If history is any guide, the good times are about to end for the U.S. stock market.

It’s been one of the longest-running bull markets ever…

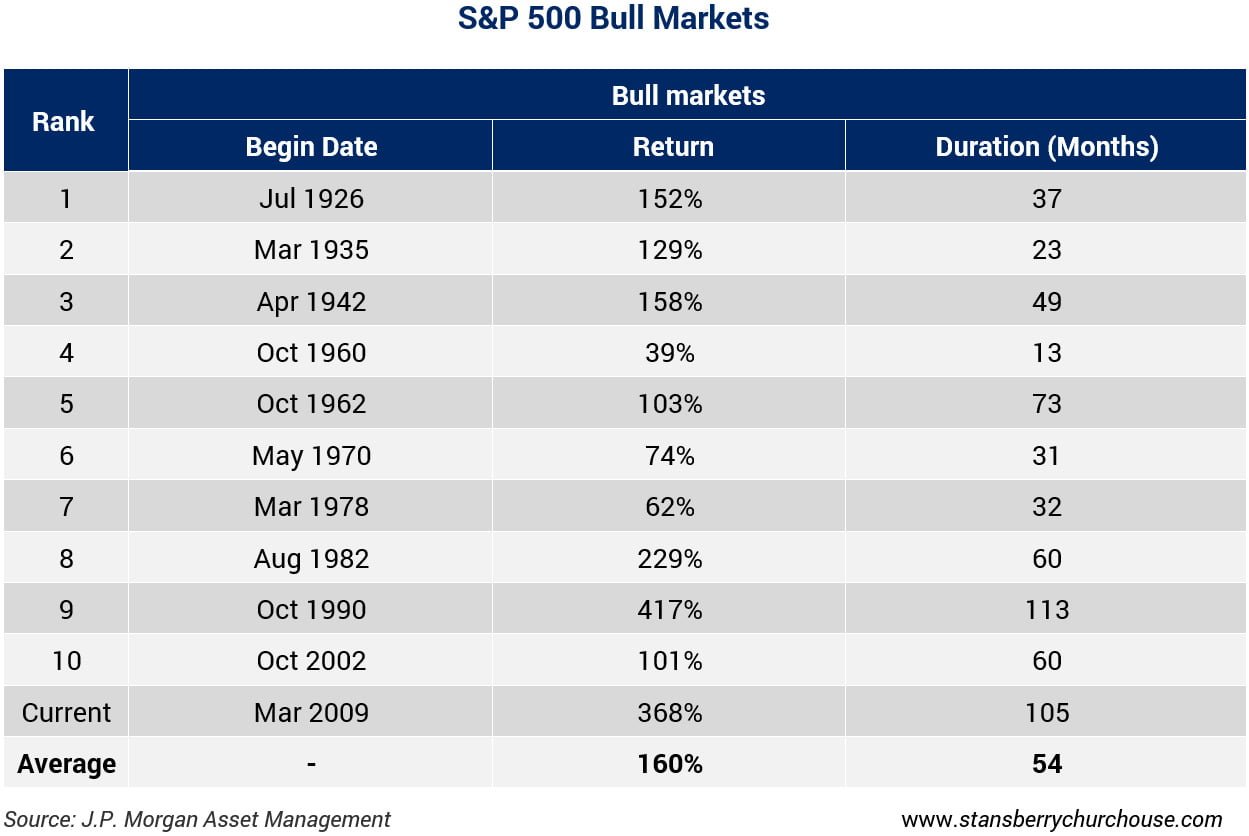

Over nearly nine years, or 105 months, the S&P 500 has returned 368 percent (including dividends).

That’s the second-longest bull market the U.S. has ever seen… just behind the nearly 9.5 year-long, or 113 months, bull market that started in 1990.

You can see the S&P 500’s past bull markets in the table below… it shows the date they began, their overall return and how long each lasted. On average since 1926, bull markets have lasted for 54 months, and resulted in returns of 160 percent.

What’s driving this bull market?

After the 2008/2009 global financial crisis, interest rates around the world plummeted. In the U.S., the Federal Reserve cut interest rates from over 5 percent to zero in the course of just over a year.

Coupled with that, we saw an unprecedented surge of money printing as the Fed expanded its balance sheet (by creating money and buying assets) from a little over US$800 billion to over US$4.4 trillion today, along with a wholesale bailout of the banking system.

We also later have seen a “Trump rally” where investors expected President Donald Trump’s tax reform and infrastructure investment election promises to boost the economy.

But the gains can’t go on forever

Take a look at the following chart. It shows when and why each of the bull markets above eventually ended.

For example, in 1990, the U.S. market entered its longest-running bull market on the back of the Internet boom. The S&P 500 soared over 400 percent in nine years. But in March 2000, the market peaked – and went on to fall 49 percent over the next 2.5 years.

In 2002, the market soared back. It went up over 100 percent in five years. Then the global financial crisis hit in 2007, and the S&P 500 fell 57 percent over the next 17 months.

The bull market/bear market cycle keeps repeating… thanks to mean reversion. Markets (along with most other things in life) tend over time to reverse extreme movements and gravitate back to average.

It’s like a rubber band… stretch it and when you let go it returns to its original shape. So after a period of rising prices, securities tend to deliver average or poor returns. Likewise, market prices that decline too far, too fast, tend to rebound. That is mean reversion, and it works over short and long periods.

And mean reversion isn’t the only reason we think the U.S. bull market is winding down…

Overpriced equities

By many measures, U.S. stock market valuations are high.

One of the best ways of measuring market value is to use the cyclically-adjusted price-to-earnings (CAPE) ratio. It’s a longer-term, inflation-adjusted measure that smooths out short-term earnings and cycle volatilities to give a more comprehensive, and accurate, measure of market value.

As the chart below shows, the CAPE for the S&P 500 is now at 33.6 times earnings. That’s higher than any time in history, except for the late ‘90s dotcom bubble. It’s even higher than the stock market bubble of the late 1920s.

High valuations don’t mean that share prices will fall. High valuation levels can always go higher, at least for a bit. Or they could stand still for a while. But mean reversion suggests that at some point, valuations will fall, one way or the other.

And as we showed you recently, the U.S. economy could also be about to see a slowdown in growth – which could also dampen market sentiment and hurt share prices.

It’s not just the U.S.

Now, this is all in the U.S. But we’re seeing a similar situation in global markets.

As we told you in November, the MSCI All Country World Index (which reflects the performance of global stock markets) has seen an unprecedented streak of gains over the past year. And it’s up 8.4 percent since we last wrote about it. As we said earlier, nothing goes up forever.

Plus, if the world’s biggest market (at around half of the global market cap) is in trouble, the rest of the world could be too.

So what should you do?

Look to diversify your portfolio. Regular readers will know that we’re big fans of diversification.

We’ve written before about the importance of not just investing in different sectors and asset classes… but in different markets and countries too. That’s because spreading a portfolio around the world reduces risk. After all, gains in one market can offset losses in another.

And while the gains in some markets are nearing an end, they’re just getting started in markets like India, Bangladesh and Vietnam. These are three of the fastest-growing markets in the world.

So do yourself a favour and diversify your portfolio.