Activists continued to lag major indices in 2017, according to Activist Insight data.

Activist-targeted stocks returned an average Annualised 13.2%* in 2017, well short of the S&P 500 Index’s 21.8% gain. The data, revealed in The Activist Investing Annual Review 2018, includes stocks invested in during and prior to the start of 2017, so long as they were held for at least two months.

Check out our H2 hedge fund letters here.

At the end of the third quarter of 2017, the Activist Insight Index, made up of the net returns of more than twenty activist hedge funds, had returned 10.7%, compared to 14.3% for the S&P 500 Index total return.

Activists performed particularly well in the health, technology and industrial goods sectors, according to the Annual Review.

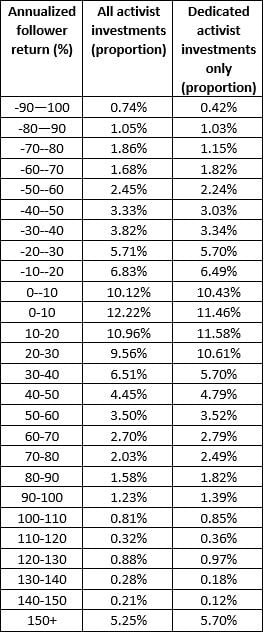

*Follower returns is a calculation of stock price change percentage from the first close in 2017 or, if the investment was disclosed in 2017, the close on the date an activist’s first involvement is disclosed until the sooner of the last close in 2017 or the date an activist discloses that they have exited the position. Average Annualised follower return calculated using a trimmed mean of 10%.

Activist Insight can help with bespoke data requests. Please note that requests may require 24-48 hours to complete, depending on their complexity. For futher information please email [email protected].

Compounded Activist Insight Index versus S&P 500 and MSCI World indexes since 2009

Annualised follower returns* of activist investments in 2017

Kind regards,

Josh Black

About Activist Insight

Since 2012, Activist Insight (www.activistinsight.com) has provided its diverse range of clients with the most comprehensive information on activist investing worldwide. Regularly quoted in the financial press, Activist Insight is the trusted source for data in this evolving space. Activist Insight offers five industry-leading products: Activist Insight Online, Activist Insight Shorts, Activist Insight Governance, Activist Insight Vulnerability – a tool for identifying potential activist targets – and Activist Insight Monthly – the world's only magazine dedicated to activist investing.