In the past three Market Ethos instalments, we covered the market correction and its most likely culprit, namely rising bond yields and inflation expectations. Turning points in the market are extremely hard to identify without the benefit of hindsight. But there is mounting evidence the very long period of benign inflation and low or lowering bond yields may be starting to finally reverse. We have discussed how higher bond yields may inevitably spell the end to the current bull market that started way back in 2009. However, that turning point still appears in the distance. Timelier though, if this change in yields and inflation is afoot, many of the strategies that worked so well over the past years and have become very popular may not be the strategies that work well in the coming quarters.

[REITs]Check out our H2 hedge fund letters here.

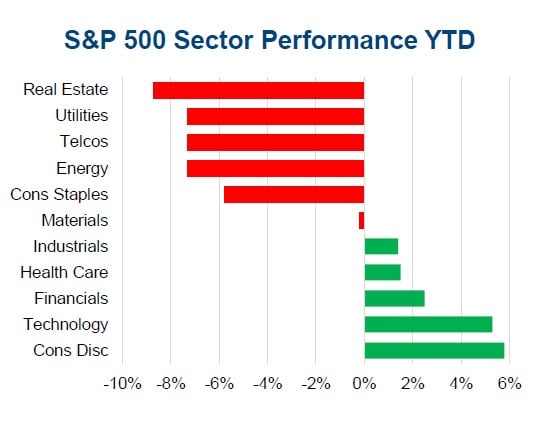

Not lost on investors, the broader market showed how sensitive it is to rising bond yields as the S&P 500 & TSX experienced their first corrections in about two years when the ten-year treasury yield reached 2.9%. What may have been lost in all the excitement was how the pain of the correction was distributed. The more interest rate sensitive sectors were by far the hardest hit while the less interest rate sensitive sectors fared much better. This can be easily visualized in the year-to-date performance of the S&P 500 sectors. The biggest losers have been Real Estate, Utilities, Telcos, Energy and Consumer Staples. Meanwhile, many of the less interest rate sectors have still managed to hold on to some of their gains from January.

The main reason we are highlighting this divergence is we are aware that many investors have become enamoured by the interest rate sensitive equities over the past decade and for good reason. These equities provided steady dividends and in most cases the share prices gave investor decent capital appreciation to boot. During periods of market volatility they were more stable than the overall market and mitigated the downside. This has led many portfolios to be very heavily weighted to these sectors and as a result very sensitive to changes in yields or interest rates. When yields were steadily moving lower this was a boon, now it may have changed. And we believe it is prudent to gauge how interest rate sensitive your portfolio may be in light of a potentially changing market.

Understand Your Interest Rate Sensitivity

Every investment is sensitive to interest rates as changes alter today’s value of the investment future cash flows or estimated cash flows. However, some investments are more sensitive to changes in rates or yields than others. In fact, some move in the opposite direction to others. This is an important point as everyone understand diversification across asset classes, but diversification across other factors is also important. As you can probably imagine, a portfolio comprised of products, equities, funds and bonds that are more interest rate sensitive may not be as diversified as it would appear on the surface.

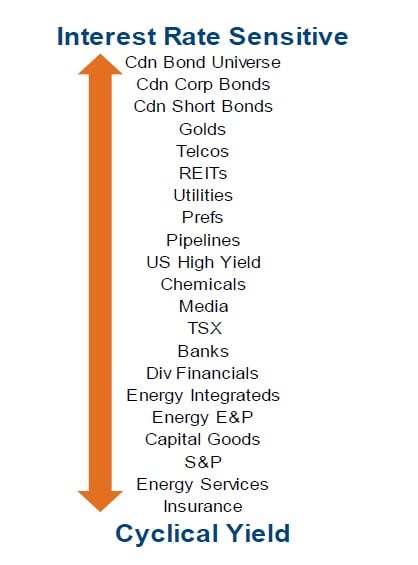

We would encourage investors and advisors to assess the interest rate sensitivity of their portfolios. It may prove more prudent now than in years past. The spectrum on the right is based on how sensitive sectors and some types of bonds were to historical periods of rising interest rates. With those at the top being most sensitive and the bottom the least sensitive. Ensuring your portfolio is not clustered with holdings from the top of the spectrum would go a long way to diversifying your exposure to changing yields.

Cyclical Yield en vogue

The bottom end of the spectrum (top chart) we label Cyclical yield. These are sectors that while still paying a dividend, do not appear nearly as sensitive to changes in bond yields as the top of the list. Within a portfolio having a reasonable weighting in these industries would help protect should yields continue to rise.

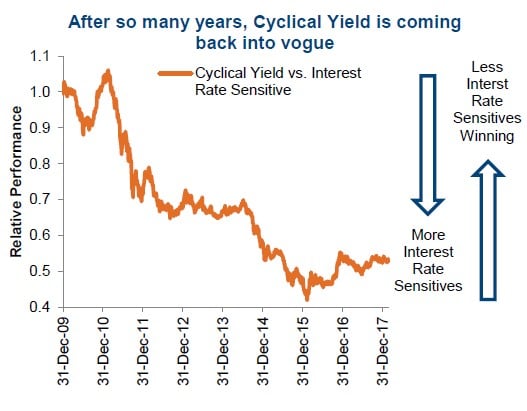

We believe the Cyclical yield theme will be dominant throughout the rest of the current market cycle. We are in the phase where inflation is rising, central banks are tightening, and the economy no longer has as much excess capacity. Plus, the interest rate sensitives had such a long run as evident in chart 2, a reversal may be a big one as well. This chart measures the average performance of the cyclical yield sectors vs. the interest rate sensitive sectors. When the line is rising cyclical yield is winning and when the line is falling interest rate sensitives are outperforming. Note the line fell from 2010 to early 2016.

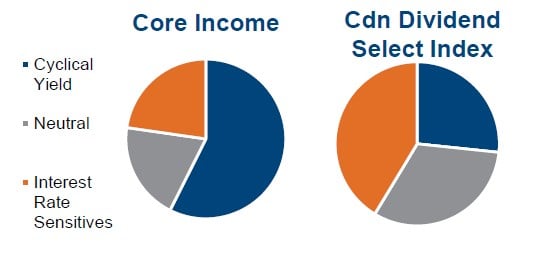

By no means are we suggesting dividend or income focused investor abandon the interest rate sensitives. However, ensuring you have a better balance would really help performance assuming this plays out to the higher end on yields and inflation. As an example, our Core Income strategy, which invests mainly in Canadian dividend paying companies with some U.S. as well for better diversification, owns some interest rate sensitives (3rd chart). About a quarter of the portfolio is in the more interest rate sensitive industries, mainly Pipelines and Telcos. However, we are much more tilted towards cyclical yield with over half the portfolio. Contrast this with the Canadian Dividend Select Index (XDV ETF) which is almost half interest rate sensitive and a quarter cyclical yield.

This cyclical yield theme has helped Core Income perform well during these changing times. The F-class fund version of this strategy (Redwood Core Income Fund CWC201) is currently ranked #1 over the past three months among Canadian dividend and income equity funds. Over the past year, it is ranked 4th according the Morningstar (as of Feb 22)

Investment Implications

Understanding a portfolios exposures is critical in every market environment. It becomes even more important when there is a possibility of a changing environment such as deflationary fears to inflationary fears. Meanwhile, we are starting to see credit spreads rise a little. Low or falling credit spreads helped many investments handle rising yields in the past few quarters. If this is no longer the case, we may be setting the market up for an environment similar to the taper tantrum a number of years back.

Key is to understand your exposures. Talk to your Advisor about how your portfolio is allocated, our firm has a number of analytical tools we use to assess the interest rate sensitivity and credit exposure of portfolios. Reduce your interest rate sensitivity, and adding some cyclical yield should help as well.

Article by Craig Basinger, Chris Kerlow, Derek Benedet, Shane Obata – Richardson GMP

See the full PDF below.