By now it’s common knowledge that the stock market is extremely overbought by nearly any measure one chooses to use. This has led many investors to infer a weaker forward return profile than usual on the logic that the normalization in the overboughtness of the market will cause a steep and lasting pullback in stocks. When we dig into the data, however, we find exactly the opposite, that the overbought nature of the stock market is indicative of significantly higher than normal forward returns. Furthermore, the numbers are highly statistically significant. To illustrate, we’ll focus on one measure of stock market momentum, the percent of issues above their own 65-day moving average.

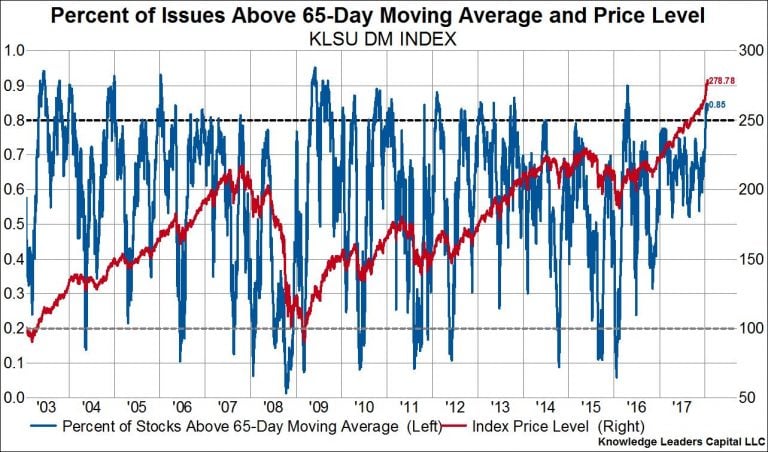

[REITs]The chart below plots the percent of issues in our developed market index that are currently trading higher than their own 65-day moving average (blue line, left axis) and then overlays the price of the index (red line, right axis). At 85%, the current reading is extremely high and in fact is in the 10th decile for all readings going back to 2000.

So what does a 10th decile reading tell us about forward returns? Well, when we compare forward returns of 10th decile readings to forward returns for all periods we find that 10th decile readings produce a forward one year return that is 7.2% higher than normal. Only readings in the first decile produce a higher forward one year return.

Furthermore, the excess return is statistically significant. In the last table below we show the t-statistics for the forward 20-day, 65-day, and one year forward returns when in the 10th decile of the percent of issues trading above their own 65-day moving average. We observe positive excess returns for every forward period as well as t-statistics well above 2, the level which indicates statistical significance at the 95% confidence level.

Could and should the market take a breather? Absolutely. Indeed, we would be surprised if it didn’t. But the historical data suggests that any pull back would be for buying.

Article by Knowledge Leaders Capital