In his latest shareholder letter, Rich Pzena at Pzena Asset Management provides some great advice for investors who are finding it difficult to invest in disruptive times saying:

“We are handling the current wave of disruptions the way we always have: by conducting intensive research to find skewed risk / reward opportunities in companies with resilient business franchises.”

Here’s an excerpt from that letter:

“New” always gets people’s attention. In 1999, Michael Lewis captured the seductive energy of the internet boom in his memorable book, “The New New Thing.” Today, the new thing is referred to as “disruption.” 2017 stock market returns reflect investors’ adoration of disruptors, as sentiment swung back powerfully to growth-style investing.

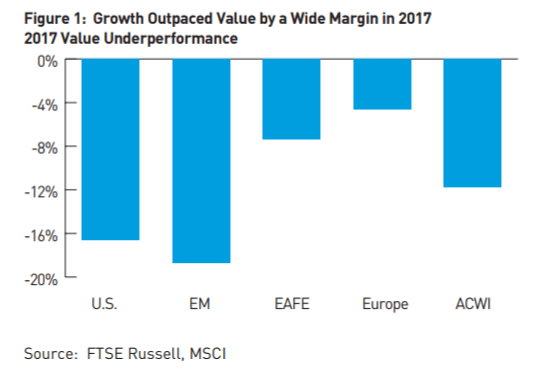

Growth indices outperformed value in the U.S. by 17%, in emerging markets by 19%, in EAFE by 8%, and in Europe by “just” 5% (Figure 1). Leading this disparity was the surge in stock prices of disruptors, many of which are in the U.S. and China, supported by the notion that these companies will displace incumbents in a fight-to-the-death battle. Investment pundits love a good acronym: in the U.S. we now have FANG MAN (Facebook, Apple, Netflix, Google; Microsoft, Amazon and Nvidia) which were up a cap weighted 46% in 2017, representing 23% of the Russell 1000’s overall gains and 13% of its market cap.

In Asia we have the BATs (Baidu, Alibaba, and Tencent) which rose a cap weighted 96%, accounting for 18% of the MSCI Emerging Market index’s gain and now account for 8% of its market cap. Those subject to disruption have lagged, opening the door to clear-eyed analysis of risk and opportunity.

Assessing Disruption

Market sentiment aside, there is nothing new about the concept of disruption. Disrupted stocks have hit our investment screens ever since we opened our doors twenty-two years ago.

The question is: are the disrupted companies going away? Of course, we don’t know the answer to that question. But we do know that disruption is difficult, and it doesn’t happen very often, even though it is regularly forecast.

For example, when low-cost Asian manufacturers came on the scene in the late 1990’s, western industrial companies were thought to be on the way to being “disrupted” out of business, yet they still retain their dominant positions today. On the other hand, digital cameras completely “disrupted” Kodak. How does one distinguish between the two?

The truth is, it is difficult. So, we resort to our tried and-true approach – intensive research. If a stock is priced as if the disruption is a near-certainty, yet management has a credible plan to retain the business, we might choose to invest. If management is right, we can realize a significant upside. If management is wrong and the business erodes, well, that’s what the market expected anyway. Low initial valuation and slow decline of the existing franchise should allow an exit from the position with limited losses.

In Kodak’s case, management’s plan to contest digital photography was to enter the digital camera business. Yet Kodak had no manufacturing capability and no experience in the cut-throat world of digital consumer electronics – basically, no edge. On that basis, Kodak seemed like gambling, and we passed on the investment.

Meanwhile, we invested in western manufacturers that had a multitude of advantages they were able to exploit to thwart the competitive threat, including extensive global dealer and service networks, longstanding reputations for quality and reliability, and an ability to lower their own manufacturing costs by moving manufacturing offshore. Two completely different risk/reward profiles, and two completely different outcomes.

Our investment approach is to apply our bottom-up, intensive research process to expose client portfolios to skewed potential outcomes, where deep undervaluation, an identifiable path to earnings normalization, and downside protection provide the opportunity for significant upside with limited downside. Downside protection can take many forms, but some common characteristics include regulatory and scale advantages, the power of incumbency, and flexible cost structures that provide financial and operational resilience.

You can find the entire shareholder letter here.

For more articles like this, check out our recent articles here.

Article by Johnny Hopkins, The Acquirer's Multiple