Citadel founder Ken Griffin thinks the core economic engine is working properly. On a day when stocks raced from down 900 points on the Dow Jones Industrial Average to down 1,600 a matter of minutes, Griffin follows hedge fund manager Ray Dalio in publicly discussing what can go wrong in the markets. Their analysis points to what was previously left largely undiscussed: Central bank withdrawal of market stimulus.

Griffin: While economy is strong, some "dark clouds" are concerning

Griffin points to a strong macroeconomic backdrop in a letter to investors released to the public last week.

“Growth prospects around the world remain positive,” he wrote, pointing to a pro-business regulatory environment and tax reform that is boosting U.S. corporate earnings growth. “In Europe, growth has also accelerated and the rate of unemployment is showing marked improvement.”

While many of the economic indicators “point upward over the short run,” he recognizes that “some dark clouds potentially loom on the horizon.”

Some of those “dark clouds” have become apparent over the last few days.

"Quantitative easing in reverse" is a concern as new Fed Chair takes over

At the top of Griffin’s list of a handful of market concerns is “quantitative easing… heading into reverse” just as newly minted Fed Chair Jay Powell takes charge.

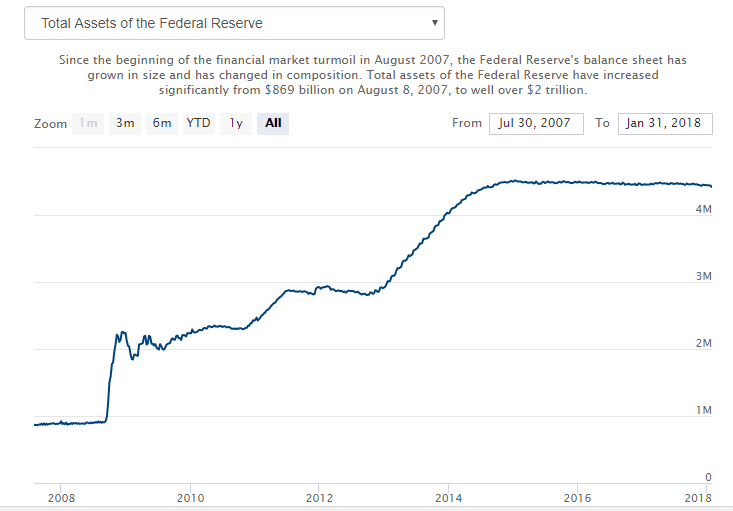

Never before in history have global central banks had such a bloated balance sheet. In September 2008, the US Fed, for instance, held just under $1 trillion in assets. Following the financial crisis, and particularly in October of 2015, that number grew and now stands at near $4.4 trillion.

Going on a diet has been a major market concern, but one often spoken in dulcet whispers. For instance, in 2015 when Balyasny Asset Management placed a top-level portfolio hedge on due to concerns over the withdrawal of what was a market dependency in some circles, discussion of this topic was mostly done behind the scenes. Now two of the most respected hedge fund managers in Dalio and Griffin are talking about it publicly all as the stock market engages in one of its wildest sell-offs in history.

The concern is that rate hikes are likely to become more aggressive to prevent an economy with the economic pedal to the metal from overheating.

“We are particularly concerned about the nascent signs of accelerating inflation in many countries around the world, given the general complacency around the risks of an inflationary shock,” Griffin wrote. “With the global economy rebounding and resource utilization tightening, we are carefully positioning for the possibility that inflation surprises to the upside.”

Of course, beyond the mechanics of interest rates there is always the “heightened level of geopolitical risk” to keep investors up at night as well.

Below is a bigger excerpt.

Looking forward, the macroeconomic backdrop continues to be constructive. Growth prospects around the world remain positive. In the United States, a pro-business regulatory environment and a sweeping tax reform bill have fueled optimism in the domestic economy, and U.S. corporate earnings growth remains strong. In Europe, growth has also accelerated and the rate of unemployment is showing marked improvement. The forward leading indicators we track continue to point upward over the short run. That said, some dark clouds potentially loom on the horizon.

First, quantitative easing is heading into reverse, beginning in the United States. As the U.S. Federal Reserve begins to shrink the size of its balance sheet, yields in the United States will likely climb higher, putting downward pressure on the price to earnings ratios of equities. Second, the U.S. Federal Reserve is raising interest rates to prevent the economy from overheating. We are particularly concerned about the nascent signs of accelerating inflation in many countries around the world, given the general complacency around the risks of an inflationary shock.With the global economy rebounding and resource utilization tightening, we are carefully positioning for the possibility that inflation surprises to the upside. Finally, we must be thoughtful about the heightened level of geopolitical risk that exists and manage our portfolios to be able to withstand the impact of adverse events that may occur, including a trade policy misstep or military conflict.

Over the past three decades, there has been explosive growth in the number of hedge funds and the assets they manage. As is the case following many such growth stories, the industry is now experiencing a period of consolidation. In the past three years, it is estimated that more than four hundred more funds were shuttered than launched. Firms that are unable to sustain a source of competitive advantage are falling by the wayside. In the hedge fund industry and across the broader economy, we are increasingly witnessing a winner-takes-all dynamic at play. Economic profits are accruing disproportionately to industry leaders.

See the full letter here