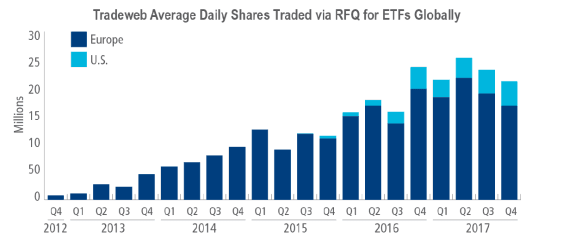

A big part of this story is the huge growth in institutional trading of ETFs and the increased prominence of electronic RFQ trading in ETFs, which allows investors to execute larger orders and access more liquidity across broader spectrum of ETF securities. Here’s a snapshot of how that’s playing out on the Tradeweb ETF platform:

EXECUTIVE SUMMARY

Institutional ETF usage is on the rise. Market participants are beginning to leverage new technology to improve their access to liquidity through disclosed, request-based platforms where multiple liquidity providers compete on price for ETF block and NAV trading.

To work larger size transactions in fixed income, institutional investors have traditionally used request-for-quote (RFQ) trading to gain:

- Optimal pricing

- Access to more liquidity

- Immediacy in execution

Through platforms like Tradeweb, investors are starting to use this approach to execute larger ETF orders, unlocking liquidity across a broader spectrum of ETF securities.

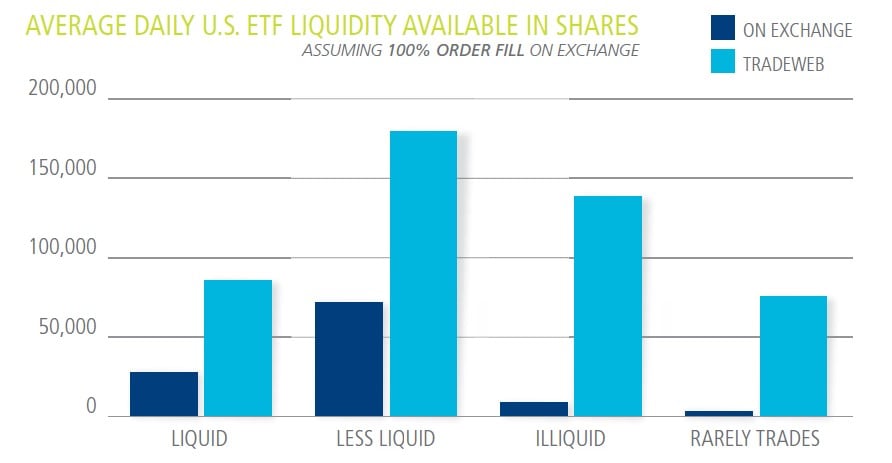

By analyzing top-of-book liquidity in securities listed on exchange v. trades executed via RFQ on the Tradeweb ETF platform, investors can access significantly larger amounts of liquidity via RFQ. For example, assuming traders are able to execute 100% of their order on the top-of-book exchange listed price and size (NBBO), Tradeweb ETF liquidity in those same securities was significantly greater in 2016:

RFQ trading also delivers an optimized workflow for straight-through-processing, and automated reporting to meet best execution and compliance requirements.

Tradeweb believes RFQ trading will accelerate the adoption of ETF trading by institutional investors by supporting market structure that delivers better access to liquidity, more competitive and transparent pricing, and an efficient workflow.

INTRODUCTION

The rise of exchange traded funds (ETFs) as cost efficient and fungible securities for the investing community has caused ETFs to become one of the fastest growing, new asset classes in financial services.

However, as institutional investors continue to increase their use of these instruments, their value and application is widening in both scale and scope.

We believe that this trend is driven by a range of factors; but specifically for institutional investors, the rise of disclosed, request-based trading has helped expand ETF market structure to enable this growth.

Adapted from fixed income trading, where large institutions often leverage a request-for- quote (RFQ) protocol to electronically solicit pricing for large, bespoke transactions, Tradeweb has observed a significant acceleration in RFQ-based ETF trading in 2016. We intend to demonstrate how this new approach to ETF trading serves as the operational linchpin that has enabled institutional investors to trade these securities off-exchange, and with increasing levels of transparency, competitive pricing, and overall efficiency than the voice-traded ETF market.

THE ENVIRONMENT

Under new regulation after the financial crisis in 2008, market participants are increasingly focused on optimizing their workflows and costs. They are improving their operational efficiency by leveraging technology, and becoming more sophisticated about engaging liquidity using different products to achieve their investing goals.

Meanwhile in the ETF space, we are seeing unprecedented growth, with over $350 billion of new investment in 2015 alone (Greenwich Associates, Global Trends in ETF Adoption, 2016). Where market conditions are driving streamlined operations in other marketplaces, ETFs are transforming into a more liquid, and more useful tool for the institutional community.

And as liquidity continues to increase across the spectrum of ETF securities, institutional investors are ever more able to leverage new products for their more specific investing needs – whether to follow a specific index, hedge other positions, or create a liquidity sleeve that mimics certain portfolio strategies.

Investors lose immediacy of execution when looking to execute a trade several times larger than the available liquidity that is priced on the exchange, and may see prices move as their order is eventually filled. This kind of market behavior is a real concern for many institutional investors, who are also committed to delivering best execution for their clients.

As a result, market participants have begun to explore new methods of execution that provide immediate access to the liquidity they need, at competitive prices, and with the same compliance and reporting benefits required to trade ETFs.

UNLOCKING INSTITUTIONAL LIQUIDITY

Many of the challenges that institutional ETF investors are facing are familiar concepts for the fixed income industry: How to access liquidity in a specific security without influencing price quality by posting a bid or listing an offer – especially when trading larger size or less liquid ETFs.

Exchange-based market structure requires a technological solution to address this issue with speed and constant operational investment. For many institutions, the related expense and risk have possibly inhibited more sophisticated investment in ETFs

on a large scale.

Principal-based trading through a more efficient, electronic medium bypasses these issues. Though most fixed income products do not trade on an exchange, electronic market structure has evolved to support immediacy in accessing liquidity with competitive pricing and an automated workflow – embodied in the multi-dealer RFQ trading protocol, pioneered by Tradeweb.

By electronifying an auction-like process for investors to buy or sell securities from their choice of market makers, the RFQ introduced more competitive pricing to the market while streamlining trade processing. Investors can request quotes for institutional and block size trades in their entirety, achieve best execution by putting market makers in competition, and satisfy their reporting and compliance needs. The two-way requestbased model on Tradeweb also allows investors to solicit prices while minimizing information leakage of their order in the marketplace.

Today, RFQ trading of fixed income products on Tradeweb has grown to facilitate more than $200 billion in trading activity daily, and a similar opportunity exists for institutional ETF liquidity.

RFQ TRADING BENEFITS FOR ETFS

Tradeweb launched RFQ trading of ETFs in Europe in 2012, helping to consolidate fragmented liquidity across the region, and provide investors with the ability to put market makers in competition. The platform grew quickly into the largest, electronic venue in Europe for ETF trading, facilitating more than $30 billion/quarter for all of 2016. However, upon launching U.S. ETF trading in Q1 2016, we are able to compare the size and pricing benefits of RFQ trading v. centralized top-of-book exchange listed price and size (NBBO) for the first time. By analyzing 2016 trade data, Tradeweb categorized comparable trades on its U.S. ETF platform and exchanges into the following ranges of liquidity:

Liquid: Over 10 million in average daily shares traded (ADST)

Less Liquid: Between 5 and 10 million ADST

Illiquid: Between 1 and 5 million ADST

Rarely Trades: Less than 1 million ADST

By mirroring all trades executed on the Tradeweb ETF platform with the liquidity available on exchange in each security, we see significantly larger amounts of executable liquidity in each of these categories via RFQ – assuming traders are able to execute 100% of their order at these top-of-book levels on exchange:

The chart illustrates the liquidity available to institutional investors across the spectrum of ETFs, irrespective of any possible price erosion. We can see that even in the most liquid ETFs, there are over 200% more shares available to trade via RFQ on average – and that RFQ trading is enabling institutional trading of rarely traded or illiquid ETFs.

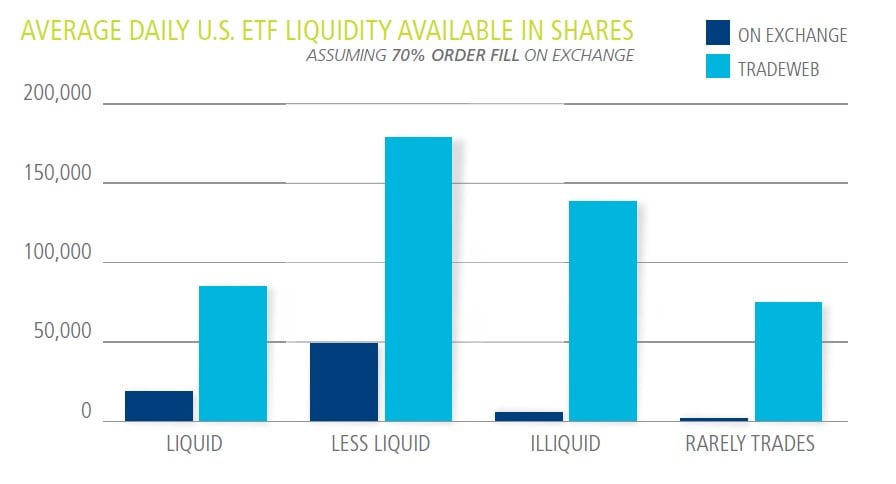

However, the disparity between liquidity on Tradeweb and on exchange amplifies when assuming a more realistic execution rate on exchange at 70% order fills. In this case, over 340% more shares are available via RFQ for liquid ETFs, and over 30 times more for ETFs that rarely trade:

The data demonstrates two important realizations when considering exchange-v. RFQ-based trading of ETFs by institutional investors:

1. RFQ trading offers immediacy to significantly larger amounts of liquidity

2. ETFs previously considered illiquid on exchange can be traded effectively via RFQ

See the full PDF below.