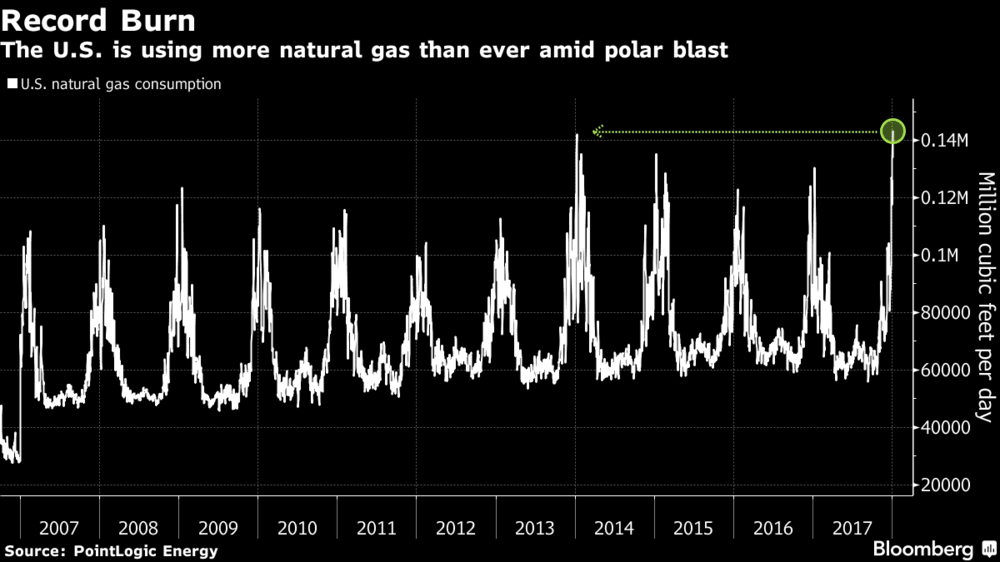

Our commute to work this morning was something brutal in Chicago: -3 degrees with a feel like temperature of -17. It’s Winter in Chicago, which means it’s that time of year where it’s painful to open the heating bill. But we all know it’s coming… Natural Gas demand goes up in the winter, and prices rise in response. As a cold front hits the majority of the U.S., Natural gas prices are back about 3.00 as the country is officially using more natural gas the even the infamous polar vortex via Bloomberg:

[REITs]America consumed 143 billion cubic feet of gas as temperatures dipped to all-time lows on New Year’s Day, topping the previous high of 142 billion from four years ago.

This might seem obvious to some; this chart shows the seasonality of commodities. For grains, there’s planting and harvesting season, and whether floods or storms impact crops, and then there’s cold weather and demand for natural gas in the winter.This chart does a good job at showing how the seasons impact Natural Gas use, but how are prices over the long term affected? Introducing Commodity Seasonality, one of the only places on the internet that displays average monthly performance for each commodity across long time periods.

(Disclaimer: Past performance is not necessarily indicative of future results)

Turns outs, demand might be up at the beginning of each year since 2007, but if you go back and look at the past 20 years, it doesn’t mean that prices are going to rise. We asked Adam Collins, the guy behind the Commodity Seasonality website and this is what he had to say about the Natural Gas chart above:

“The pictured seasonality data is for rolling a front-month position in natural gas futures based on open interest. Front-month natural gas seasonality tends to lean negative in most months. This is because the front part of the natural gas curve is typically in contango, meaning futures rise in price further out in time. This forces traders to pay up for the more expensive deferred contract to maintain long exposure. Over the long term, this constant contango has a larger influence than most short-term price seasonality.”

Quants in the Alternative Investment space will build entire strategies around this, including risk perimeters which are important in markets with large price movements. And if you think a natural gas ETF might be a good alternative, it seems no matter which one you pick, you are probably going to lose.

If you’re looking to understand the seasonality of commodity markets, we think Commodity Seasonality is a good place to start. As a side note, if you’re thinking of betting a chunk of cash on this, go read about Amaranth first.

Article by RCM Alternatives