Data has become one of the world’s most valuable commodities. The alternative investment industry is far from exempt from the trend – with both quality and quantity of information becoming core components of success.

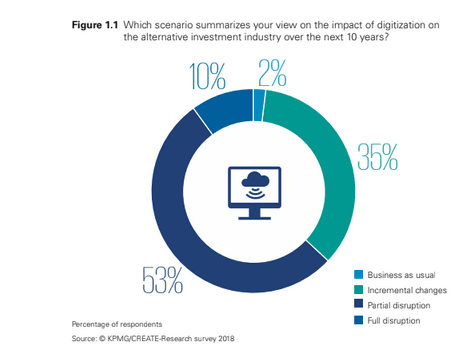

So crucial is data and the related management processes that a recent global survey from KPMG found from 125 alternative investment managers across 19 countries, “Only 2 percent of our respondents anticipate a ‘business as usual’ scenario.

The rest see it as a treadmill to oblivion since digitization is now a necessity as much as a choice”. With alternative assets under management of US$2.6 trillion, survey respondents perceive digitization as a necessity in keeping pace with industry competitors. 1 Despite understanding the need for change, the pace will remain moderate at this time – with 35 percent of respondents anticipating only ‘incremental changes’ in the short to medium term due to the persistence of various technology and legacy issues.

5G Innovations – Hampered by Legacy Issues

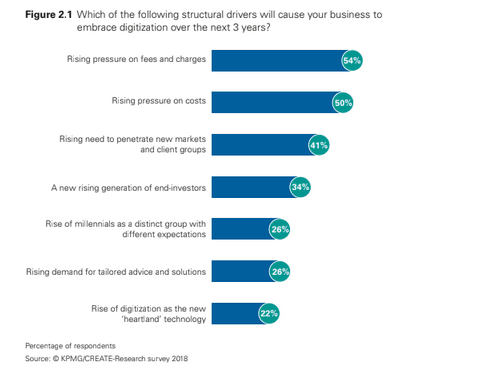

The latest generation of digital tools and solutions is widely predicted to have a far- reaching impact on the alternative investment business over the long-term horizon, with some survey respondents suggesting 5G will be to hedge funds what the internet has been to business and society over the past 20 years. However, pace will be constrained. While mass market industries have been able to capitalize on digitisation innovations, there are a number of legacy issues that have been holding hedge funds back. Take for example, pioneers such as Amazon and Uber – they have been able to take risks and leverage on technology-based process standardisation and service simplification. They launched with little to lose and everything to gain, with the ability to fail, learn and reboot – the so called “fail forward” business model. Managing other people’s money is another matter entirely – not to mention the regulatory restrictions and legislative encumbrances of dealing with B2B clientele. Further to this, investor allocations to hedge funds thrive based on track record. Therefore, exploring new territory without evidence of potential results has been difficult to argue a case for.

Raising Awareness

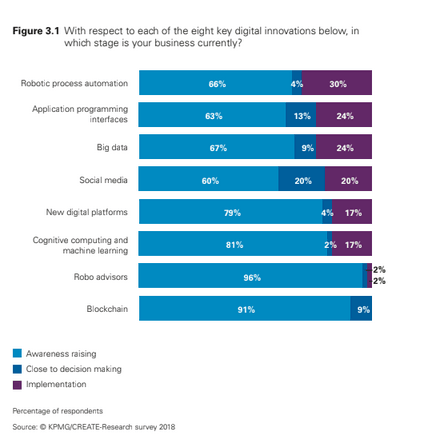

From this position it is not a huge leap to observe that the KPMG survey research found at least three in every five hedge fund respondents are at the ‘awareness raising’ stage of incorporating digitisation. Focus has remained on the accessible end of the spectrum – bolt-on technology solutions, for example. Evolutionary, rather than revolutionary, changes.

Jobs - Creation and Replacement

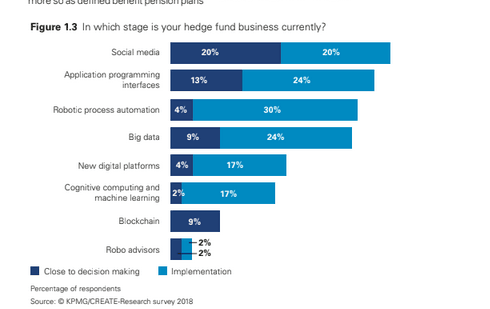

Robotic process automation has slotted into this evolutionary approach. One of the most prominent findings from the research is that out of eight key digital innovation areas (including big data, social media, blockchain and machine learning) robotic process automation has seen the highest levels of implementation in hedge fund businesses – specifically 30%, with the next most implemented areas being 24% for APIs and 24% for big data.1 This has been due to the high convertibility of robotic processes into near term improved bottom line. The research specifies that each robot has displaced 1.5 full-time employees in some cases but that new jobs have also been created in other parts of the value chain due to improvements in competitiveness. Reassuring, from both an employment and profit perspective.1

Targeted Areas of Application

While progress may be moderate across the sector overall, survey respondents expect the most front office digital innovation to take place in the portfolio risk management and research and securities selection – with 59% and 50% identifying these business areas as especially amenable to the newly emerging digital innovations. Meanwhile it seems that the most natural fit will come in the back office and middle office with the same figures at 67% and 65% for risk and compliance and fund accounting roles, respectively.1

Systematic vs Discretionary

Hedge fund managers, are tasked with managing reams of data and distilling it down to relevant information – organisation is as important and access and analysis. The KPMG research also highlights that big data will play an increasingly important role in both discretionary and quant strategies. On the discretionary side digitisation will allow managers to make data analysis more robust, implement thorough validation checks on investment calls and flag risks ahead of time. However, there are more gains to be made on the quant side – adding value at all points along the investment decision and management path. In fact, assets in systematic strategies are reportedly expected to grow from around 20 percent of the hedge fund universe today to 25 percent by the end of this decade.1

Overall, digitisation is going to add dynamism and scope to the hedge fund industry. The speed at which change occurs may be moderate, but the range is wide. A new generation of investors is coming to market – with millennials predicted to play a key role in developments. We can therefore expect enhanced use of robo-advisor platforms and more hands-on investor engagement overall.

Sources:

1. KPMG Alternative Investments 3.0, Digitize or Jeopardize, February 2018