Advisors are interested in using factors. But it takes a lot of due diligence to choose among the many products and implement them in portfolios.

Check out our H2 hedge fund letters here.

The 2017 Cerulli survey of ETF usage shows that advisors are interested in factor-based (also known as strategic beta) products and expect to increase client allocations to the category in the coming two years. But choosing particular ETFs or conventional mutual funds to use among the hundreds available can prove daunting.

If an advisor decides that factor-based investing is the right choice for client portfolios, the advisor will need to answer three major questions before selecting the factor products, said Doug Grim of Vanguard Investment Strategy Group and coauthor of the white paper Equity factor-based investing: A practitioner’s guide.1

Those questions are:

- What is the most appropriate securities weighting method?

- Should the factor-based strategy be structured as a rules-based passive or active vehicle?

- If multiple factors could help achieve a client’s goals, how should they be combined?

“A lot of marketing highlights the long-term performance of particular factors or strategies.

But the reality is that the performance of any factor-based product, as with other forms of active management, will likely vary over time and be difficult to predict,” Grim said. “Just like a roller coaster, every factor strategy has its ups and downs. If you understand the nature of this cyclicality, you can better set your own and your clients’ expectations, and that can help you make a better decision on how much of your clients’ money, if any, you may want to commit to factors.”

| Before choosing factor products

Deciding how to implement factors assumes that an advisor has already decided which factor(s) may help the client achieve a certain goal (for example, enhance return or reduce risk). There are three important criteria to consider when deciding whether to use one or more factors:

|

Security weighting

An important, yet often underappreciated, consideration when choosing a factor product, and an equity factor product, in particular, is how securities should be weighted, Grim said.

ETFs or conventional mutual funds that screen for particular factors and then weight securities by market capitalization provide a modest level of factor exposure and often have lower costs and turnover.

The alternatively weighted category is a catchall for any long-only technique that is not market cap-weighted. For those interested in factor exposure, it is often best to narrow their search to products that weight stocks based on the stocks’ sensitivity to particular factors, such as relative price momentum or price-to-earnings ratios, because these products will provide higher and more consistent exposure to the targeted factor.

Long-short products often attempt to provide exposure to the desired style factor while attempting to reduce or eliminate sensitivity to movements in the overall equity market (i.e., market beta). Managers of these products buy those securities that are the most attractive based on favored metrics and sell short those securities that are the least attractive. Because short-selling is an expensive strategy that requires leverage, these types of products should be expected to incur additional costs.

“The answers to critical questions can help you determine which approach to take,” Grim said. “Those might include: How much factor exposure do I want, and what is the right price (cost) to obtain it? Is the strategy expected to provide consistent exposure to the desired factor? Do I want to give up the potential equity risk premium (in the case of long-short)?”

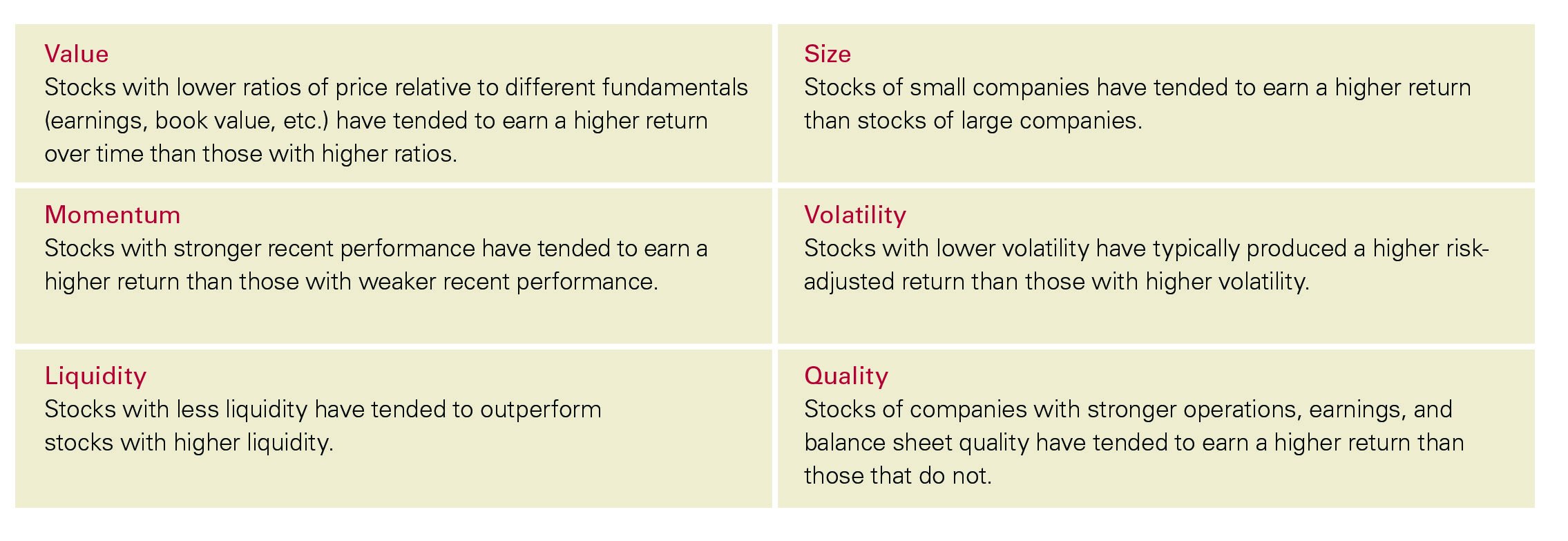

Six common stock factor exposures

Source: Vanguard.

Read the full article here by Vanguard, Advisor Perspectives