This research was originally published by the CFA Institute’s Enterprising Investor blog. Here is the link.

SUMMARY

- Some factors show structural sector exposure while others rotate sectors frequently

- Sector concentrations explain factor performance and may represent concentration risks

- Value is currently long Financials, Low Volatility is short Health Care, and Growth is short Energy

INTRODUCTION

Despite all the hustle and bustle surrounding factor investing, considerable uncertainty remains about what factors and their related products represent and contain. For example, there is a large discrepancy between the excess returns of long-short factor portfolios and investable smart beta products. Taking a step further back to the factor construction level, it’s illuminating to examine what stocks compose the building blocks of factors.

By analyzing how the factors break down by sector, we can gain valuable insights into factor performance and concentration risks.

With that goal in mind, we explore the six well-known factors – Value, Size, Momentum, Low Volatility, Quality, and Growth – using definitions in line with academic and industry standards and focusing our analysis on the United States. We construct the long and short portfolios using the top and bottom 10% of the stock universe.

THE VALUE FACTOR

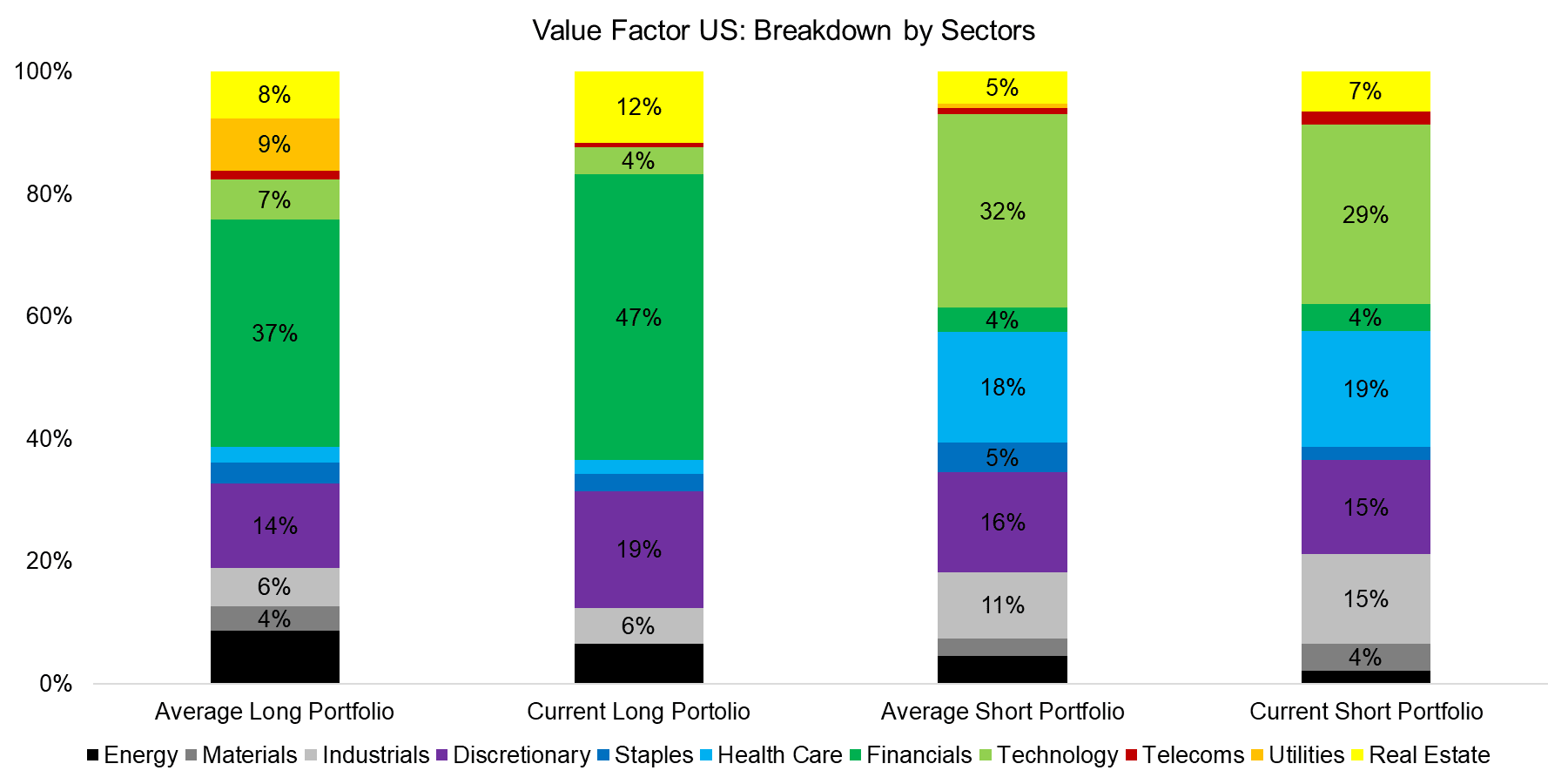

The chart below shows the long and short value factor portfolios by sector, with the average portfolios covering the years 2000 to 2017. Financials make up more of the current long portfolio than the average portfolios, indicating that banks, insurance, and other financial services companies are cheaper today than their historical average. Interestingly, the Technology sector does not compose a larger share of the current short portfolio despite concerns about the high valuations of tech companies like Amazon and Facebook.

Source: FactorResearch, chart shows all percentages larger than 3%.

THE SIZE FACTOR

The shifting compositions of Size factor portfolios demonstrate how the US stock market has evolved in terms of sectors over time. Neither the long portfolio, which represents small caps, nor the short portfolio, which consists of large caps, shows significant variation in composition today compared to the last 17 years.

Source: FactorResearch, chart shows all percentages larger than 3%.

THE MOMENTUM FACTOR

Characterized by frequent portfolio changes as the winning and losing stocks over the previous 12 months are constantly rotated in and out, the Momentum factor often mirrors other factors. Because of this, it tends to be well diversified across sectors. Currently, there is almost a zero allocation to Energy stocks in the long portfolios, but nearly twice the historical weight in the short portfolio, indicating the poor performance of oil and gas companies over the previous 12 months.

Source: FactorResearch, chart shows all percentages larger than 3%.

THE LOW VOLATILITY FACTOR

Based on strong performance and supportive research, the Low-Volatility factor has gained immense popularity in recent years. The underlying theory behind the factor is that stocks with lower volatility exhibit higher risk-adjusted returns than those with higher volatility. Intuitively, we would therefore expect to find less exciting and less volatile sectors like Utilities and Real Estate in the long portfolio and more dynamic sectors like Technology in the short.

The following chart confirms this. It also shows that there has been minor sector rotation in the long portfolio over time, but a dramatic shift from Technology to Health Care in the short portfolio. Tech companies, which have likely grown into more mature and less volatile businesses, may have been replaced by more volatile biotech companies from the Health Care sector.

Source: FactorResearch, chart shows all percentages larger than 3%.

THE QUALITY FACTOR

The Quality factor is a combination of profitability and balance sheet ratios. Though it shows no structural changes in the long portfolio, the short portfolio has reduced Real Estate sector exposure. Why the decreased exposure? Real estate stocks (REITs) played a role in the global financial crisis, so likely strengthened their balance sheets thereafter.

Source: FactorResearch, chart shows all percentages larger than 3%.

THE GROWTH FACTOR

Calculated by a combination of sales and earnings-per-share growth over the last three years, the growth factor shows the greatest sector rotation of all factors and illustrates the ever-changing nature of the economy. The Technology sector currently features larger in the long portfolio, reflecting the strong growth of tech companies in recent years. The short portfolio is dominated by the Energy sector thanks to lower oil and gas prices.

Source: FactorResearch, Chart shows all percentages larger than 3%.

FURTHER THOUGHTS

Some factors have structural sector exposure while others rotate sectors more frequently. Naturally, the highlighted risks – large sector exposures, among them – could be mitigated by creating factors sector-neutral.

However, our prior research has found that factor trends are remarkably similar intra versus cross-sector. This implies that any sector risks on a cross-sector level are replicated at the intra-sector level, or through sub-sector exposures. It’s therefore worth monitoring the sector compositions of factors as a source of risk as well as returns.

ABOUT THE AUTHOR

Nicolas Rabener is the Managing Director of FactorResearch, which provides quantitative solutions for factor investing. Previously he founded Jackdaw Capital, an award-winning quantitative investment manager focused on equity market neutral strategies. Before that Nicolas worked at GIC (Government of Singapore Investment Corporation) in London focused on real estate investments across the capital structure. He started his career working in investment banking at Citigroup in London and New York. Nicolas holds a Master of Finance from HHL Leipzig Graduate School of Management, is a CAIA charter holder, and enjoys endurance sports (100km Ultramarathon, Mont Blanc, Mount Kilimanjaro).

Article by Nicolas Rabener, Factor Research