With the declines yesterday, U.S. markets are now in an official correction. Just to get the terminology straight, a “correction” means a 10-percent decline, while a “bear market” indicates a 20-percent decline. As of the close yesterday, the Dow was down 10.3 percent, and the S&P 500 was down 10.1 percent. The decline really accelerated at the end of the day—bringing the indices into official correction territory.

[REITs]Of course, putting a name on something doesn’t change it. A drop of 9.9 percent is not that different from one of 10.1 percent, despite the fact that the latter is a correction and the former is not. But now that we are at that point, we need to take another look at whether this could become much worse. I still don’t think this is the big one. I do have to admit, however, that it has come far enough that I am taking a closer look. So, let’s see what that means.

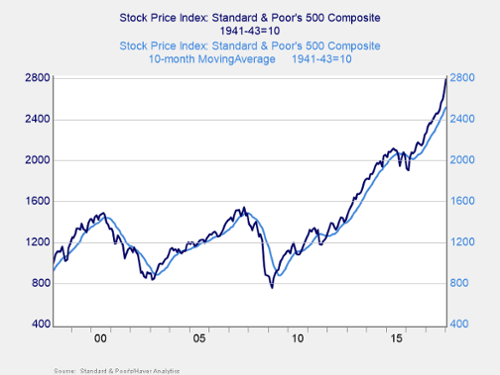

200-day moving average

Historically, one of the better warning signs for larger declines has been when the market breaks what is called the 200-day moving average. This is nothing more than the average of the closing prices for the past 200 days. If the market is above the average, it is in an uptrend; if below, it is in a downtrend.

As you can see in the chart above, in both 2000 and 2008 when the S&P 500 broke the 200-day moving average (shown here as 10 months, which equates to 200 trading days), larger declines followed soon thereafter. This is why I start to pay attention when the market breaks below that line.

What you can also see, however, are the multiple occasions when the index broke through the 200-day average and then bounced back up—rather than declining further. We saw major breaks in early 2016 and mid-2015, plus a minor break in 2014. Looking even further back, there were major breaks in 2010 and 2011. In other words, while a break of the 200-day moving average can be a warning sign of trouble ahead, over the past 20 years or so, there have been about four false alarms for every real alarm. This is why I start to pay attention then, but I don’t react. Chances are, even if we break the trend line, this is just another false alarm. And, to be clear, we are still above that line.

The worry point

For those who are looking for the actual worry point, it is around 2,540 on the S&P 500 and 22,800 on the Dow. While we are above those points, we are actually not that far away (which is why I am writing this). It is getting really close to paying attention time.

It is not, however, getting close (at least for me) to reacting time. That point would be when the indices drop below a longer-term trend line, probably the 400-day moving average. This is the same idea as the 200-day moving average. But the longer period trend line has had fewer—and more reliable—signals of trouble. We are nowhere close to those levels, and I suspect we won’t get there.

Why? The economy remains solid. Corporate revenues and profits are rising quickly. Valuations, while high, are now more reasonable than they were a couple of weeks ago. Finally, many of the risks—inflation, a government shutdown, and geopolitical concerns—are either moderating or likely to do so. The conditions for a sustained drawdown, based on history, simply are not in place.

Could it get worse?

That doesn’t mean the current pullback can’t get deeper. Could we keep going down? Certainly. Would that worry me? Only as much as I said above. When we hit the 200-day average, I will start to be concerned. Somewhere below that—and I will get into that if it becomes necessary—I might start to take action. Then again, I might not. Action has costs and advantages, so I will think carefully before I do anything.

Measure your ability to accept risk

The reason I can take this approach is that I have thought through my reaction to volatility ahead of time. For anyone reading who is upset by what is happening, I suggest you do the same. One real benefit of a drawdown is it lets us measure our own ability to accept risk. We have not had a chance to test that much in recent years, so take advantage of this. If you are a concerned investor, talk to your advisor. He or she can help you make changes that will allow you to meet your goals and still be able to sleep at night.

Article by Brad McMillan, Commonwealth Financial Network