Big Media is in the middle of a monumental shift.

With immense pressure on revenues, market share, and distribution stemming from platforms and the migration to digital, the traditional big media players are scrambling to find new models and tactics that work.

In addition to forcing companies to evaluate new ways to monetize and distribute content, this industry turmoil has also served up the perfect environment for massive mergers and acquisitions. Big conglomerates aren’t going to go down without a fight, and as a result they are willing to “bet the farm” on M&A to try and compete.

The Big Media Landscape

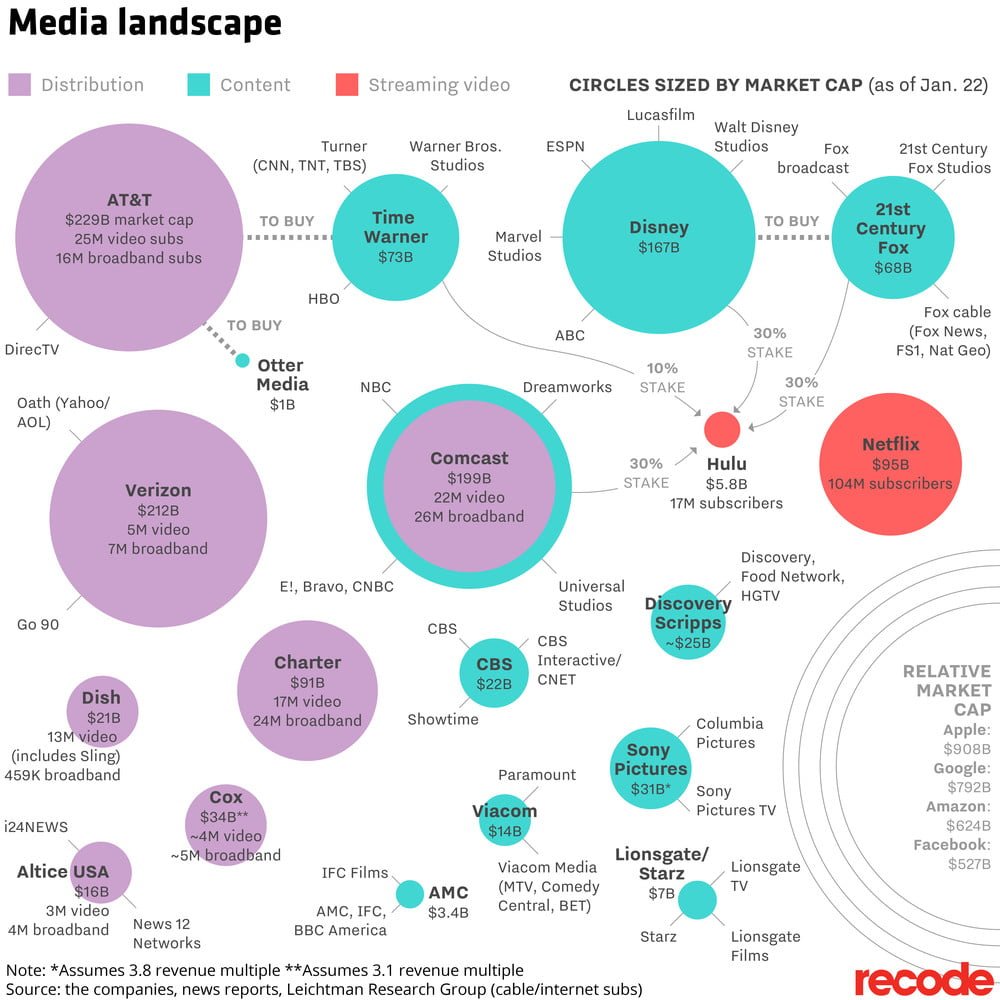

Today’s visualization comes to us from Recode via media reporters Peter Kafka and Rani Molla, and it does an excellent job in summing up the changing landscape of Big Media.

Notably, it helps visualize the significance of the recent $52.4 billion merger between Disney and 21st Century Fox, as well as the $85 billion merger between AT&T and Time Warner. The latter is set to go to antitrust trials in March.

It’s worth noting that the above graphic only shows the big players in the media landscape – and new media companies like Buzzfeed ($1.7 billion valuation) and Vox Media ($1.0 billion) are “too small” to include.

As such, it focuses primarily on the conglomerates that own many different media assets, with a heavy slant towards video content and distribution.

Platform Takeover

The impetus behind much of the turmoil in the media space comes from the unrivaled success of platforms.

Netflix has quickly emerged as a $100 billion+ company, and it already outsizes content stalwarts like Time Warner and 21st Century Fox, which each have histories going back many decades.

In response? In the visualization, you can see the investments made by Disney, Comcast, 21st Century Fox, and Time Warner into video streamer Hulu in one attempt to hedge bets.

But unfortunately, it’s not only Netflix that is a threat – on the advertising side, the Google/Facebook duopoly is wreaking havoc on virtually every online media company in existence. The below graphic, which helps to contextualize the trend in global ad revenue, is from a previous chart we published last year.

To combat a shrinking share of the pie, even long-running brands like the New York Times are migrating their monetization strategy towards paid subscriptions. In other words, even the Times acknowledges that it can’t compete with the scale and targeting ability of the platforms.

That’s why, unless the dust settles in the near-term, there will be even more consolidation and attempts towards innovation in the media sector. This is especially true for the big conglomerates, who need to show shareholders that they are trying to do something to stop the bleeding.

Article by Jeff Desjardins, Visual Capitalist