The Trump tax cuts and talk of potential fiscal stimulus, pushing the economic pedal to the metal, is delivering tangible results in wage growth. But this, at the same time, is raising concerns. Bridgewater’s Ray Dalio, for instance, notes that the recent stock market sell-off is “a taste of what tightening will be like.” Moody’s analyst Christina Padgett and her team, meanwhile, put pen to paper to determine exactly how positive tax law changes could turn up the heat on inflationary pressures — and how it might impact individual credit ratings.

Getting central bank timing right at the end of an economic cycle is like threading a needle

Dalio is one of the world’s leading systematic thinkers who has been watching the debt supercycle play itself out. But even he is surprised by the rate of change in market conditions at present.

When considering market concerns over rate hikes, he says “this is happening sooner than we expected.”

Getting the timing right on any trade can be challenging, with debt-based economic models being notoriously long before the market experiences a negative reaction. Bond investor Jeffery Gundlach, for instance, is known to believe that a debt crisis takes much longer for the market to react, but when it does react, that price move will come quicker than people expect.

The “rekindling of animal spirits,” as Dalio puts it, has placed the Fed in a box.

“Fiscal stimulation is hitting the gas,” he wrote in a Linkedin post. This, in turn, is driving economic demand “forward into the capacity constraints, which is triggering interest rate increases,” a move that serves as “hitting the brakes, first in the markets and later in the economy.”

Late economic cycle market gyrations “make it difficult for the Fed to get monetary policy exactly right.”

Modeling the impact of yet to be determined fiscal stimulus is difficult

A component of the difficulty might stem from the inability to model the economic gas pedal. How much impact will tax reform really have in the economy is just starting to emerge as fact, and the potential for fiscal stimulus to boost wages and inflation further remains a known unknown.

In a February 1 Moody’s piece, analysts Padgett, John Puchalla and Tom Marshella recognize the additional free cash flow that is being generated by tax changes, the question that is unclear remains: how will corporates use their newfound wealth?

“While some companies will use their windfall cash to take credit-positive decisions, such as reducing debt and re-investing in their core businesses, some will likely opt to reward shareholders,” Moody’s noted, pointing out activities that represent different economic benefits. “More broadly, we are evaluating whether companies alter capital structures, cash deployment, operating strategies and even their legal organization to assess the credit effects of all elements of the new tax laws.”

As corporates receive an additional cash windfall, Moody’s is watching for them to improve their fiscal positions, which could have positive impact on their credit rating.

This is particularly true with regards to cash repatriation.

For corporates with cash oversees, they will see a one-time tax liability on unrepatriated overseas profits payable over eight years. “This liability is an additional cash burden but is accompanied by the flexibility to now repatriate cash to the US with little to no incremental US tax,” Moody’s pointed out. “For companies that repatriate a lot more cash, the credit implications will depend on how the cash is used and any related changes in debt structure.”

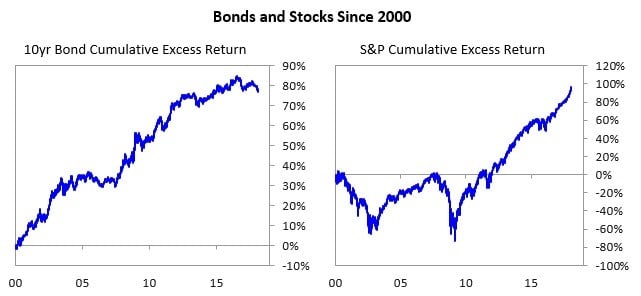

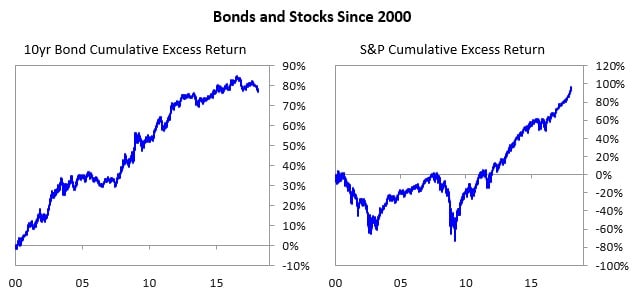

Dalio, for his part, doesn’t think the recent sell-off in stocks due to potential rate hikes is going to result in much more than a temporary blip. “The recent price declines are not even noticeable within context of the bigger and longer-term picture,” he wrote.

The larger issue that remains to be determined is how corporates use the extra cash they have in their collective pockets – and if this spurs the inflation monster to come out of hibernation.