Forget all the “earnings season” analysis you read last month. The real earnings season – annual 10-K filing season – is happening right now.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with a 12/31 fiscal year end. Our analysts work tirelessly to uncover red flags hidden in the footnotes and make our models the best in the business.[1]

For February 20, 2018, our forensic accounting red flag is from a hotel REIT with significant hidden non-operating income.

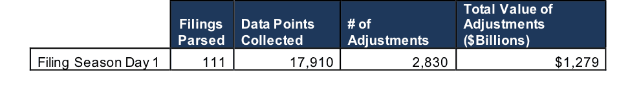

We pulled this highlight from yesterday’s research of 111 10-K filings, from which our Robo-Analyst technology collected 17,910 data points. Our analyst team used this data to make 2,830 forensic accounting adjustments with a dollar value of $1.3 trillion. The adjustments were applied as follows:

- 1,239 income statement adjustments with a total value of $130 billion

- 1,138 balance sheet adjustments with a total value of $478 billion

- 453 valuation adjustments with a total value of $671 billion

Tuesday was the first day of filing season. Figure 1 shows the work our analysts did yesterday. As filing season goes on, we’ll compile the total amount of work performed by our analysts over the whole period.

Figure 1: Filing Season Diligence for Tuesday, February 20th

Sources: New Constructs, LLC and company filings.

We believe this research is necessary to fulfill the Fiduciary Duty of Care.

Today’s Forensic Accounting Needle in a Haystack Is for REIT Investors

Analyst Hunter Anderson found an unusual item yesterday in Chesapeake Lodging Trust’s (CHSP) 10-K.

On page 26, CHSP disclosed a $14.3 million decrease to expenses due to the write-off an unfavorable contract liability and a settlement gain following the change in management at its Denver hotel from Marriott (MAR) to Hilton (HLT).

CHSP’s GAAP net income, which includes this non-operating item, stayed flat between 2016 and 2017. Excluding this non-operating income, along with several other adjustments, shows that CHSP’s after-tax operating profit (NOPAT) actually declined by 15%, from $111 million to $94 million.

This article originally published on February 21, 2018.

Disclosure: David Trainer, Hunter Anderson, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter (#filingseasonfinds), Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper, “Getting ROIC Right”, proves the superiority of our research and analytics.Article by Sam McBride, New Constructs