The economic calendar is light. That leaves plenty of time for the pontificating punditry to opine on a possible turning point in markets, bubbles and overheating, the Fed, geopolitical risks, and continuing Washington turmoil. Many will be asking:

What does the increased volatility mean for financial markets?

Last Week Recap

In the last edition of WTWA (two weeks ago) I asked whether we might be at an inflection point for stocks and the economy. A month ago, I asked whether we should be worried about inflation. My annual Seeking Alpha preview explained my reasons to be cautiously bullish. These are all quite relevant to the current markets. If you missed the original posts, please take a few minutes to catch up.

The Story in One Chart

I always start my personal review of the week by looking at a great chart. I especially like the Doug Short design with Jill Mislinski updates and commentary. You can see many important features in a single look. She notes the new records along with other indicators. The entire post is well worth reading for the collection of charts and analytical observations.

The decline for the week also reflected a larger trading range and included intra-day moves that exceeded those of recent months. Volatility has returned.

A key question is how long the current decline might last, and how large it could be. As a starting point, this history of drawdowns over the last ten years is quite helpful.

Drawdowns of 5-10% are completely routine, often occurring several times a year. The last two years have been quite unusual.

Personal Note

Our weekend away was enjoyable and successful. While Mrs. OldProf and I did not win the event, our team came in second in a strong field. Thanks to our well-wishers.

And a special thanks to Focus Economics for including us in the list of top blogs in economics and finance. There is a wide variety of great sources, including some that you probably have not seen.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The economic news remains very positive, despite the reaction of the markets this week. New Deal Democrat’s weekly comprehensive indicator update should satisfy even the nerdiest observer. I read it every week. Here is his conclusion:

The near term forecast remains extremely positive. The downturn in stocks took them back to where they were 3 weeks ago, and so is not a major concern. The nowcast also remains positive.

The Good

- Construction spending was up 0.7% beating expectations of 0.3%.

- Earnings news remains positive. As usual there have been some blowups in big names and conflicting reaction to comments in conference calls. These draw the attention in financial media. Halfway through this season, the data paint a brighter picture. John Butters (Factset) reports that both earnings and sales are beating expectations more often than the five-year average. The size of the beats is not as great as the average. Brian Gilmartin takes this an important step further, describing the impact on expected earnings, now 18% for 2018.

- ISM manufacturing had a slight decline from December’s high, but beat expectations with a reading of 59.1 (Bespoke).

- Personal income growth increased from 0.3% to 0.4%, beating some estimates.

- Ford truck sales were “monster” according to Bespoke. This is a good proxy for small business and construction activity, they argue.

- Consumer confidence moved even higher, from 123.1 to 125.4. (Jill Mislinski) Michigan sentiment of 95.7 declined slightly from December’s 95.9, but beat expectations.

- Factory orders were up 1.7% beating expectations of 1.3%.

-

Employment news was positive.

- ADP reported private employment net gains of 234K, much higher than the expected 190K.

- Initial jobless claims declined to 230K, a bit better than expectations of 238K.

- Nonfarm payrolls increased by a net of 200K jobs, beating expectations of 180K.

- Private payroll gains were up 196K, also beating expectations, consistent with ADP.

- Unemployment remained at 4.1%, but the number of long-term unemployed (over 27 weeks) declined from 22.9% to 21.5%.

- Hourly earnings were up 0.3%, in line with consensus, and December’s reading was revised from 0.3 to 0.4%. The year-over-year increase is 2.9%.

But… Hours worked declined from 34.5 to 34.3, missing expectations. Many translate this into an adjustment to job gains. There was also a 24K downward revision in payroll jobs from the prior two months. Dr. Robert Dieli’s excellent monthly employment analysis takes a comprehensive, close look at the data. It is unusual to find a first-rate economist who also writes well and knows how to present data effectively. Bob’s conclusion was that the story is not quite as good as it appears on the surface. He notes the decline in the rate of growth in net job gains. His analysis is not alarmist because it is placed in the context of his overall business cycle updates.

The Wall Street Journal always has an excellent chart pack on the employment numbers. Here are two of my favorites, each illustrating a key point in the report.

- ADP reported private employment net gains of 234K, much higher than the expected 190K.

The Bad

- Productivity declined 0.1% in Q417, from a gain of 2.7% in Q3. This contributed to a unit labor cost increase of 2.0%, Q/Q.

- DC shenanigans threaten. The posturing is difficult to read as various deadlines impend. I usually expect 11th hour compromises after all sides have demonstrated their commitment. Their backers expect this. It seems like there is more “digging in” than usual.

- GDP increased only 2.6% in Q4. This story is a week old, but worth mentioning. Eddy Elfenbein notes the result and looks deeper into the data.

- Excessive exuberance among the might in Davos? Fortune’s excellent CEO Daily analyzes the sources of excitement. Others wondered whether this was a contrary signal.

The Ugly

This week there is a choice. A Cleveland man, shot sixteen times, could not get an ambulance since he was over a city boundary. This is simple, factual, and possibly illustrative of intergovernmental problems and issues in the health care system.

The second choice is both more speculative and more significant.

Eddy Elfenbein takes a closer look at a story about bumbling Russian spies, including a famous old character. The spies were focused on the U.S. financial infrastructure.

Possible change in nuclear policy. The most recent nuclear policy review encourages smaller weapons and permits their use even in situations where there has not been a nuclear attack. The stated purpose is deterrence of non-nuclear threats, including cyber-attacks. This is an important story which we should all follow.

The Doomsday Clock now shows only 2 minutes to midnight. This is in no way related to the items cited above! This is tied (with H-bomb development in 1953) for the shortest time in history.

As is usually the case with “ugly” news, there is no good way for investors to hedge.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

The Calendar

We have a light economic calendar. The ISM Services report is a good coincident read on the economy, and perhaps some leading qualities on employment. The JOLTs report is helpful for the study of labor market structure and the economic cycle but is rarely used or reported accurately.

In the wake of last week’s FOMC meeting, the quiet period has ended and FedSpeak resumes. The most important news will once again be corporate earnings reports, especially discussions of outlook.

Briefing.com has a good U.S. economic calendar for the week (and many other good features which I monitor each day). Here are the main U.S. releases.

Next Week’s Theme

The light economic calendar is insignificant compared to the market reaction and the continuing focus on Washington. In normal times, corporate earnings would take center stage. Instead, the increase in stock (and bond) volatility will have everyone asking:

What does the spike in volatility mean for financial markets?

As usual, here is a typical range of opinion, from bearish to bullish.

- The crash is starting – read anything from the usual suspects.

- The major correction is upon us – read those who have been forecasting a correction almost weekly for five years. (See the solid, witty and entertaining commentary from Alan Steel).

- The much-needed and healthy selling is upon us. (A solid viewpoint, well stated by Horan Capital Advisors).

- Higher wage gains will move the Fed to raise rates four times instead of three. (Fed expert Tim Duy, but please also see my description of how the Fed views inflation).

- Caution is indicated. (Schwab).

- 700 points is a small move in percentage terms. “Trivial so far” said one respected observer.

- Economic fundamentals and earnings remain strong.

As usual, I’ll suggest my own interpretations in today’s Final Thought.

Quant Corner

We follow some regular featured sources and the best other quant news from the week.

Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

We use several different tests for technical health. The signals are bullish in all time frames.

The Featured Sources:

Bob Dieli: Business cycle analysis via the “C Score.

RecessionAlert: Strong quantitative indicators for both economic and market analysis.

Brian Gilmartin: All things earnings, for the overall market as well as many individual companies.

Georg Vrba: Business cycle indicator and market timing tools. None of Georg’s indicators signal recession.

Doug Short: Regular updating of an array of indicators. Great charts and analysis. With several important releases in the last two weeks, it is time for another look at the Big Four.

Guests:

Scott Grannis notes that rising bond yields are a positive for stocks.

Prof. James Hamilton updates his GDP-based recession indicator – better and more sophisticated than the two-down quarters rule of thumb. His findings remain consistent with our regularly-cited sources.

Insight for Traders

Our discussion of trading ideas has moved to the weekly Stock Exchange post. The coverage is bigger and better than ever. We combine links to trading articles, topical themes, and ideas from our trading models. This week’s post discusses how to deal with extremes in market strength. It was a prescient topic, and the answer varies with your objectives. We cite leading sources and update ideas from our models. Performance updates are published, and of course, there are updated ratings lists for Felix and Oscar, this week featuring the Russell 1000 components. Blue Harbinger has taken the lead role on this post, using information both from me and from the models. He is doing a great job, presenting a wealth of new ideas and information each week.

As he often does, Dr. Brett provides insight for both traders and investors. His post on preventing emotional trading is helpful to everyone.

He also has done an excellent organization of information on his long-running blog. (There’s a good idea for many of us!) This makes it easy for anyone to check out the best resources from his past work.

Insight for Investors

Investors should have a long-term horizon. They can often exploit trading volatility! I remind investors of this each week, but now is the time to pay attention.

Best of the Week

If I had to pick a single most important source for investors to read this week it would be the advice from Harry Markowitz, the Nobel Prize winning father of modern portfolio theory is 100% invested. (Barron’s) Why? He is bullish for the long run, but not the very long run. He has much less diversification than usual, because he expects rebuilding in the hurricane aftermath. Check out the whole story, but if you look for lumber, wallboard, glass, bulldozing, mining, and elevators, you can guess his top mega stock picks.

Markowitz may have the same information as everybody else, but he sees things differently: Even as news articles forecast that the stock market was getting too high and had to have a correction, Markowitz didn’t see it as out of line with the economy at all, especially when combined with the benefits of tax cuts and corporations repatriating money they’d kept overseas.

“I’m just looking at the statistics of the stock market—they are not looking one step beyond how the economy is doing or what the economy is likely to do. The economy is likely to rebuild Puerto Rico! We suddenly have a big influx of capital and an incentive to spend it, and we have an increase in supply and an increase in demand. But we are going to have economic activity at least until Puerto Rico is rebuilt, at which time I might be dead.”

This is a great lesson on adapting your portfolio to the most important current themes.

Stock Ideas

Chuck Carnevale channels Peter Lynch in his analysis of Ulta Beauty. His article includes an excellent update on the widely-misinterpreted Peter Lynch approach and a lesson in how to evaluate a growth stock. The Lynch lesson takes experience as a starting point and then brings in serious fundamental research.

I’ve never said, ‘If you go to a mall, see a Starbucks and say it’s good coffee, you should call Fidelity brokerage and buy the stock,'” Lynch says, some 25 years after his retirement from running Magellan Fund was front-page news.

Tax law effects. The WSJ has an update on impacts. Just as I have written, the analyst changes have been slow to capture these ideas. There is a lot of great analysis in this article. The table of some big companies is only a taste of the story.

Beaten down REITs? Dividend Sensei has some ideas in the beaten-down medical sector.

Analyst psychology as a driver? Stone Fox Capital thinks the direction for Gilead has changed.

D.M. Martins compares the cruise lines and gives the nod to Carnival (CCL). (I like this theme, but currently own RCL).

David Fish updates the list of dividend champions – 3 new members and 23 new challengers.

Trends often lead stocks

Barry Ritholtz notes the change in homeownership and the attitude of young adults. Mortgage rates were 7 – 10% as recently as the 90’s. The percentage of young homeowners is increasing as they form households.

Personal Finance

Seeking Alpha Senior Editor Gil Weinreich continues his excellent series. While theoretically aimed at advisors, there are many themes of interest for individual investors. As usual this week had several great entries, making it even more difficult to pick a favorite. I especially enjoyed his commentary on the need to address major US budget problems. His swing at my state, Fix the U.S. Before It Becomes Illinois, is warranted. He highlights an informative post by Eric Basmajian on the “third rail.”

I am not expecting immediate action, but it is still right to highlight this issue as much as we can. On a related front, I got an offer to interview someone with an answer to the Washington problems. Her specialty is mental health and counseling, with plenty of advice for married couples. There is plenty of common-sense advice about working together, but nothing about the powerful incentives driving players apart. Sheesh!

Abnormal Returns has a special Wednesday focus for individual investors. There are a variety of ideas, and nearly always something you will find useful. I especially liked this week’s citation of the Financial Samurai’s analysis of how much risk to take in retirement. This is a question that I take up with clients almost daily and should be the starting point for your investment program. Here is the important conclusion from the article:

Don’t let money get in the way of a wonderful retirement. Your investments should be a relatively worry-free tailwind that ensures you never have to return to the salt mines again. If you are starting to worry about your risk exposure, then dial down risk by raising more cash, CDs, or rebalancing more towards treasury bonds or top-rates muni bonds.

Yes, it can get annoying if you underperform your respective benchmarks. But you’ve got to remember that you’ve already won the game. Every single dollar you make above the rate of inflation is gravy. During bull markets, you’ll sometimes be able to return a greater amount from your investments than you would make at your job.

Value investing

Market runs often emphasize the exciting names, leaving behind those who emphasize long-term value. Bill Smead takes a good luck at this history. He has an interesting review of some of the “dark periods” for a value strategy.

Watch out for

Failed hedge funds moving into Bitcoin. (Institutional Investor)

Health insurance companies facing the “Amazon effect.” (Kirk Spano)

Final Thoughts

There was a lot of interpretive discussion on Friday. What did we learn?

Dana Lyons featured this chart of how stocks performed after a January gain of 5% or more. All good news except for 1987.

Friday’s selling sparked the expected question: Is this like 1987?

- It is unhelpful to single out a particular year in a search to explain the present.

CNBC repeatedly showed an intra-day chart showing each move with a news annotation. Everyone scrambled to find reasons.

- Not every blip requires an explanation – even when the moves are 1 – 2% range.

Many are concerned about the increase in yields, threatening more competition for stocks from bonds.

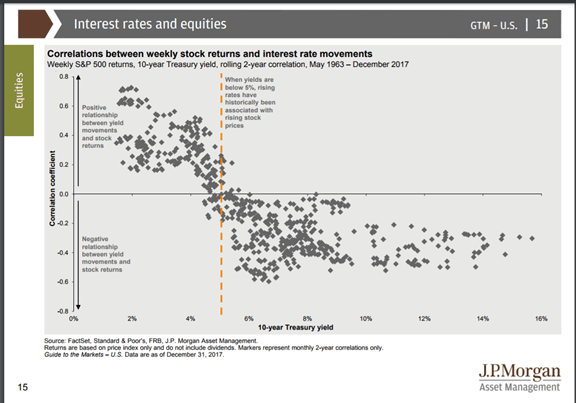

- Competition doesn’t really start until about 5% on the ten-year note. Ralph Acampora, JP Morgan.

- Losses on bond funds will nudge many into stocks. Bill Miller sees the tipping point for this at about 2.7%% on the ten-year. That leaves a wide window for stock investors to enjoy – and probably a considerable length of time before real problems ensue.

A wary eye on Washington.

- Normally we get a compromise at the 11th hour. It seemed like the ingredients were there last week, but the situation has gotten worse. Art Cashin opines that this has (so far) had little effect on stocks.

Do you have a plan?

- If not, you are a potential victim of everyone selling fear and making their profit from gold, page views, annuities, bitcoin, or newsletter subscriptions. Bill Miller: “Why would you sell because others are selling? You should have an idea of what businesses are worth and buy when there are opportunities”.

If you have been paying attention, you have thought about a plan for the current circumstances. Here is mine:

- Stick to the fundamentals, especially recession signs and earnings news.

- Rely on actual proven, quantitative measures, not hype.

- Normal selling of some winners that hit price targets and trimming my largest holdings has left me with a little more cash than usual. I did not begin buying on Friday, but I expect to go shopping next week. I joined many others in taking a wait-and-see attitude about events this weekend.

- I am perfectly willing to become less bullish, if the economy and earnings get worse.

In my last installment I wrote:

When the volume of the noise increases, reliable risk indicators become even more valuable.

That conclusion carries extra weight this week. I know that many will see the news and feel some stress. I made a special effort this week to provide some extra sources and analysis. If you are really worried, read a little more than usual from some sensible sources, and turn off the noisemakers!

I’m more worried about:

- The lack of progress on the federal budget. The inability to find a compromise has an immediate economic effect. If it reduces confidence, that effect will be magnified.

- The escalation of partisan rhetoric over the FBI. This is difficult to quantify so far, but voices are getting louder.

I’m not worried about:

- The Fed. There are no signs of sharp policy changes that would block economic growth. Current inflation levels are not worrisome.

- The immediate selling reaction. It is a normal part of investing.

[Do the economic challenges seem complicated and threatening? Need a year-end tune up for your portfolio? This is the time to schedule a free consultation, read my paper on the top investor pitfalls, or both. If you are concerned about major declines, you might be interested in my paper on risk. Just write for our free information on these topics. While they describe what I am doing, the do-it-yourself investor can apply the same principles. Both the concepts on recessions and how we used it to forecast Dow 20K are available for free from main at newarc dot com].