Mergermarket, an Acuris company, has released its Global M&A roundup report for the Technology, Media and Telecom (TMT) Sector for 2017. Take a look at the full report HERE.

A few key findings include:

- In 2017, global dealmaking in the TMT sector saw 3,389 deals worth a combined US$ 498.2bn. Although total deal value fell 26.3% compared to the US$ 676.3bn tallied in 2016, a new Mergermarket record (which dates back to 2001) by deal count was set, increasing by 233 transactions over 2016 (3,156 deals) to reach an all-time high

- Such trends highlight the increasing influence of Technology in just about everything, and how many industries have been finding themselves under pressure to, at times rapidly, incorporate digital tools in order to survive. This has forced consolidations in long-standing industries such as Consumer; Pharma, Medical & Biotech; and Media, etc.

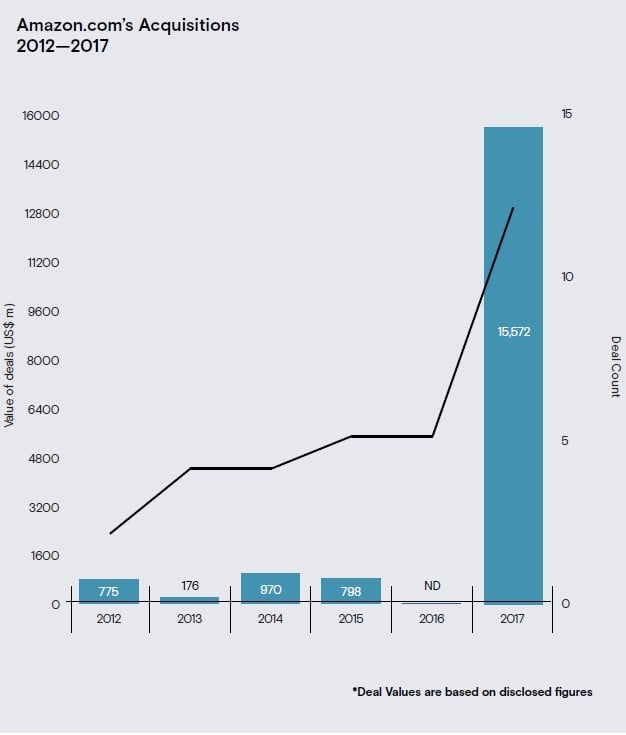

- Though not – yet – entering the humanoid robot market, Amazon stayed busy throughout the year, disrupting markets left and right – even literal ones. In what at the time was a somewhat surprising move, the company entered the consumer retail space with a bang, snatching up health food supermarket chain Whole Foods in June for US$ 13.5bn, its largest acquisition ever as well as the largest grocery deal in a decade, while also expanding and/or opening several brickand-mortar shops including Amazon Books and Amazon Go. This has in turn caused some panic among industry giants such as Walmart, which by August had teamed up with Google, as well as Target and Kroger, according to Mergermarket intelligence.

Data analysis

2017: A Most Disruptive Year

Sophia, a humanoid robot created by Hanson Robotics, made an appearance at Saudi Arabia’s Future Investment Initiative last October. In addition to being interviewed by CNBC Squawk Box co-anchor and New York Times DealBook founder and editor-at-large Andrew Ross Sorkin, she became the first robot to receive citizenship in any country – Saudi Arabia, in this case.

Speaking calmly and confidently to an audience of high-profile business executives, she managed to at once capture their attention and instill fear, as well as in those beyond the room. The experience, no doubt fascinating, perhaps evoked the concept of the “Uncanny Valley” for many.

Will Sophia and her kind be a significant part of our future? Do we have a choice?

As digital Technology increasingly melds with various elements of our world, at times even leading us to question our notions of what it means to be human, so too does it appear to be affecting countless other aspects of our lives, with considerable consequences for society as a whole. This has been particularly evident in the economy and business world. Usually a reliable indicator of the health of a given market, the world of M&A itself has begun to reflect the disruptive effects of digitization and technology overall, and their ever-growing repercussions.

In 2017, global dealmaking in the Technology, Media & Telecommunications (TMT) sector saw 3,389 deals worth a combined US$ 498.2bn. Although total deal value fell 26.3% compared to the US$ 676.3bn tallied in 2016, a new Mergermarket record (which dates back to 2001) by deal count was set, increasing by 233 transactions over 2016 (3,156 deals) to reach an all-time high.

Technology: Software as a dominant service

Such trends highlight the increasing influence of Technology in just about everything, and how many industries have been finding themselves under pressure to, at times rapidly, incorporate digital tools in order to survive. This has forced consolidations in long-standing industries such as Consumer; Pharma, Medical & Biotech; and Media, etc.

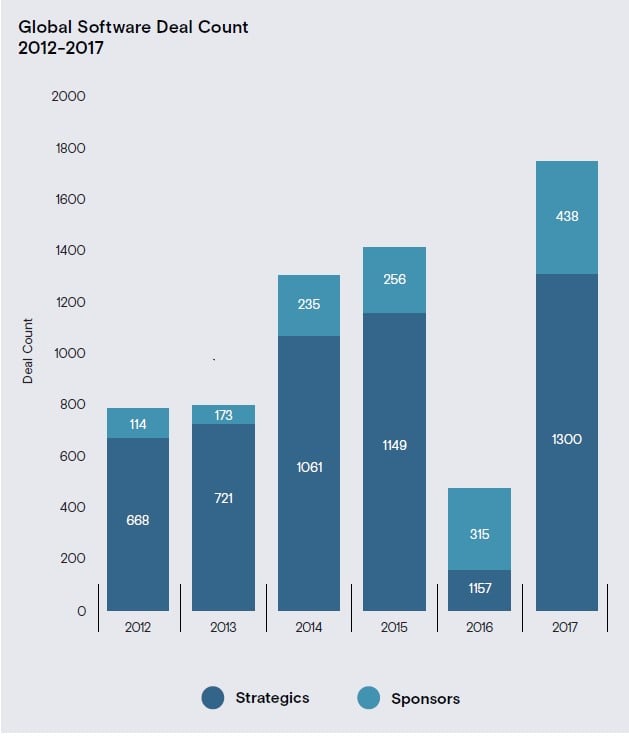

Half of all deal activity in TMT was driven by M&A in the Computer Software sub-sector alone, which accounted for 1,739 transactions (worth US$ 128.8bn) – 2.8x that of eCommerce, which saw the second-highest deal count with 629 transactions (worth US$ 85.1bn). Notably, Software was one of only a few spaces where deal count actually rose in 2017 compared to other sectors. By deal value, Software was responsible for 25.7% of total TMT deal value. Also worth noting is that there were no Software deals in 2017 anywhere in the globe that reached megadeal (>US$ 10bn) status; the top deal within the sub-sector was China-based SJEC Corporation’s US$ 6.4bn purchase of Chinabased online virus detection and protection firm 360i Technology.

Along with cybersecurity, Software transactions ranged from FinTech (US-based Vista Equity Partners’ US$ 3.4bn buyout of Canada-based DH Corporation) and music app media (US-based Apple’s US$ 400m purchase of UK-based Shazam) to public relations and marketing communications tools (Capitol Acquisition Corp III’s US$ 2.4bn blank check company reverse takeover with US-based Cision, resulting in the latter going public) and pharmaceutical IT (US-based McKesson Corporation’s US$ 1.1bn acquisition of US-based CoverMyMeds).

Private equity activity within the Software space also set a new record in terms of the number of deals that took place. While disclosed deal values for Software buyouts ended with an aggregate US$ 38.8bn, a 16.4% decrease from 2016, 2017 was still the third-highest value on record, with deal count hitting a peak of 438 transactions – 123 more than in 2016, which had previously held the record. The largest of these was UK-based PE firm HgCapital’s US$ 5.4bn buyout of Norwaybased business software and services company Visma.

Undeniably, and increasingly so, the Software sub-sector, and the Tech sector by extension, has made powerful waves into other sectors. There is perhaps no better company that embodies this concept than Amazon.

Welcome to the Age of Amazon

The year 2017 could very well become known as the Year of Disruptions, a.k.a. the Year of the “Amazon Effect.”

Though not – yet – entering the humanoid robot market, Amazon stayed busy throughout the year, disrupting markets left and right – even literal ones. In what at the time was a somewhat surprising move, the company entered the consumer retail space with a bang, snatching up health food supermarket chain Whole Foods in June for US$ 13.5bn, its largest acquisition ever as well as the largest grocery deal in a decade, while also expanding and/or opening several brick-and-mortar shops including Amazon Books and Amazon Go. This has in turn caused some panic among industry giants such as Walmart, which by August had teamed up with Google, as well as Target and Kroger, according to Mergermarket intelligence.

In addition to disrupting the retail grocery market, the healthcare space also saw the emergence of Amazon in its midst. In a defensive move, CVS Health announced that it would be buying Aetna, an insurance carrier, for US$ 67.8bn in what amounted to the second-largest deal of the year. The move purportedly came after Amazon had filed for licenses to operate pharmacy benefit management operations in multiple states, with more planned. That a Tech giant could cause such a shift in industry strategies as in the Pharma, Medical & Biotech (PMB) sector demonstrates how eCommerce, Technology, and analytics have increasingly grown to be powerful tools capable of reshaping entire trades.

Media: The Force is Woke

Such consequences have also extended beyond pure business models and begun to disrupt the personal lives of business

executives.

Increasingly, social media has made it easier to tell stories to a wider audience, holding individuals accountable for their private

actions by affecting their professional lives.

For all its unforeseen consequences, the medium has led to watershed events and the sudden rise of entire social movements, as well as the equally rapid fall of magnates and tycoons alike. As the New York Times and the New Yorker broke news in October on long-standing sexual assault and harassment allegations against Hollywood mogul Harvey Weinstein, Technology played an undeniable role in the seismic shifts taking place throughout the Media industry. Following the allegations, Weinstein was fired from his film company and had his membership terminated in the Academy of Motion Picture Arts and Sciences. His company is now engaged in talks to be sold, with a deal announcement expected in Q1 2018.

Media M&A had already been on shaky ground as the sector as a whole – including not only entertainment but also advertising, publishing, and broadcast – struggled over the past few years to deal with the massive onslaught of changes brought on by Tech advances. Moreover, the sector now finds itself grappling with the effects of the #MeToo and Time’s Up movements. Global figures for the sector recorded US$ 131.2bn, a decrease of 28.9% compared to 2016’s US$ 184.4bn, though deal count was up by eight transactions to 568 over the same period. The US accounted for the bulk of the share of global Media dealmaking, comprising 78.9% of total deal value within the sector, and just under 30% of total deal count. At the same time, this was 22.4% below total value in the US in 2016 (US$ 133.3bn) and 17 fewer deals.

In fact, Media’s deal value fell across the globe, by 52.5% in Europe to US$ 13.6bn in 2017, by 26% in Asia-Pacific (APAC) to US$

13.4bn, and by 85.3% in the rest of the world to US$ 600m. By deal count, however, activity rose in Europe and APAC, by 22 transactions over 2016 to 228 total in Europe and by six to 135 total in APAC.

The Deal of the Twenty-First Century Fox Among the Media entities embroiled in scandal, former CEO and Chairman of Fox News and Television Roger Ailes was forced to resign after multiple sexual misconduct allegations came to light. Ailes passed away less than a year later. Further, Fox News host Bill O’Reilly was also forced out after several sexual harassment suits settled by Fox on his behalf became public.

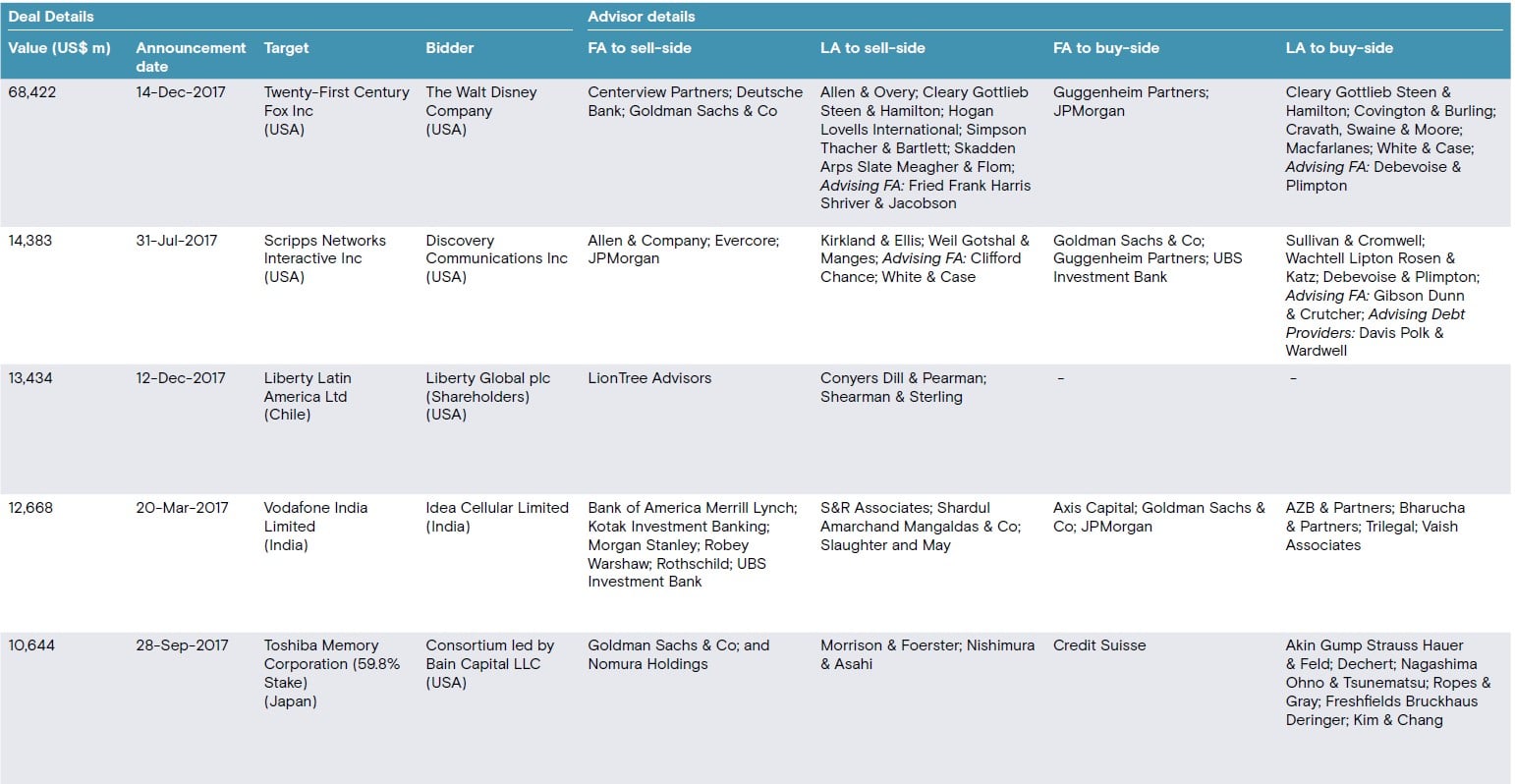

Shortly after both men were let go, the media company founded by tabloid titan Rupert Murdoch announced that it was selling the bulk of the corporation to Disney for US$ 68.4bn, resulting in the top deal of the 2017 by value, according to Mergermarket data. Disney had been on the hunt for high-value assets as it prepared to take on the threat from industry disruptor Netflix. Disney’s acquisition of Fox also makes it the majority owner of popular streaming service Hulu, one of Netflix’s primary rivals along with HBO, Showtime, and Amazon Prime.

Talk of the revival of a possible merger between CBS and Viacom would only add to pressures to consolidate within the

entertainment industry in addition to all that occurred in 2017. Should such a transaction actually reach the signing table, one can only question what the next move might be for the likes of Comcast.

Another headliner facing intense scrutiny, though this time by government regulators, was the US$ 105bn AT&T/Time Warner vertical merger first announced in 2016 and which remains the fifth-largest deal since on record. Such holdups have given dealmakers pause, especially affecting deal values.

What to expect in 2018

The structural changes taking place across industries as well as society brought on by Technology’s advances are likely to continue shaping the landscape for dealmaking into 2018. While deal values may continue to fall, deal count in sectors such as Technology are set to rise further. The sector will only add more pressure to other long-standing sectors to consolidate and battle over highvalue targets, despite political and regulatory uncertainty.

Tax reform in the US, which resulted in a sizeable cut to the corporate tax rate from 35% to 21%, is also widely anticipated to spur more M&A transactions as companies look to spend some of their newfound tax savings on deals. However, with interest rate hikes projected for 2018 this could also put an additional damper on deal values, driving them downward further. Meanwhile, TMT’s deal count momentum is unlikely to be affected, as it continues on the inevitable path of continued growth.

Top deals

Drivers & Heat chart

based on potential companies for sale

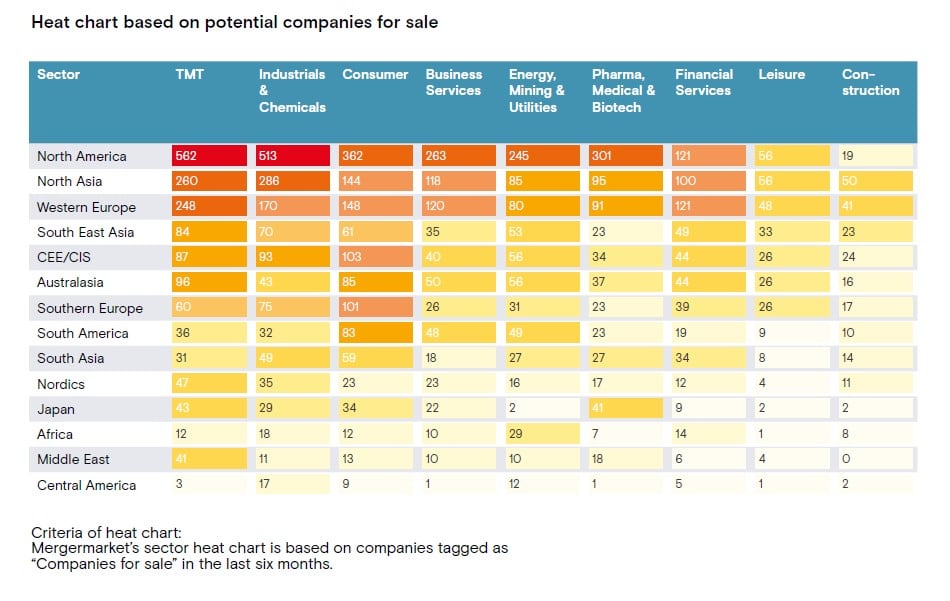

Looking forward into 2018, both strategic and financial TMT players worldwide are expected to show interest in cybersecurity and data management targets, as well as assets in fintech. There is mounting evidence that buyers are looking into the internet-of-things and data space, and the emergence of new EU regulations concerning data privacy will accentuate dealflow on the cybersecurity side, said Peter Watts, partner at Hogan Lovells.

Other forthcoming areas of focus, particularly for PE investors, are Saas platform companies. With the ever-increasing digitization of business sectors, Saas offerings continue to grow from both new entrants into the field, as well as old-line hardware companies moving into SaaS via cloud computing, adds Helen Croke, a private equity partner in the London office at Ropes & Gray. Cybersecurity and artificial intelligence platforms that can used in industrial work will be particular interest going forward. Financing conditions should remain strong for buyouts in the tech space into 2018, as the cost of debt remains relatively cheap.

Croke expects cross-border activity from European players scouring start-up heavy regions like Israel for these kinds of targets, as well Ireland from US investors in SaaS platforms.

Tech applications will also have ramifications among dealflow in the Media space worldwide, Watts said, as broadcasters may look to merge to gain scale to shave costs to better compete with OTT media providers.

21st Century Fox’s move to acquire full control of Sky Plc for GBP 11.2bn pounds at the end of 2016 was one move in this direction; that deal has been held up by heavy review by the British government and the Walt Disney Co [NYSE: DIS], announced it would acquire most of 21st Century Fox in an all-stock transaction valued at roughly US$ 68.4bn 14 December. That deal itself requires the approval of anti-trust regulators, though it is widely seen as a move to gain access to additional TV and sports programming as Disney develops streaming services to challenge Netflix [NASDAQ: NFLX] , Apple [NASDAQ: APPL], Amazon [NASDAQ: AMZN], Google [NASDAQ: GOOGL] and Facebook [NASDAQ: FB] in the fast-growing realm of online video.

Watts added that there should be a healthy amount of outbound Asian dealflow in 2018 through vehicles like the Softbank Vision Fund although increased protectionism from countries like the US in a more rigouous examination of Asian deals via bodies like CFIUS and from the the UK as terms of its exit from the European Union are hammered out might slow cross-border activity going forward.

See the full report below.