rates.

So Powell looks behind him to retreat. But standing there is none other than Inflation Nation, led by the fiercest warmongers of them all: the Commodities. He might take comfort that he is not alone on the battlefield. But then he looks over at the Washington, DC, fiscal battalion and realizes they are drunk on 5% deficit beer. That’s what Powell is facing, whether he recognizes it or not. And how he navigates this is going to be fascinating to watch.

Though PTJ’s rant is pretty entertaining, I would take his macro analysis with a grain of salt. The guy is a trading legend but he made his money through tape reading and gauging sentiment. Not macro fundamental analysis… and he has a record of saying some pretty out there stuff regarding the macro landscape that never ends up materializing.

Podcast I’m listening to —

I’ve been on a big Mark Dow kick lately. I think he’s one of the few macro guys who can truly fit his fundamental convictions within the reality of trading. That means honoring the tape and changing his views when price action goes against his narrative.

He’s also someone you want to listen to if you’re looking for the counter argument to the gold bugs and the central bank balance sheet fanatics. Dow hates gold and doesn’t think the Fed’s balance sheet had anything to do with the run up in equities.

His latest podcast interview was with JC Parets of All Star Charts. (Link here)

Video I’m watching —

The Italian election narrative has been drowned out by recent US equity market volatility, but I still think it’s worth keeping tabs on. If an anti-establishment party happens to win, the fear of populism could come to the forefront and set off another sell-off in European equities.

John Oliver did a fantastic breakdown on what to expect going into this vote. (Link here)

Elections will go down on March 4th. Perhaps this is the event Ray Dalio has been trying to get in front of…

Trade I’m looking at —

Equites are in a tough spot right now so I’ve been scouring the corners of the market to find some source of return that’s not completely dependent on the price of the S&P.

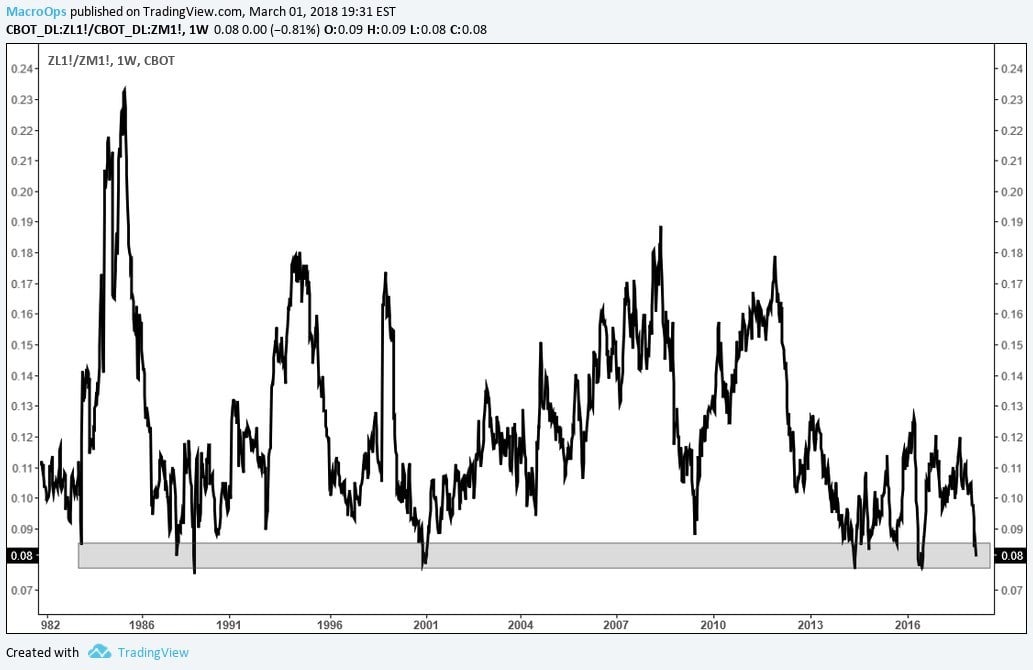

I stumbled across this graph which shows the price of Soybean Oil divided by the price of Soybean Meal. The spread is trading at historical lows — a spot which historically reverts back to the median price of the spread.

The spread has plummeted because of a sharp rally in CBOT Soybean Meal futures. Hot and dry conditions have weighed on yield potential in Argentina, and a weather premium is now embedded across the meal curve.

Here’s a picture of the curve showing the futures in backwardation.

When grain futures go into backwardation it opens up the opportunity to fade the bull move and play for a reversion after supply fears settle down. This trade is a lot like buying stocks after a VIX spike.

I don’t like fading breakouts in grains directly. But once price momentum settles down, short Soybean Meal against long Soy Oil could be a nice trade that’s completely uncorrelated with moves in the S&P.

Quote I’m pondering —

If anyone can refute me—show me I’m making a mistake or looking at things from the wrong perspective—I’ll gladly change. It’s the truth I’m after, and the truth never harmed anyone. ~ Marcus Aurelius

I bet Marcus Aurelius would’ve been a fantastic hedge fund manager had he lived in modern times. No one can thrive in speculation without having a relentless thirst for finding the truth. An open and flexible mind is a winning mind in this game.

That’s it for this week’s Macro Musings.

If you’re not already, be sure to follow us on Twitter: @MacroOps and on Stocktwits: @MacroOps. Alex post’s his mindless drivel there daily.

Here’s a link to our latest global macro research. And here’s another to our updated macro trading strategy and education.

Article by Macro Ops