In our recent ValueEdge Chinese New Year Event, in collaboration with RHB Securities, we presented on our investment strategy and opportunities for the Year 2018.

Check out our H2 hedge fund letters here.

A few things covered which reflect our thinking with regards to areas to avoid in Singapore + areas of investment opportunity:

- Large cap stocks in Singapore are fairly valued / on the expensive side, especially the Singaporean bank stocks, most specifically DBS (have attached valuation chart in the slide deck)

- The more obvious dividend plays like Starhub and M1 will continue to face pressure sustaining their dividends because free cash flow does not support it

- Have to look at mid-size companies for Singapore to find good opportunities – we think construction companies are the best placed with good order book from increased infrastructure spending and property development growth the next few years

- Other areas which offer compelling risk/reward opportunities include luxury watch retailers in Hong Kong, and the oil & gas sector in Singapore

With regards to the Singaporean economy:

- The Singaporean economy is in an extremely good place with it recovering well from the last “bust” in the O & G sector

- Credit growth will be robust, driven by property development, mortgage growth, infrastructure spending and construction

- Chances of dramatic showdown like in 2016/2017 are quite unlikely

- Unfortunately these positives are also priced into large cap stocks especially banks as mentioned above

With regards to market outlook:

- Valuations are closer to fully valued or on the higher range for most large cap stocks

- Sentiment is generally bullish across the board, pays well to err on the side of caution and be more conservative especially compared to 2015/2016

- The low hanging fruit has already been taken (Singapore banks), going forward investors have to look harder for investments with good risk/reward prospects

- We personally think mid-size businesses in Singapore and Hong Kong still offer good value

- UK offers some good value if one knows where to look because of poor sentiment on the ground – BT Group, a dominant local telco with a 6% + dividend, strong free cash flow generation and stable financial position is one such idea we have

As Grahamite investors, we seek companies trading at a price fractional of their liquidation or fair values. We believe that over time, the price of the security will eventually reflect the fair value of the underlying business.

However, what causes this revaluation?

Graham was asked a similar question on what causes undervalued stocks to find its value and Graham replied, ‘I don’t know’. We believe that we have come 40-50 years since then and can offer some light as to what causes this revaluation.

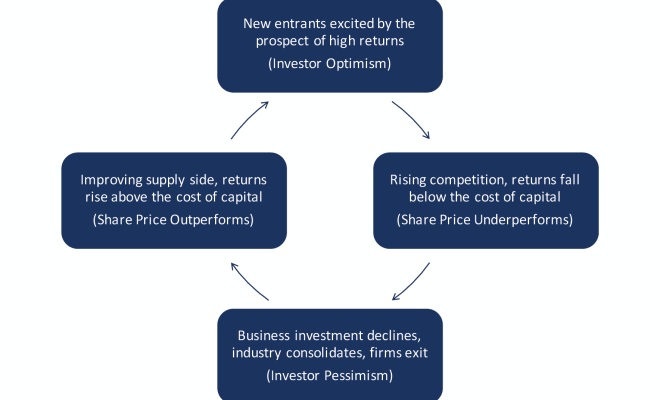

At the heart of our investment philosophy, is our emphasis on the capital cycles. It is based on the idea that the prospect of high returns will attract excessive capital; hence huge competition, just as low returns repel them. The resulting ebb and flow of capital affects long-term returns for shareholders in often predictable ways, what is termed as the capital cycle.

We aim to identify sectors that are in its down cycle and that are starved of capital. This is followed by detailed research-based analysis of the fundamentals of the companies and behavioural insights within this sector to uncover publicly-listed companies that are selling at a significant discount to its intrinsic value historically.

Given the contrarian and long-term nature of the capital cycle, the strategy results in strong views versus the market and long holding periods (3 – 5 years). Such a disciplined and patient deep value investing approach allows us to seek superior risk-adjusted returns with limited volatility.

It is our belief that if we can minimise our losses; the winners will take care of themselves. This also explains our propensity to favour businesses that are backed by substantial asset values. They are in our experience more reliable determinants of value than projected earning.

Sign up for our weekly newsletter here where we will be sending our slides to our readers by 04/03/2018.

Article By Tee Leng Goh, Value Edge