Forge First Funds commentary for the month ended January 31, 2018.

January started off as one of the strongest months for equities in the history of capital markets with stocks marching relentlessly higher amid investor optimism and non-existent volatility. Continued strong performance in the US economy combined with positive earnings revisions from US tax reform helped buoy the S&P 500 5.7% for the month, the best start to the year in 31 years. Meanwhile, here in Canada, uncertainty surrounding NAFTA weighed on the TSX, resulting in a loss of 1.4% for January. Both of the Forge First funds generated positive net returns for January.

From January 2nd through the 29th, stock markets could be thought of as a “spinning top”. As you watch a top you’re amazed it isn’t shaken from its axis, spinning with what appears to be perfect control and little friction. And so it went – the world marveled at the rise in equity prices, investors dismissed hedging as pointless, and optimism shattered records. However, when the mesmerizing display of fluidity and rhythm begins to confront the inevitable end of its motion we watch the wobble that is, every single time, a harbinger of things to come. January ended with what could best be described as this wobble the top begins to experience before the spinning stops, always more abruptly than seems likely. If January’s final few trading sessions were the wobble, February’s first few were akin to a bear appearing out of nowhere and stomping on the top. The combination of investors piling into stocks, extremely high sentiment, high valuations, and the spike in longer term interest rates (the yield on 10-year government bonds rose from 2.40% to 2.72% in January) triggered early February’s volatility and a liquidation in stocks. North American equity markets returned anywhere from nearly -9% (TSX) to -12% (S&P 500) from January 26th to February 9th. This of course was punctuated by the largest ever point drop in both the DJIA and S&P 500 on February 5th.

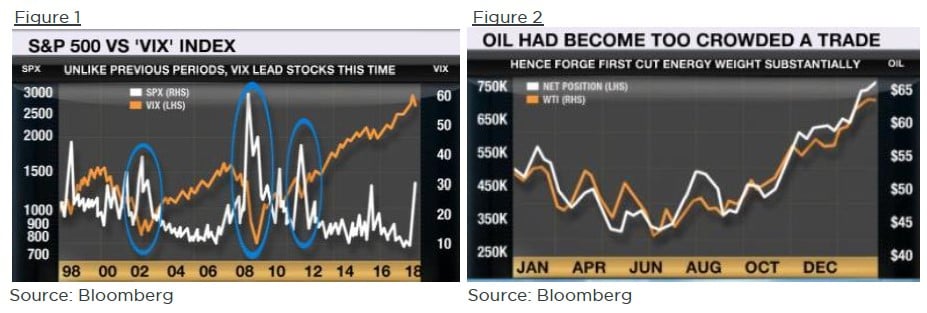

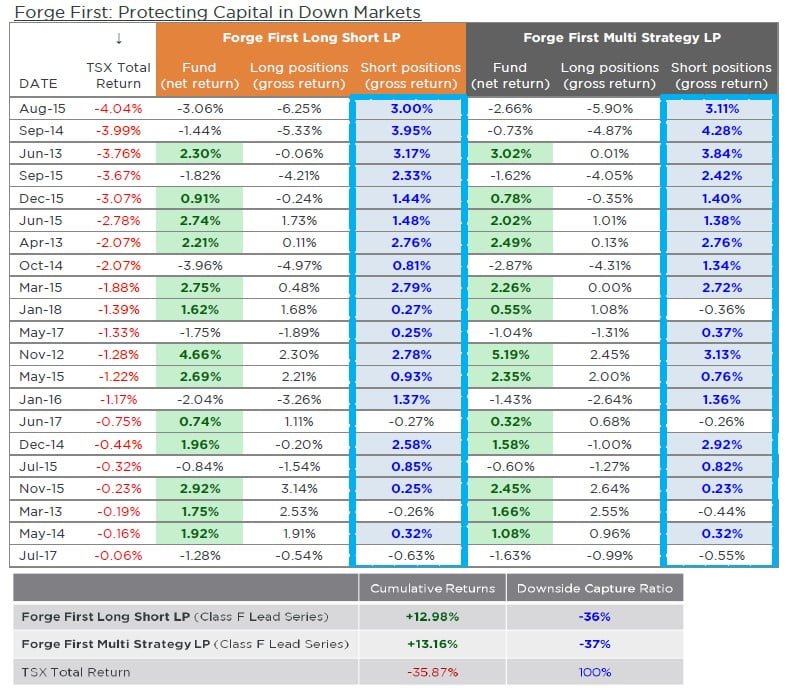

Crowded trades are something we actively avoid in our funds. As is the case with many things in life, one needs to be ahead of the crowd to get the full benefit of the experience. To suggest that the “short volatility” trade was crowded is an understatement of epic proportions. Beginning the last week of January, market tranquility was shattered and volatility (as measured by the VIX index, Figure 1) exploded to the upside, triggering the aforementioned selloff in equities. However, to be fair, we still believe that economic prospects seem reasonable and that the current market tantrum is letting some proverbial air out of what we have repeatedly noted are over-inflated tires. Leading economic indicators are still supportive of equity performance, so for the time being we are playing it safe. In the last few days of January we began to bring our oil exposure down dramatically (to approximately 2-3% net long) as we were not comfortable with the dramatic growth in the speculative long positioning (Figure 2) into the industry’s traditional shoulder season. We haven’t put our bullish stance towards energy away for good, but it’s on hold until the trade can (again) become a little less crowded.

Our focus now, given our relatively low net exposures to the market is to actively manage this volatility, add additional protection to the portfolios, and prepare to add to high conviction names on the long side. This mindset will persist with us at Forge First assuming we do not begin to see a contagion effect whereby these equity market gyrations spread to credit markets and consequently, the economy. With a pullback of more than 10% already, names are working their way toward us that begin to fit into our valuation criteria. Absent special situations, with long positions we are always looking for sustainable 10% free cash flow yields, something we believe is the hallmark of a business’ strength throughout multiple cycles.

To conclude, the action of the last two weeks reminds us of how humbling markets can be. Just when one thinks markets will continue to grind ever-higher, in less than two weeks nearly all of the TSX’s gains for 2017 were completely erased! Our focus at Forge First has always been to deliver a competitive rate of return for our investors. Our shorting strategy in our funds has served investors well during bouts of volatility and declines in markets, resulting in better risk-adjusted returns. As can be seen from below, both of our funds have on average generated positive returns in down markets (negative downside capture ratios) with their short positions being positive in 17-18 months out of the 21 down months for the TSX since inception. In a world characterized by a secular decline in interest rates since the 1980s and that tide beginning to turn as interest rates rise and policy moves from “quantitative easing” to “quantitative tightening”, our solutions will complement and lower volatility of the long only portfolios of many investors.

As always, we welcome any feedback, and for more information please visit our website at www.forgefirst.com.

Thank you,

Daniel Lloyd

Portfolio Manager

D: 416-597-7934

Andrew McCreath, CFA

President and CEO

D: 416-687-6771