Has Crispin Odey’s ship finally arrived? Always a groomsman but never a groom, one of the world’s most bearish fund managers who has been anticipating and betting on a market crash now has finally gotten a payout from other people’s gore. Odey’s fund was reported to have jumped 6% Monday alone as a result of the market carnage. In a January letter to investors, Odey OEI MAC fund was already making money – a relative rarity of late. Mr. Doom still has a bearish monetary outlook going forward, but in the short term the market could bounce — depending what happens over the next week or so.

Odey: Humans are not responsible for this market crash

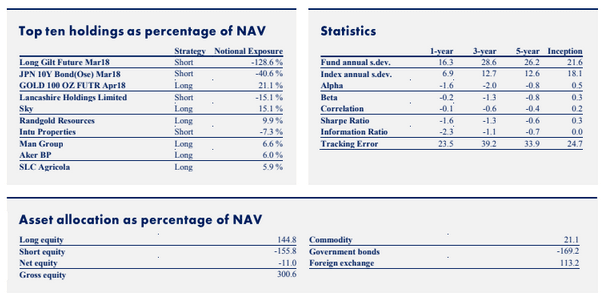

Odey, who runs near $5.5 billion of assets (or did), much of it from wealthy individuals and those seeking a tail risk hedge for a portion of their stock investments, has a patient lot of investors of those who remain. The fund has been gored by a nine-year bull market.

With stocks getting hammered, Odey doesn’t celebrate as much as he does reflect and analyze in an unemotional fashion. When he looks at Monday’s 1,400 point drop in the Dow Jones Industrial Average in a little under an hour, he knows who to blame.

“Frankly what happened… had nothing to do with humans,” he wrote. “A reputation for being safe and secure was enough for mathematicians to build castles in the sky for ‘investors’ to live in. On Monday those castles fell from the sky.”

He said the move was initially caused by a rise in bond yields and concern over central bank quantitative moves given a potential rise in inflation.

####

There are both fundamental and technical concerns Odey addresses.

On a fundamental level, he sees a world where its leaders are more interested in trading than building great economic business models. China is now manufacturing nearly 50% of the world's goods and dominates the commodity markets:

Antinomy is a very small market but like all commodities it is dominated by China who manufacture 50% of it. In 1995 they arrived in this market and quickly drove out western refineries with the low margins they were willing to work for. Twenty three years later the world is running scarce of easily obtained antimony and this is a market in which domination by a country more interested in trading than commercialisation has had a price. From here supply can only be brought on by higher prices and a commercial thinking which develops markets outside of where they currently are. It feels like a microcosm of many commodities’ positioning today. If the world is again full of scarcity, printing money will first lead to inflation and more importantly stagflation.

It is in that last sentence when Odey tears not into a central bank as much as the mathematical magicians who dominate:

QE introduced mathematicians to our market place. With risk doubled down, they had a ball with financial instruments. Their ability to marshal data was game changing but their demand for data was also their weakness. The further back in time they went, the poorer the data they could recover and the sheer amount made it impossible to mine far back.

This all leads to the dreaded inflation bogeyman:

And thankfully so because it allowed historians to study similar times to this and draw out trends that rhyme with today. Monetising has taken many forms in the past, but it rarely lasts more than 2 years before it passes from financial assets into the real economy. For my money the closest fit is with 1971- 1974. Like then nobody had witnessed inflation greater than 2%.

And of course it wouldn’t be a bearish market piece without some reference to the gold standard:

Governments reacted to the end of the Bretton Woods exchange rate system (a gold standard) by both monetising and spending on a giant scale. The massive monetary injection was felt firstly in 1972 by the rise of the nifty fifty stocks – those companies whose prospects could never dim – to begin with but by the end of ’73 and into ’74 by a global boom which in the end lifted all commodities and by ’75 had led to wage inflation in the western world of over 8%. The secret as to why this happened was that the authorities were very slow to tighten monetary policy and were more intent on maintaining full employment than a sound currency. If this all sounds familiar, please remember that the stagflation of the 1970’s came only after 2 years of monetising, not ten years. Financial assets – both bonds and equities – react only badly to ever rising inflation and moreover equities, thanks to QE, are as expensively priced as they were in 1928/9 and 1999/2000. This is not a place from which you would like to begin this journey.

But don’t fear, gentle investor. The world according to Crispin isn’t always doom and gloom:

For the optimists, globalisation and productivity needs to come to their aid. Remember that the 70’s were not just a time of economic crisis. It witnessed a crisis for capitalism as well. Wealth cannot be defended, but capitalism is about competition overcoming rent-seeking and should be defended.

Are we in a major bear or was the recent market activity just a technical glitch? That may take time to tell. “Whether the fall was the herald of more bad news to come out of financial assets, the next few weeks will tell,” he wrote, his fund up 1.8% in January and licking his chops to deliver February numbers.