During one of the best earnings seasons in recent years – 74% of companies are beating expectations compared to 68% over the last three years – the stock market is nonetheless having meaningful issues, down 131 points on the S&P 500 from Friday to just after the Monday open. As Fed Chair Janet Yellen walks into the sunset of her term, preceding over one of the slowest tightening periods in central bank history, it is interest rates that are “causing more problems for equities,” according to one analyst. But are interest rates going to mean revert and ultimately go negative? Societe General’s Albert Edwards thinks so.

Interest rates will rise, but will it last?

Earnings acceleration has been strong, but when interest rates begin to rise the relative ratio in many value formulas starts to re-adjust. But with equity price-earnings ratios running near all-time highs, any adjustment in interest rates means the already abnormally stout earnings ratios start to deflate as interest rate concerns mount. Interest rate concerns have been driven, in part, by Friday’s jobs number, which showed the fastest pace of wage increases since the 2008 market crash.

CNN’s Alison Kosik noted that 2.9% wage growth is a milestone for the Trump economy, but wage growth is always a double-edged sword because it leads to inflation.

In recent years, inflation is something analysts had not previously given much weighting in their stock valuation models. That could be changing.

“Until recently, subdued US wage and CPI inflation left investors relaxed about the extent of this Fed tightening cycle,” Cross Asset research analyst Edwards wrote in a February 1 strategy note.

In the report, titled “Double bubble trouble - Are you feeling lucky?” Edwards recognizes the impact of rising bond yields on stocks, but ultimately takes a very contrarian view of where bond yields are headed over the long term.

After touching 3%, Edwards predicts US interest rates go negative

A major concern of analysts is the recent move in the US Ten Year interest rate. Yields have popped from near 2% in September to now trade above 2.8% Monday morning. That short quick move, which broke numerous technical range indicators, might not entirely be that serious.

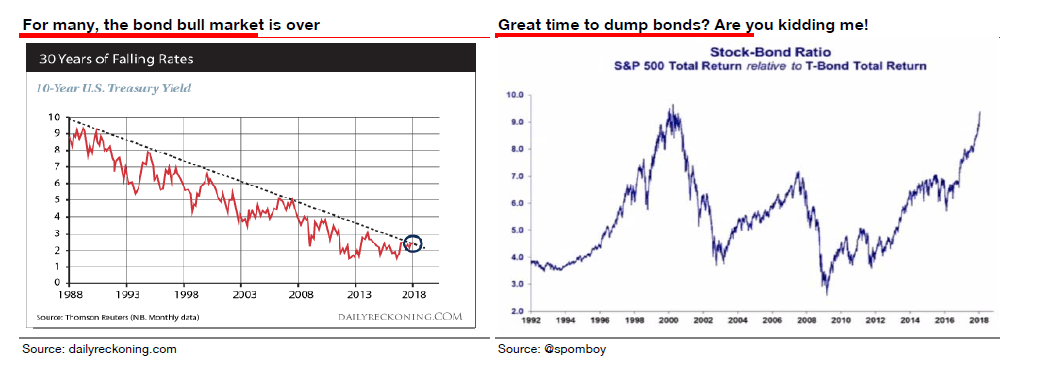

“Every man, woman and child seems to have decided that the US 10y bond yield has broken out of its long-term downtrend and we are in a bond bear market,” Edwards opines. Soc Gen’s technical analysis, however, indicated that a run to the 3% level is perfectly logical and does not necessarily mean the bond bull, sending rates lower, is over.

“With much anticipation the US 10y bond yield broke the critical 2.6% many regard as key to defining whether the current bull market is still intact or not,” he wrote. “With yields now closing on 2¾% and the 30y closing on 3.0%, many see this as a great time to dump bonds and switch into equities.”

Don’t bet on this strategy, however.

Like many value models, Soc Gen considers the return of stocks relative to bond yields, which are pointing to highs not seen since the 2001 tech wreck market crash. Fleeing bonds into stocks isn’t the play during a value readjustment. But here Edwards, known for his alternative thinking, significantly differs with the consensus again. He doesn’t believe the bond market trend towards higher yields. In fact, he is looking for rates to go negative.

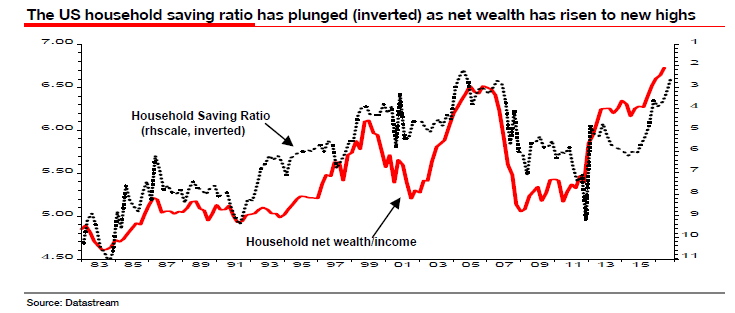

Pointing to “soaring US corporate debt” and a declining household savings ratio, interest rates are going to mean revert, he thinks, pointing to a familiar whipping boy.

“The Fed’s easy money policies have driven household net wealth to new highs and the SR has fallen hand in hand in the last two years,” Edwards pointed out. “The US has now got double bubble trouble (ie bubbles in both corporate and household debt). Just like 2007, this is another economic boom fueled by an unsustainable credit bubble that will inevitably blow up with a rooky Fed Chairman in place.”

Ultimately Edwards sees yields going negative. Why?

“I expect that the true extent of how close the US is to actual outright deflation, and hence how high real yields currently are, will soon be revealed,” he said, mentioning the last event first. “But before US 10y yields turn negative, expect them to visit 3% first.”