Even though on the face of it the US economy may appear to be in rude health, there is one major problem lurking below the surface. The ballooning US budget deficit, may not be at the top of policymakers’ agendas today but as it continues to grow, sooner or later, Washington will have to deal with the issue.

A recent report from a Washington think tank estimates that the US budget deficit could hit a staggering $1 trillion by 2019, the first time since 2012 the US economy will have to support a deficit so massive. If current policies continue, the think tank believes that the deficit could hit a mammoth $2 trillion by 2027. These numbers include the fallout from the recently passed tax bill which is expected to add $1.5 trillion to the country’s national debt over the space of a decade.

U.S. Budget Deficit Will Lead To A 30% Market Crash

Funding this spending gap is going to be a colossal undertaking for the US Treasury. At a time when interest rates are rising for the first time in nearly a decade, and the Federal Reserve is beginning to unwind its quantitative easing programme, careful planning will be needed to ensure the market can handle the additional supply.

Funding the US budget deficit

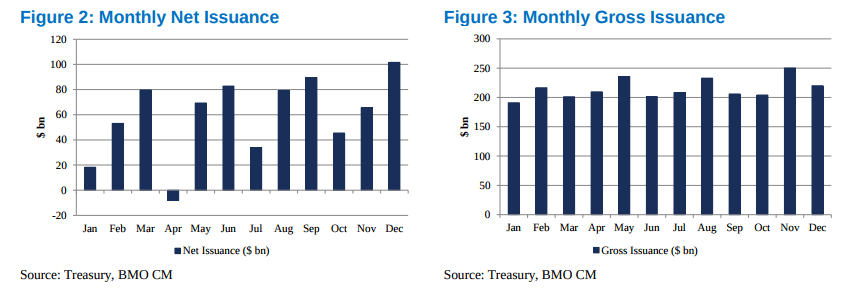

BMO Capital Markets estimates that the Treasury will have to issue a net $1.1 trillion in US budget deficit for 2018. a gradual increase in year-on-year monthly issuance is expected throughout the year. Two-year and three-year insurance is likely to increase by around $2 billion per month through December “which would reach $48 billion and $46 billion by year-end, which exceeds the maximum auction sizes indicated by the most recent primary dealer survey” according to the BMO report.

BMO also finds that current treasury estimates suggest net coupon issuance of $710 billion in 2018 leaving a shortfall of about $429 billion “to be funded through increased bill issuance.”

Another method the Treasury could use to balance the books would be to increase front end and floating rate issuance or even slightly increase TIPS which would increase “net issuance by another $65 billion while also keeping issuance sizes near the maximum levels per the dealer survey.”

Net issuance is expected to peak at $102 billion in December 2018 and print a low of -$8 billion in April although this is due to a timing difference between auction settle and maturity.