Key Points

- Small caps continued their momentum from 2016, rallying 14.7% in 2017, hitting new highs along the way. Although ending the year on a sour note, as December posted a -0.4% return, the quarter finished positive, bolstered by President Trump signing into law a historical tax reform. The Russell 2000 Index (R2K) has closed at record highs over 30 different times this year.

- U.S. small caps have risen over 13.7% since August 21st, when President Trump reignited the tax bill conversation, contributing to the majority of their year-to-date return of 14.7%. During this period, small caps outperformed U.S. large caps by 3%. Unfortunately, this recent outperformance by small was not able to overcome large's lead for the year, trailing by 7.2%. For the first time ever, the S&P 500 closed positive in every single month during a calendar year.

- Constant themes for 2017 have been stretched valuations and historically low volatility. The R2K trades at 21.5x forward earnings, slightly above where it started he year at 20.5x. The Russell 2000 Value Index (R2KV) trades at 18.8x, above historical averages, while the Russell 2000 Growth Index (R2KG) trades at 23.5x. Furthermore, on 52 different occurrences this year, the VIX index closed below 10. To put this in perspective, the VIX index has only closed below this mark nine (9) other times since 1990.

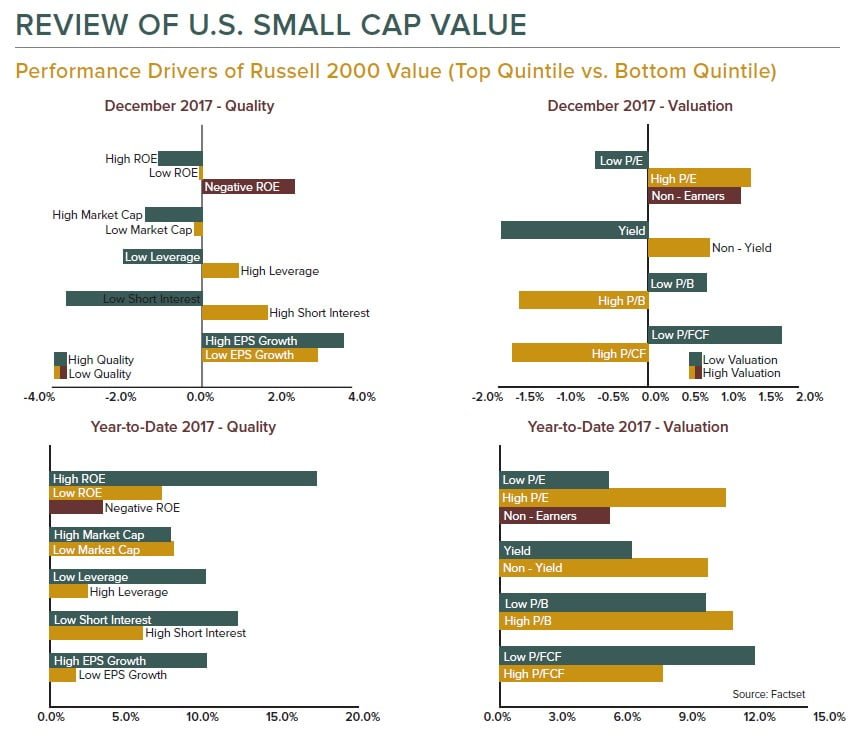

- Another theme in 2017 was Growth outperforming Value, which again, was the case in December. September remains the only month this year where Value materially beat Growth. Even with Health Care and biotechs lagging in December, Growth bested Value by 1.1% for the month as Financials and Utilities, both overweights in Value, led sector underperformance. Growth finishes the year outperforming Value by 14.4%. However, the win by Growth was not as big as its loss to Value in 2016.

- During the month, with the U.S. 10-Yr Treasury moving higher on increased inflation expectations, REITs and Utilities struggled. Energy posted its first back-to-back months of positive returns in 2017, as OPEC oil output continued to fall, coupled with a Libyan pipeline blast and a suspected leak in the North Sea's largest pipeline, sending oil prices above $60. For the year, Energy was one of only two sectors in the R2KV to finish in negative territory. Even after a difficult Q4, Health Care finished the year up 30.8%, outperforming the second best performing sector, Producer Durables, by 12.4%. Surprisingly, the spread between the best and worst performing sectors, Health Care and Energy, at 47.7%, was on par with historical norms, which has historically seen an average annual spread of 55%.

- Though better than expected, small caps trailed large cap earnings growth for the fifth consecutive quarter. With this, the 2017 growth rate for small caps has been estimated at 6.4% with sales growth of 6.7%. Estimated growth in 2018 sits close to 24.0% and 5.7%, respectively.

- For the year, only 26.3% of small cap core managers outperformed their relative benchmarks, while Value and Growth managers fared better with 57.6% and 51.7% outperforming, respectively. Even in a difficult environment, as the VIX index set a record for the calmest year, Value and Growth managers were able to add value, something which only one other style box was able to do successfully during the year; large cap value.

About Opus Capital Management

Opus Capital Management, based in Cincinnati, Ohio, is a 100% employee-owned registered investment advisory firm specializing in high-quality investments. Opus offers separate account management for public funds, corporations, endowments, foundations, Taft-Hartley and registered investment companies.

Opus’ investment solutions leverage decades of experience discovering value in high-quality companies and include:

Follow Opus on LinkedIn and Twitter, or subscribe to the Insights Blog, for regular updates and insights from the firm’s portfolio managers and research analysts.