Peak Price- to –Earnings: Cause for Caution?

2017 was a great year for global stock markets – closing the year firmly higher after drifting consistently upwards over each of the 12 months. US Equities were no exception with the S&P 500 delivering annual returns close to 20%1 and close to breaking the 2700USD level into the new year. Contrary to realised market dynamics, the cautious sentiment was lurking beneath the surface with investors growing wary of peak levels in the 12month forward P/E, the median P/E and price to sales ratios for US equities– popular absolute valuation metrics that may be misleading in the current climate. The nervous feelings have been further exacerbated by peak levels in the Shiller P/E of US equities (at a 19x median multiple), which haven’t seen these heights since the tech bubble of 2000 (Shiller P/E at a 21x median multiple).2

The US Equity Story – Unto its Own

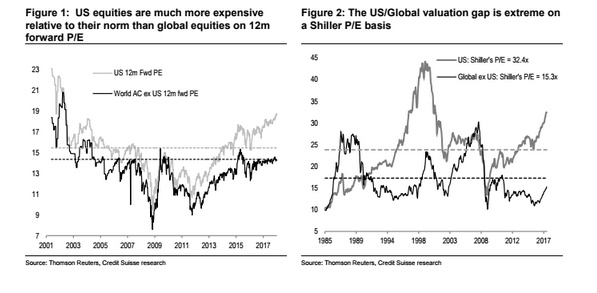

These absolute valuations are sending out an, albeit potentially misleading, message that US equities are overpriced. However, investors should be careful to acknowledge that the US equity story is not in step with the global equity story. There are certain unique factors at play in the US market - and the above valuation metrics do not accurately reflect the situation of equities markets the world over. When considering global equities excluding the US, we see a concurrency between trading values and long-term valuation indications provided by the 12m forward P/E ratios. 2 In fact, when looking at this group we see trading levels falling under the average Shiller P/E – perhaps pointing to a potentially cheap buying opportunity for non-US equity investors.

Contra – Indication from the Equity Risk Premium (ERP)

Now when it comes to US equities we must also consider that the absolute valuation framework cannot be considered in isolation – especially in the current low rate environment. Taking a more holistic look at the US economy and capital markets provides a more robust indicator of what to expect for 2018 – enter the Equity Risk Premium (ERP). The Equity Risk Premium calculates the expectation of excess return that an equity investor might expect compared to the lowest risk instruments in the market. For example, the difference in the return on the S&P 500 compared against US T-bills gives one indication of an equity risk premium. Recent research figures based on IBES consensus forecasts indicate an ERP of 5.8% and additional recent research from Credit Suisse indicates a lower ERP of 4.9%. 2 (The calculation differs depending on the choice of equity indicator and low risk instrument chosen.)

What is important to notice is that while the absolute valuation metrics point to an overheated market, poised for a downturn, the ERP indicates that there is significant upward opportunity to be captured.

Bearish investors suggest the ERP reflects unrealistic growth expectations of economies across the globe rather than real, substantiated, potential for equities to deliver returns. However, looking at the figures suggests that there are signs that the ERP has developed in real terms. If we consider that the ERP is the additional discount rate investors require above the current bond yield to make the present value of future dividends equate to market-pricing, we can see a solid basis for the ERP values indicated above.

Specifically, projections from the FOMC indicate that the trend growth rate in real GDP has been revised downwards from 2.6% in 2009 to the current rate of 1.85%. Concurrently, the 10-year TIPS yield has fallen from 2.0% to close to 0.5%.2 These sizeable declines in low risk instrument yields and trends in economic performance indicate a potential 80bps rise in the ERP over the same period – explaining part of the gap.

Overall balance is the best approach to valuation - no single metric applied in isolation can be optimally robust. However, current economic factors indicate the ERP to be a valuable addition to a prudent investor's arsenal.

Source:

1. Yahoo Finance, S&P 500 (^GSPC), Real Time Price, USD, https://finance.yahoo.com/chart/%5EGSPC/,

2. Credit Suisse, Global Equity Strategy, 12th January 2018