All equity portfolios have some positions that will, over the coming year, provide their owners with surprising downside movements – unexpected losses relative to the market. Diversification is the strategy used to manage these risks, creating portfolios that, overall, seem to adjust for these surprises in a manner that is both risk-reducing and return-enhancing. But the process of diversification misses some critical ways to identify and intercept many of these emerging problem stocks before they realize their full potential negative impact. Using insights into how companies are governed, how their risk is perceived by the market, and whether their valuations accurately reflect their prospective risk, portfolio managers can improve their performance.

Also see 2017 hedge fund coverage

The concept of resiliency is well-known among risk managers. It’s a process that seeks to identify emerging problems and to interrupt them, or to transfer their risk elsewhere. Portfolio Shaping is a term used to describe a process of resiliency building within portfolios. That process uses quantitative and qualitative methods to identify companies wherein the market has become too complacent – has mispriced their risk, or where a company is not structured in a manner enabling it to respond well to its own negative surprises. When poor governance is combined with investor complacency, layered on top of excessive valuations, a flammable mixture is created, and any spark will cause unexpected, large downside moves.

A very recent example of this phenomenon occurred with Gartner Inc. (Ticker: IT) whose financial governance ratings were among the worst in our modeling universe. The company also had a prospective risk rank higher than 97% of all companies that we model. Having increased in price by almost 250% in five years, Gartner’s stock was on average 62% higher than a variety of substitutes (equivalent industry, sector, risk, and quality, for example) where similar expected future cash flows could be attained far less expensively. Such valuations garnered IT an “F-“ rating for Value in our models. Through this combination of characteristics, the Gartner tinder was looking quite dry.

In our internal portfolios (we do not offer outside management) we transferred risk in IT to a market index long position starting in early January. This strategy was non-directional to the market-as-a-whole. When Gartner issued earnings, they announced a miss of $0.11 and revenues that, while they had grown nearly 44%, were slightly below expectations. Because Gartner investors had become complacent about risk and Gartner’s valuations were so high, the financial governance failure resulted in a drop in the company’s stock by more than 17% from our transfer price versus a broad market decline of just under 9%.

Similarly, Omnicell (Ticker: OMCL) announced a small earnings beat on February 1 along with a small revenue miss. Being among the worst-rated companies in our database for financial governance, going into the earnings report Omnicell’s prospective risk rank was higher than 93% of companies in our universe and its valuation received a grade of “F-” from our models. Since the beginning of 2013, Omnicell’s stock price had climbed approximately 250%, but the quality of its earnings was poor and our measures of quality on their earnings had been steadily in decline. Since mid-January, when we initiated a risk-transfer trade in OMCL — a period of time that included this relatively benign earnings release — Omnicell’s stock price fell by 16%, compared to a broad market decline of approximately 4%.

These are just two examples from among approximately 25 companies on which we have engaged in risk-transfer trades since the start of the year. We’ll use the same evaluation process as we identify and describe some of these companies in future articles here on this site.

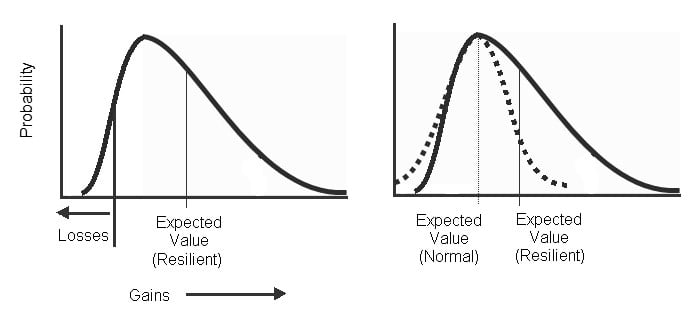

So how do these two examples relate to portfolio shaping? if a typical portfolio has a slightly positive skew — not unlike the economy as-a-whole, and equities like Gartner and Omnicell, which have the greatest potential for surprise negative prices moves are removed, the skew of that portfolio will become more positive. This implies that the mean expected return will shift higher and that the amount of capital required to support the portfolio at some level of confidence will be reduced. This means that the portfolio has become a more efficient user of capital and can either generate higher returns for the same risk, or less risk can be taken in pursuit of the same expected returns, freeing capital to be deployed elsewhere.

The shape of the portfolio’s possible future values has changed for the better. The portfolio has become more resilient.

In any diversified portfolio, you may find one hundred, or even several hundred equity positions. Within this group, 5-10% likely present downside risks not found by most portfolio analysts because they don’t consider the combination of governance risk, complacency in the marketplace, and excessive valuations. These are just a few factors that can be used in this process, but they are important elements to be utilized in a regular process of building portfolio resiliency.

Investors are served better when risk is managed well by portfolio managers. Portfolio shaping, regardless of which factors you use, can lead to an improvement in expected returns and a reduction in risk. If the improvement is simply 100 basis points in return, or the required risk capital is reduced by 10%, this process becomes highly valuable. In most cases, the expected improvements can be even greater in magnitude.

Investment analysts demand that the companies they research make effective use of capital. The same expectation should be true of investment managers – to govern and use their risk capital well. It’s one and the same process, and the resiliency building of portfolio shaping is under-utilized.

By David R. Koenig

Founding Principal

The Governance Fund

Disclosure: Our internal portfolios continue to hold risk-transfer positions in both IT and OMCL where those stocks are shorted and the capital is transferred to a broad market index long position, or a long position in a substitute single equity position.

About the Author - David R. Koenig is the Founding Principal of The Governance Fund, was responsible for developing risk management programs at three different companies, had risk oversight for all of the public mutual funds for one of the worlds largest banks, is the author of Governance Reimagined: Organizational Design, Risk, and Value Creation (Wiley, 2012), was awarded an inaugural M-Prize for Management Innovation, and was chosen as the recipient of the PRMIA Higher Standard Award for contributions to the risk management profession. He also manages the Directors and Chief Risk Officers group, a global association of board members and c-level executives from more than 115 countries whose work focuses on the governance of risk. His full bio is available at https://thegovfund.com/about-us.

Important Disclaimer

This report is provided solely for information.

This report is not an invitation or inducement to engage in investment activity, nor is it an offer to buy or sell securities, and does not constitute tax, investment or other advice. Neither this report nor the information contained in it should be relied upon.

The Governance Fund does not aim to provide advice which is appropriate to the individual circumstances of the private investor. Use of this report is not a substitute for obtaining proper investment advice from an authorized investment professional. While the information contained herein has been obtained from sources deemed reliable, neither The Governance Fund nor any party through whom the reader obtains this report guarantees that it is accurate or complete or makes any warranty or representation with regard to the results obtained from its use. In addition, the information contained in this report may become inaccurate as a result of the passage of time and should therefore be read for historical information only. Potential investors are urged to consult their own authorized investment professional.

The Governance Fund makes no warranty or representation that this report or its contents are current or that they have been updated based on changes in the economic market or other factors. In particular, but without limiting the preceding sentence, statements of fact or opinion made by The Governance Fund in this report may not be up-to-date and may not represent the current opinion of The Governance Fund.

When used in this report, the terms "we," "our" or "us" mean, unless the context otherwise indicates, The Governance Fund Advisors, LLC.