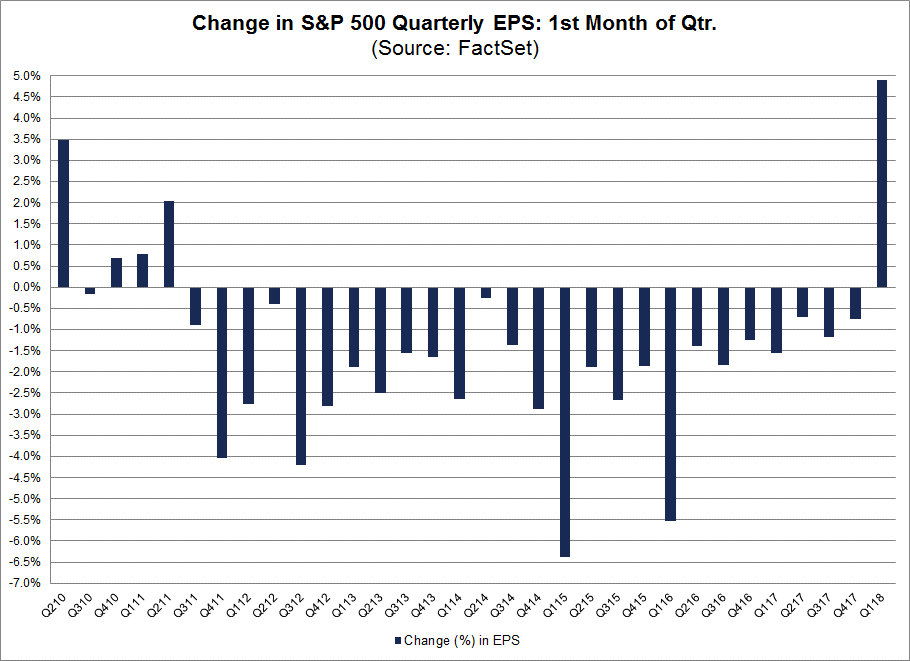

During the month of January, analysts increased earnings estimates for companies in the S&P 500 for the first quarter. The Q1 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for all the companies in the index) rose by 4.9% (to $36.04 from $34.36) during this period. How significant is a 4.9% increase in the bottom-up EPS estimate during the first month of a quarter? How does this decrease compare to recent quarters?

[REITs]On average, the bottom-up EPS estimate usually decreases during the first month of a quarter. During the past year (four quarters), the bottom-up EPS estimate has recorded an average decline of 1.0% during the first month of a quarter. During the past five years (20 quarters), the bottom-up EPS estimate has recorded an average decline of 2.1% during the first month of a quarter. During the past 10 years (40 quarters), the bottom-up EPS estimate has recorded an average decline of 2.5% during the first month of a quarter.

In fact, the first quarter of 2018 marked the largest increase in the bottom-up EPS estimate over the first month of a quarter since FactSet began tracking the quarterly bottom-up EPS estimate in Q2 2002. The previous record for the largest increase in the bottom-up EPS estimate was 3.5%, which occurred during the first month (April) of Q2 2010.

Sector-Level Changes

At the sector level, 10 of the 11 sectors recorded an increase in their bottom-up EPS estimates during the first month of the quarter, led by the Energy (+20.3%) and Financials (+10.8%) sectors.

What is driving the increase in the bottom-up EPS estimate for Q1 2018? The decrease in the corporate tax rate for 2018 due to the new tax law was clearly a significant factor in the upward revisions to EPS estimates. The rapid increase in earnings expectations for Q1 2018 occurred just after the tax bill was signed into law. However, it is difficult to quantify the exact impact of the changes in the tax rate on the upward revisions. Other factors also have fueled the increase in earnings estimates as well. For example, rising oil prices have contributed to the large increase in earnings estimates for companies in the Energy sector. Expectations for higher interest rates in 2018 have also likely contributed to the significant increase in earnings estimates for companies in the Financials sector.

Article by John Butters, FactSet