According to data from Bank of America Merrill Lynch, for the week to February 6th US equity sales spiked to the most massive level since June 2016, two weeks before the Brexit vote. According to the bank’s latest Equity Client Flow Trends report, its client sold a total of $3.6 billion of US equities during the period under review. This is the 9th largest outflow recorded since 2008.

JPM Warns: We Risk Downward Spiral Exacerbated By, Balanced MFs And Risk Parity Funds

Sales of ETFs were the largest since the bank started tracking these instruments in early March 2017.

Equity sales: It’s all relative

While these flows may be some of the largest ever recorded by Bank of America’s analysts, in the grand scheme of things they are a drop in the ocean. In the last week of January, an estimated $25.6 billion gushed into equity funds around the world taking the total inflows for the month to around $100 billion, the most significant inflow ever recorded into equities. The second largest flow recorded was in January 2013 when investors dumped $77 billion into global equity funds.

Still, it seems investors were quick to turn away from equities as volatility returned and no sector appears safe from the selling:

“Clients sold single stocks across nine of the 11 sectors last week, led by sales of Discretionary, Industrials and Energy stocks. Only Staples and Telecom stocks saw net buying; clients also bought ETFs in these sectors. Discretionary continues to have the longest selling streak (for 13 straight weeks, and with sales on a rolling four-week average basis since last January). Year-to-date, only Health Care and Telecom stocks have seen cumulative inflows from our clients, while Discretionary and Financials stocks have seen the biggest cumulative sales. Discretionary, Industrials and Utilities saw net sales by all three client groups last week; no sector saw net buying by all three.”

Interestingly, according to BoA’s data, all clients have now become net sellers of equities over the past four weeks. Hedge funds and now net sellers of stocks on a four-week average after a brief period of buying towards the end of last year.

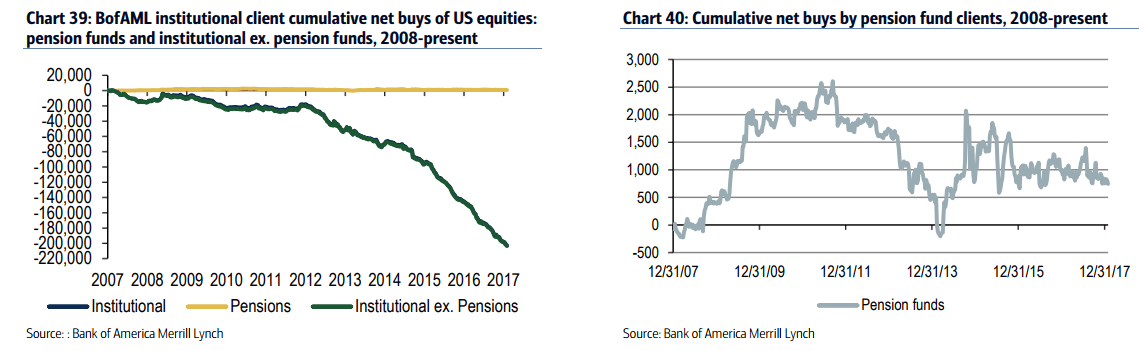

Meanwhile, institutional clients have been net sellers on a four-week basis since early February 2016. In fact, BoA’s institutional clients have been the most aggressive sellers of equities since 2012. Last year, this client set sold a total of $53 billion in US equities, or $61 billion including inflows into ETFs. This substantial outflow followed an outflow of $52 billion in 2016, $19 billion in 2015, $26 billion in 2014 and near $30 billion in 2013.

Pension funds have been the one subset of this group that has bucked the trend. Wiley institutional investor group as a whole has been significant net sellers for the past five years pension funds have remained almost neutral. As shown in the two charts below, since the end of 2007 pension funds clients of BoA have racked up cumulative net us equity buys of around $1 billion compared to total net sales of nearly $200 billion for BoA’s institutional investor clients overall.