The 2018 Software Survey, conducted by Advisor Perspectives, Joel Bruckenstein at T3, and my firm, Inside Information, offered by far the most comprehensive data on the advisor tech landscape ever collected. In all, we received 1,554 useable responses, representing firms very small to very large, across a broad spectrum of experience in the business.

You can read the full report here.

The survey started by examining market share data – that is, the percentage of the total respondents who are using each of more than 300 different software programs and web-based services, broken down into 13 different categories:

All-In-One Programs (led by Morningstar Office and Envestnet/Tamarac)

Risk Tolerance Instruments (Riskalyze and FinaMetrica)

Portfolio Management Tools (PortfolioCenter, Envestnet/Tamarac, Morningstar Office, Orion Advisor Services)

Trading/Rebalancing Tools (iRebal, Envestnet/Tamarac)

Financial Planning Tools (MoneyGuidePro, eMoney)

CRM Tools (Wealthbox, Junxure, Redtail, Salesforce)

Document Management/Processing Tools (DocuSign, LaserApp)

Online Portfolio Management (“robo”) Tools (Schwab Intelligent Portfolios, Envestnet, Betterment Institutional, Folio Institutional)

Investment Data and Stress Testing Tools (DFA Returns; Riskalyze Stats/Scenarios)

Investment Data/Analytics Tools (Morningstar, fi360, YCharts)

Custodial Custody and Trading Platforms (numerous)

Cloud Hosting and Cybersecurity Providers (Rightsize Solutions, Entreda, True North Networks)

Miscellaneous Tools (SS Analyzer, MaxMyInterest, i65, WhealthCare)

In addition, we asked each user to rate the software tools and services they were using on a scale of 1 (probably replace) to 10 (highly recommend to my friends). The report provides average ratings for each software program and average category ratings, to see how satisfied users were with what they were using, and in general how satisfied the community is with each category.

A surprising number of programs/services scored above 7.0, which suggests that advisors today are generally satisfied with the functionality and feature set of their tech tools. A few programs achieved extraordinary average ratings at 8.00 or more, including iRebal (TDA free version) in the rebalancing category (8.32); Advyzon in the all-in-one category (8.08); eMoney in the financial planning group (8.00); Concenter Services/XLR8 among the CRM tools (8.65); DocuSign among the document management tools (8.21); and the trio of Kwanti/Portfolio Lab (8.56), the Bloomberg Terminal (8.52) and FactSet (8.03) in the investment data and analytics category.

The highest overall category rating (7.73) was found in the cloud hosting/cybersecurity group, where the highest rated services were True North Networks (8.83), and Rightsize Solutions (8.33).

Finally, we asked the survey participants which programs/services they’re looking at adding in the next 12 months – on the theory that this would provide us with an early warning system as to who will soon be gaining market share in their categories.

The programs and services that appear to be on the rise include:

Envestnet/Tamarac and Oranj (all-in-one)

Riskalyze and FinaMetrica (risk tolerance)

Orion Advisor Services (both portfolio management and trading/rebalancing)

eMoney, MoneyGuidePro and Right Capital (financial planning)

Redtail and Salesforce (CRM)

DocuSign (document management)

Schwab Intelligent Portfolios (online portfolio management)

Riskalyze Stats/Scenarios (investment data and portfolio stress testing)

YCharts (investment data and analytics)

True North Networks (cloud hosting/cybersecurity)

Whealthcare, SS Analyzer and MaxMyInterest (miscellaneous)

All of this information should be helpful to the advisor community as you sort through the bewildering range of options available to your firm, especially since so many of today’s options are either new or dramatically upgraded from the last time you viewed a demo. But bigger picture, what were some of the most surprising nuggets to be pulled out of this data?

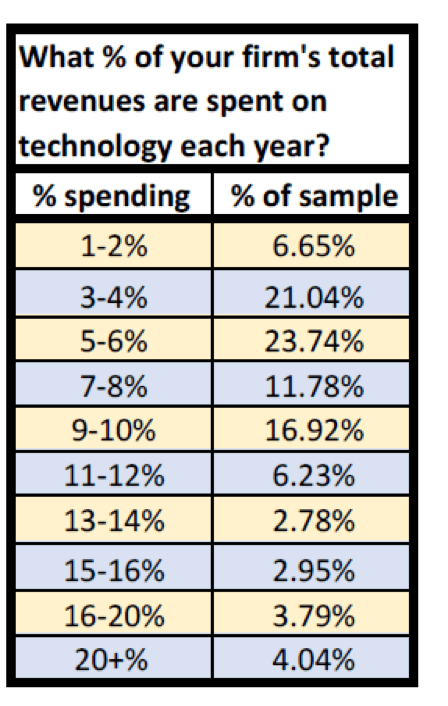

One thing that advisors might find surprising is the average “tech spend” in the industry. This result was not included in the survey writeup, but we asked survey participants to estimate how much of their total revenues are spent on technology (which includes hardware costs, software license fees and consultant fees) each year. The idea was to help the community determine roughly what their peers are spending, and whether their own expenditures are normal or within industry averages.

Read the full article here by Bob Veres, Advisor Perspectives