Tax reform bad in the long-term, good in the short-term.

The United States’ new tax regime will boost S&P 500 earnings per share by 10% overall to $153 according to analysts at Bank of America Merrill Lynch.

In a report issued today, BoA’s analysts have boosted their earnings expectations for the S&P 500 for 2018 to $153 from the previously projected $139. This is slightly lower than initially projected due to already announced investment and bonus plans.

Tax Reform Bad overall says BAML

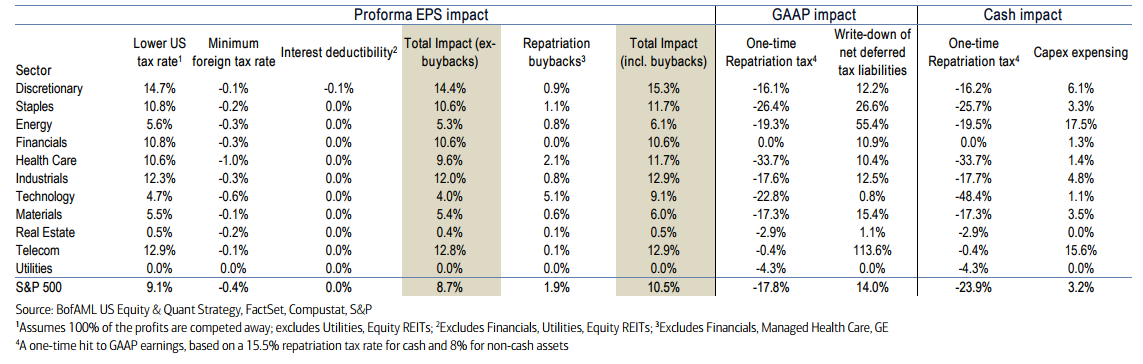

Breaking down the tax benefit, the most prominent benefit will come from the lowering of the corporate tax rate. The lowering of the federal rate from 35% to 21% will add an estimated $10 to overall EPS. On top of this, share buybacks will add another $3 per share of growth with "some modest offsets from the minimum foreign tax rate and the cap on interest deductions."

Not all sectors are expected to profit equally from the tax changes. According to BoA's analysis, companies with the highest tax rates and greatest domestic exposure stand to benefit most from the lower tax rate. Growth expectations for the Consumer Discretionary and Telecom sectors have been hiked to +14% (from +3%) and +12% (from +1%) respectively as these are the sectors that are expected to benefit the most. A full breakdown of sector benefits is shown in the table below. However, while tax reform is set to be a growth tailwind in 2018, heading into 2019 and 2020, BoA's analysts believe that the GOP's tax plan could turn out to be more of a headwind.

As the analysts explain:

"While tax reform should provide a big boost to 2018 earnings growth, there are several reasons to expect it to be a headwind to growth in subsequent years. First, economic theory suggests that higher returns should incentivize additional competition, which should have a negative impact on margins over time, especially with many traditional industries already facing increasing disruption. Second, stronger growth could result in more aggressive Fed tightening, which could eventually weigh on overall economic growth. The bull case for earnings is that tax reform and deregulation could spark a sustained pick-up in growth from animal spirits. Following the passage of tax reform in 1986, the S&P 500 posted two consecutive years of double-digit earnings growth, although that did not prevent the 1987 bear market, and actually contributed to the savings & loan crisis."

Unfortunately, no one (not even BoA's analysts) can predict the future, so whether this will turn out to be the case remains to be seen. That being said, it is difficult to deny that the tax cuts are already having an impact on both company spending and sentiment among business owners.

The 2017 Fourth Quarter Manufacturers’ Outlook Survey by the National Association of Manufacturers showed the highest level of optimism in the 20-year history of the survey among respondents with more than 90% declaring that they had a positive outlook for their company. Rather than regulation, taxes or lack of demand being cited as a headwind to growth, nearly 73% members said attracting and retaining talent and a quality workforce was their top concern.