February 20, 2018 | By Jennifer McDermott, consumer advocate helping people improve their personal finances, finder.com

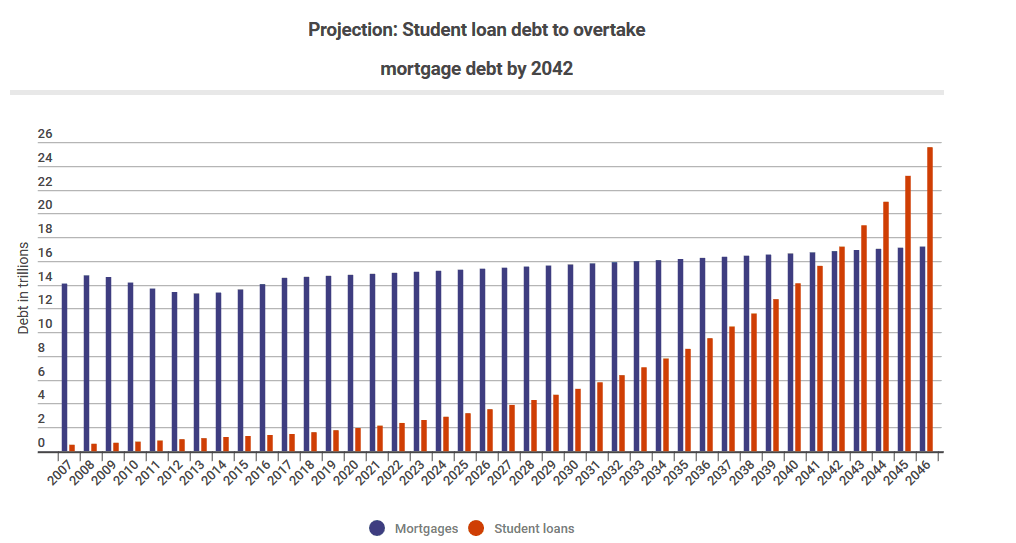

With 44 millions Americans living with student debt it’s concerning that a recent finder.com analysis of Federal Reserve Bank data reveals that student loan balances could be larger than mortgages in just 25 years. Student loans have tripled since 2006, with totals rising from $481 billion to more than $1.45 trillion. This means student loans are now the second-largest form of household debt following mortgages.

Mortgages are growing at a rate of 0.6% annually, while student loans are growing at 10.4%. If these rates of growth continue student loan balances will overtake mortgages by 2042.

Why We’re Concerned

Students loans have a higher delinquency rate than any other type of household debt. When compared to mortgages specifically, it’s a more troubling problem. Nationwide we see student loan delinquency rates standing at 11.2% with some as high as 16% in West Virginia, Arkansas and New Mexico.

By missing one payment a borrower is considered a delinquent, even if it’s just a few days late. Unfortunately, 5 million Americans admit to being at least 90 days late on repaying their student loans. However, due to stronger regulations put in place since the 2008 financial crisis, we’ve seen a descent in delinquency rates for mortgages, settling at a low 1.5%.

Protections: Mortgages vs. Student Loans

The majority of mortgage interest rates are calculated on a secondary market. This system determines what they’re willing to let you borrow, driving more competition among lenders and rates that are more consistent for homebuyers. On the other hand, Congress sets the rates for student loans and vary by private lender taking into account level of study, any lender fees and the year in which you’re borrowing money.4

In addition, since mortgages come with a physical asset, such as a home, there is less risk for a lender. If a borrower defaults the home can be repossessed or sold. With a student loan there is no guarantee for a higher income or even a job. Since the lender has nothing to repossess if a borrower defaults, the lender takes a risk for a big loss. What’s even worse is that defaulting on student loans could make you ineligible for low-rate, low-down-payment FHA mortgages in the future.

Student loan borrowers can also run into trouble if ever in the position to declare bankruptcy. Mortgage debt allows you to discharge the debt entirely since it typically falls under under “undue hardship.” Without proving “undue hardship” to a bankruptcy judge it’s quite difficult to discharge a student loan.

States With Most Student Loan Delinquencies

The finder.com analysis revealed West Virginia, Arkansas and New Mexico sit at the top with the highest delinquency rates, with over 16% of borrowers late on payments. On the opposite end we see Massachusetts, Minnesota and Connecticut with the lowest delinquency rates – 7.84%, 8.12% and 8.18% respectively. And, accounting for nearly $40 billion of delinquent student debt and over 11 million borrowers is California, Texas, Florida and New York.

Jennifer McDermott is Consumer Advocate at personal finance comparison website finder.com. She has more than 12 years’ experience under her belt in the finance, lifestyle and travel industries where she’s analyzed consumer trends. Jennifer loves to uncover interesting insights and issues to help people find better.