Tesla Inc (NASDAQ:TSLA) stock slipped on Wednesday as investors and analysts started to digest fresh data on soon-to-arrive competitors. However, a new report from Moody’s Investors Service points out that the cash-related struggles that bears have mauled Tesla stock over time and again will soon spread to the rest of the auto industry as competitors up their game in battery electric vehicles (BEVs).

Meanwhile, CEO Elon Musk‘s unusual compensation plan is also raising some eyebrows as Jefferies analysts feel that it’s sending investors mixed messages.

Automakers scramble to release BEVs

Forbes notes that one of the highlights of this year’s North American International Auto Show was a surge in investments in EVs. For example, Ford is sinking $11 billion into the launch of 40 new EVs by 2022, but it’s certainly not the only one making this push. Even though EV demand is still minute at less than 1% of the global auto market, regulations are starting to make electrification a necessity for automakers as a growing number of regions set target dates for banning sales of vehicles running on internal combustion engines.

Boston Consulting Group doesn’t expect EVs to become more economical for consumers until 2025, and then the firm expects the market to explode until EVs make up half of all auto sales in the world in 2030. Excluding Tesla, which is by far the dominant player in electric vehicles, IHS Markit expects only 48,000 battery electric vehicles (BEVs) to be produced this year.

Sinking cash into electrification

The big story for Tesla stock today—other than Musk’s compensation plan—is competition as the auto market is about to be under siege by a host of BEVs all taking aim at Tesla’s lineup. Reuters collected data from all the public announcements from automakers regarding their spending on BEV development and reports that over $90 billion across the whole industry is being poured into developing competition for Tesla.

Moody SVP Bruce Clark and team highlighted the growth in spending on the development of BEVs in a note on Tuesday. They noted also that the shift toward BEVs is coming in response to emissions regulations, but they added that this transition will be a “credit negative” for the auto sector because of “the significant capital needed to support the initiatives, the low returns BEVs will generate through the early 2020s, and the hurdles to achieving broader consumer acceptance.”

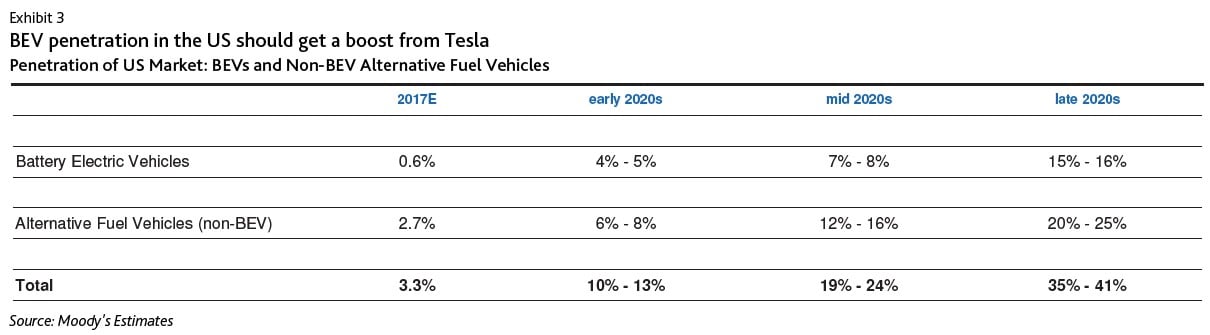

Like IHS Markit, Moody’s also expects BEV sales to remain low through the mid-2020s:

Other automakers are about to feel Tesla’s pain

Moody’s called out several struggles traditional automakers are about to face, most of which Tesla has been feeling from the start. For some, this could put Tesla’s cash problems into perspective. The firm explained that “considerable capital investment” is needed to shift toward newer EV technology, and “returns on electrified vehicles become progressively lower than on internal combustion engines.”

“The shift to electrifications will press returns that are already low,” Clark and team explained. “Moreover, the investments in electrification will occur at the same time the industry must invest in other rapidly-developing technologies—autonomous driving, connectivity, and ride sharing.”

Tesla has been dealing with these issues for years, which is why the company has been eating cash for a long time. But traditional automakers are at a disadvantage to Tesla, and not only because it has a first-mover advantage in BEVs.

One struggle Tesla doesn’t have

Unlike Tesla, traditional automakers won’t rely solely on BEVs to meet emission regulations, as Moody’s expects them to use a mix of “mild-hybrids, full hybrids, plug-in hybrids, and fuel cells” to get there. Thus, this presents an additional struggle when it comes to cash needs.

Clark and team explained that investing in “multiple propulsion technologies increases the risks associated with electrification and heightens the need for strong balance sheets.” They said that automakers are investing in multiple technologies at the same time because there is still much uncertainty regarding which type of EV technology will end up being “most successful” in balancing the needs to not only meet emission regulations but also satisfy consumers and generate “an acceptable return,” all at the same time.

Tesla remains the key disruptor

The Moody’s team also highlighted other areas in which Tesla has traditional automakers at a disadvantage. They said the company has been “acting as a disruptor in the industry” and noted three differentiating elements in its business model. First is what they call the “clean sheet approach,” meaning that Tesla’s “vehicle design, engineering, and assembly processes have been formulated from a clean sheet of paper in order to produce BEVs in an efficient manner.”

They also point out that Tesla has kept its lineup mostly at the “luxury, or near-luxury, retail price point,” and because of these higher prices, the company has been able to turn a profit on its BEVs. Meanwhile, traditional automakers have so far been selling their EVs at a loss in some cases, compensating for those losses with sales of traditional vehicles.

Moody’s expects Tesla to sell about 250,000 to 300,000 vehicles in the U.S. alone this year, which means the firm seems to be expecting Tesla to fix the production issues it has been having with the Model 3. They’re also expecting strong growth from here on out.

“Our base assumption is that the company’s long-term annual unit sales growth rate approximates 10% to 15% per year,” they wrote. “These Tesla unit sales would be additive to those sold by traditional auto manufacturers, and would help lift total BEV penetration in the US to approximately 7% to 8% by the mid-2020s.”

In fact, Tesla plays such a major role in the firm’s forecasts that if it is able to sell about 200,000 Model 3 cars this year, it would be a big enough factor to change those forecasts.

Tesla stock tumbled by as much as about 2% to as low as $343.52 in intraday trading on Wednesday.