Volatile market action in early February caught many investors off guard. While many were rushing for the exits at the first sign of turmoil, Templeton Emerging Markets Group’s Chetan Sehgal and Claus Born have been emphasizing calm. They point to resilience within emerging markets overall in the long term and still find plenty of reasons to be optimistic about the year ahead.

Senior Vice President, Institutional Portfolio Manager,

Templeton Emerging Markets Group

Senior Managing Director, Director of Portfolio Management,

Templeton Emerging Markets Group

As the late Sir John Templeton once said, “the most dangerous words in investing are, this time it’s different.” After a strong multi-year run, perhaps many global equity investors had become a bit too complacent. The market certainly has a way of making one humble!

Stronger-than-expected January employment figures (notably wage increases) in the United States brought a general feeling that interest rates may rise faster than anticipated to thwart inflationary forces. And, the markets had to price in this scenario. The result was a sharp decline in the US markets that spread throughout equities globally in early February.

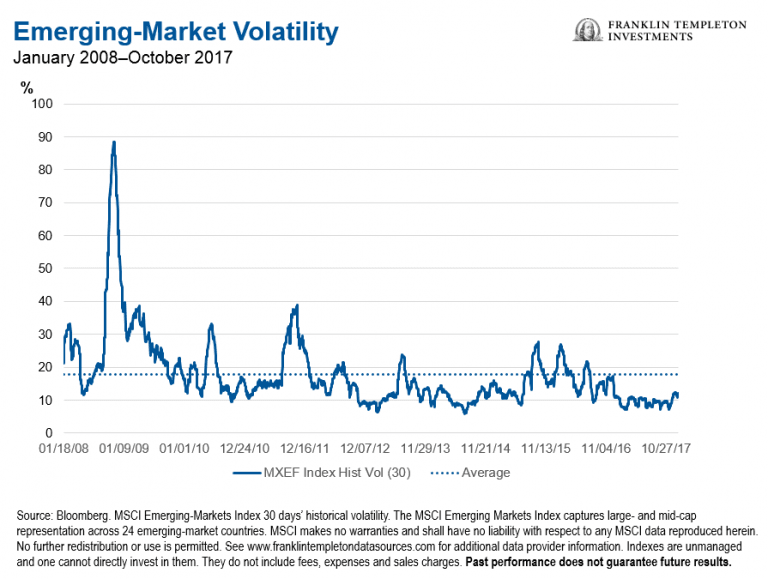

We must put the current volatility into context of historic volatility. Even though heightened volatility recently may signal a derating, many asset classes have had a long period of low volatility, including emerging markets (see chart below).

When there are major corrections in developed stock markets, emerging markets also take the heat, and often overreact with even greater declines. This is related to the fact that emerging markets are generally viewed as higher-risk investments and therefore global investors are often quick to bail out of them first. This often happens regardless of underlying economic fundamentals in the individual countries. Emerging markets have proven resilient during this latest market shock and haven’t so far followed prior patterns of this type of overreaction.

Looking at the selloff from February 1-6, the MSCI Emerging Markets (EM) Index fell 5.8%, while the MSCI World Index fell 5.1%. However, the MSCI EM Index had outperformed the MSCI World Index in 2017 as a whole, as well as in the first month of 2018.

In January, the MSCI EM Index rose 8.3%, compared with 5.0% for the MSCI World Index.1 And through February 8, the MSCI EM Index was up 0.40% year-to-date, while the MSCI World Index was down 2.78%.2 So actually, emerging markets are proving to be somewhat resilient.

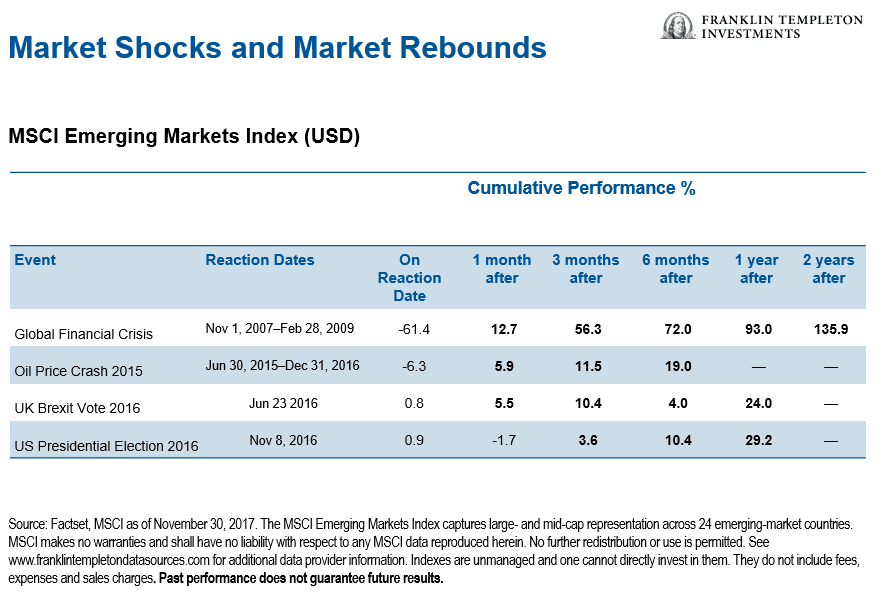

Looking long term, we have seen emerging markets bounce back from crisis periods time and again—not only crisis situations in their own home countries, but also from global shocks. The table below illustrates this ability to bounce back.

Market Quakes Can Unearth Values

Our observations tell us that the asset class is underrepresented in many investors’ portfolios based on the percentage of global market capitalization emerging-markets currently hold.

Valuations also remained relatively cheap overall versus developed markets last year, and this current market turbulence could serve to make EM equities even more attractive to bargain hunters.

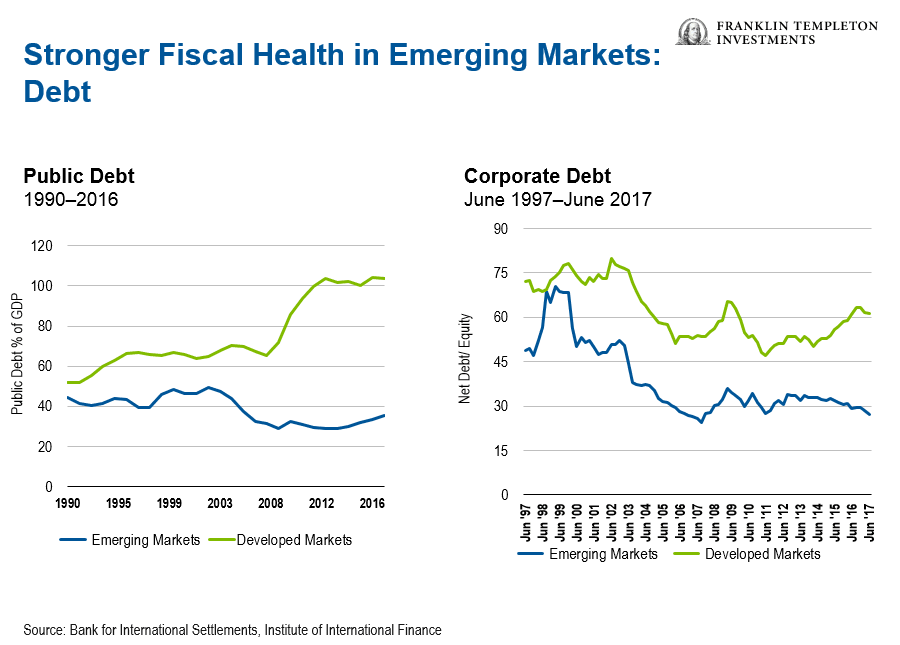

Discounted valuations are one of several trends which underpin the upside potential we see in emerging markets today. Other positive trends include undervalued EM currencies and lower EM debt levels.

Three Factors Underpinning Emerging Markets

Undervalued Emerging-Market Currencies: EM currencies remain undervalued compared with recent years, which offers a good environment for export-driven companies.

Lower Emerging-Market Debt: EM debt—both corporate and private sector—has declined in recent years and may look much more attractive than developed-market debt.

Discounted Equity Valuations: We think emerging-market equities have reached an inflection point in regard to earnings and appear to be providing us with valuation opportunities we do not generally see in most developed markets. We think earnings should continue to recover and prompt companies to come back to a more normalized level.

Reasons for Optimism

Emerging markets have doubled their share of global gross domestic product (GDP) over the past 30 years and now amount to 60% of global GDP growth.3 And EM growth in general this year is expected to outpace that of developed markets in general—the International Monetary Fund is forecasting 4.7% GDP growth for emerging markets versus 2.3% in developed markets.4

The changing profile of EM economies also offers much potential, in our view. Many emerging-market countries are moving away from purely commodity-based goods and into higher-value goods and services (for example, smartphone or automobile components). This leads us to think some investors may be missing out on opportunities in this asset class.

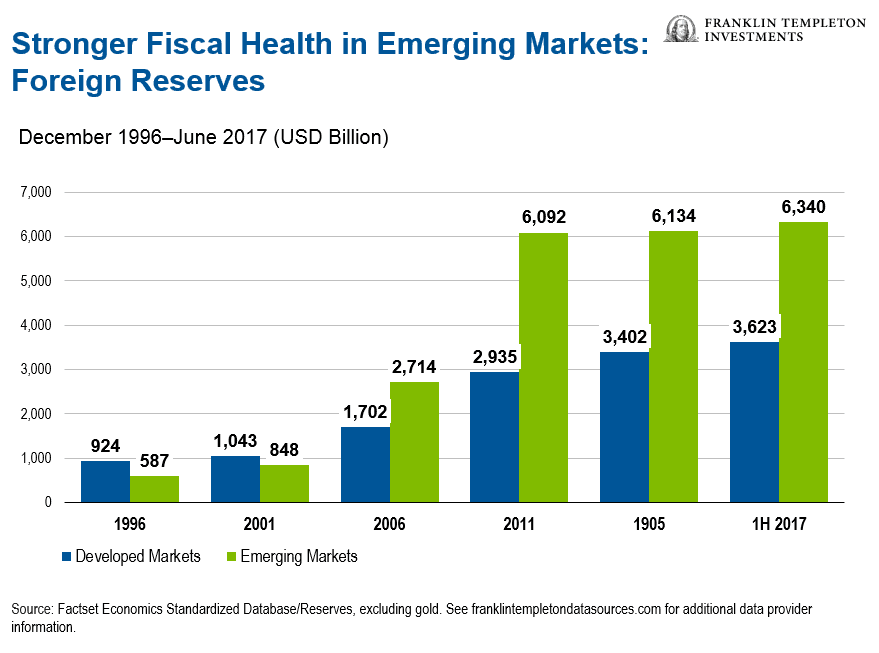

When making a case for emerging markets in the year ahead, we think foreign reserves should not be underestimated.

Previous financial crises have been exacerbated by insufficient foreign reserves and the inability to manage domestic savings. However, we believe emerging markets have learned their lessons, as foreign reserves now outstrip those of their developed market peers (see chart below).5

Tech Trends for the Future

Technological advancements have prompted more focus on the development and manufacturing of high-tech components in emerging markets. We think the companies that produce these components could hold multi-year earnings growth potential, which the market does not seem to fully appreciate yet.

This changing dynamic provides us with opportunities, and also challenges to find specific non-crowded trades, for example within the subsectors of technology.

Again as Sir John also once said, “The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” We don’t know if we are yet at a time of “maximum pessimism” in the markets, but we find plenty of reasons to be optimistic about the prospects for emerging markets in general and continue to look for opportunities to invest.

Chetan Sehgal’s and Claus Born’s comments, opinions and analyses are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Important Legal Information

All investments involve risks, including the possible loss of principal. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The technology industry can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants as well as general economic conditions.

- ources: Factset, MSCI as of November 30, 2017. The MSCI Emerging Markets Index captures large- and mid-cap representation across 24 emerging-market countries. The MSCI World Index captures large- and mid-cap representation across 23 developed-market countries. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. See www.franklintempletondatasources.com for additional data provider information. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses and sales charges. Past performance does not guarantee future results.

- Source: Ibid.

- Source: World Bank, January 2017.

- Source: IMF World Economic Outlook update, January 2018. There is no assurance that any estimate, forecast or projection will be realized.

- Source: Source: Economist Intelligence Unit.

Article By Franklin Templeton Investments