As with the majority of cryptocurrencies, the Ripple price has not been doing very well over the past few weeks. There may be some good news for the currency’s value, however, as it will soon be added to Dubai’s top cryptocurrency exchange, BitOasis.

A Newcomer To BitOasis

Around the end of December and the beginning of January, the Ripple price had soared to a value of $3.61, elevating the currency’s market cap to over $100 billion. However, the good times soon ended with a recent crash down to $1.04 on January 17th. While the currency has started to bounce back with a current price of around $1.30, the fact remains that the Ripple price is in far worse of a spot than it was just a few weeks ago.

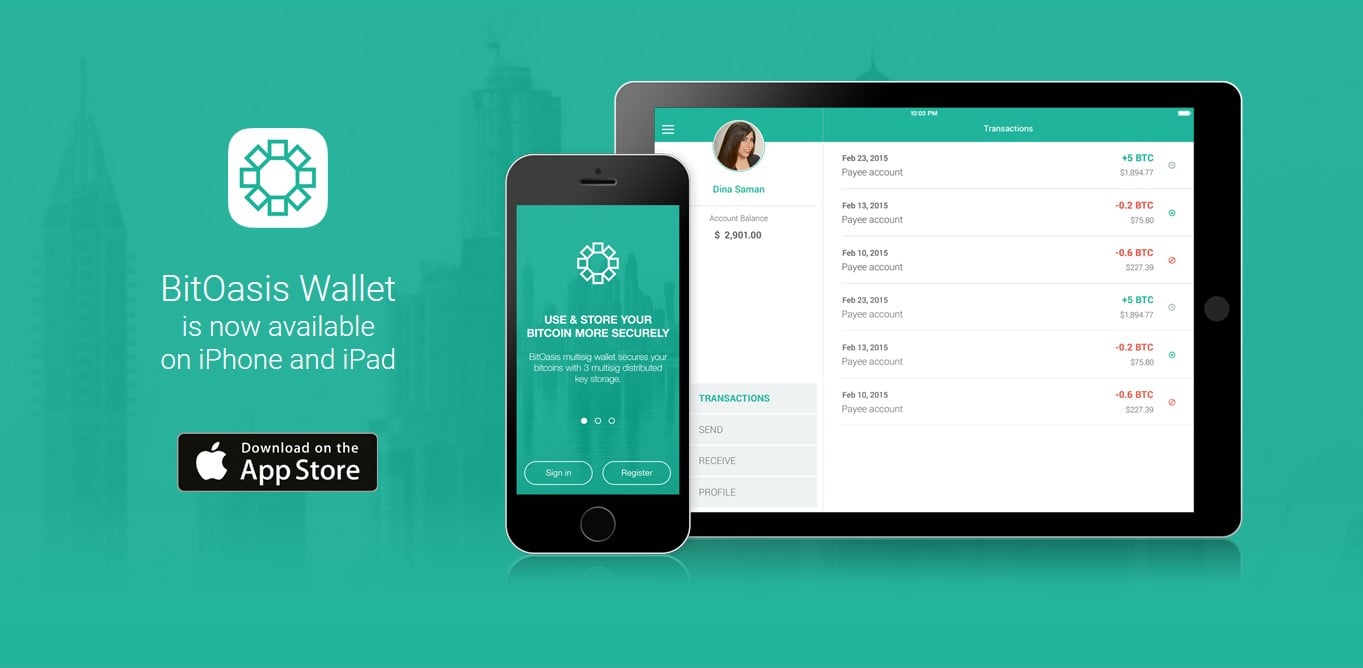

Metro reports that this little bump in Ripple price may be due to the fact that it is set to be included on BitOasis, which is described as “the Middle East and North Africa’s leading digital asset wallet and exchange.” While BitOasis is top dog when it comes to cryptocurrency exchanges in that region, it currently features only Bitcoin and Ethereum. Adding this new currency to the mix could have big implications for value, and the Ripple price has climbed slightly to account for optimism surrounding the change.

BitOasis released a statement on January 28, saying “As one of the largest and fastest-growing companies in the blockchain space in the region, we’re committed to providing our customers with a secure way to buy and sell Bitcoin, Ethereum and now, Ripple.”

The bump in Ripple price initially climbed to $1.40, but has since declined back to $1.3. This gives the impression that the price improvements may be fleeting – at least until we see what impact the actual trading on BitOasis will have on the price. Unfortunately, the Ripple price continues to suffer from the same problems that cryptocurrency at large struggles with.

The Cryptocurrency Dilemma

Cryptocurrency is a newcomer to the financial scene and is set to turn the idea of traditional investing on its head. As a form of investment without any real-world entity that determines value (such as with a company’s performance in traditional stocks), the Ripple price is determined largely through supply and demand. While cryptocurrency has a low barrier to entry and provides an anonymous and secure form of payment, the currency’s lack of regulation has led to an incredibly volatile market that is prone to massive highs and devastating lows.

While many people have earned a significant amount of money by investing in currencies like Ripple soon after its creation, it’s clear that these investments are anything but a guarantee – and regulatory bodies are starting to recognize the risk involved with trading in cryptocurrency.

The Ripple price, among others, is heavily influenced by rumors and policy. With a recent leak that suggested China would soon be charging Bitcoin farmers higher taxes, prices of the coin plummeted due to the large amount of crypto organizations that call the country home due to the low prices of utilities. This downturn was also affected by the shutdown of a major cryptocurrency exchange as well as the banning of Initial Coin Offerings. China wasn’t the only country with second thoughts regarding cryptocurrencies, with hesitation from Israel and restrictions from South Korea also having a negative effect on Ripple price and the cryptocurrency market’s value as well.

With the cryptocurrency market cap in the hundreds of billions, the fact remains that these new investment opportunities are becoming too big for financial regulators to ignore. Governments are starting to take notice of the extreme volatility, and ironically their desire to regulate is causing the prices to plummet even more. After the record high for Bitcoin and Ripple price back in late December, many first-time investors put a lot of money into the market only to see huge losses just a few weeks later. While the bump in Ripple price due to the inclusion on BitOasis may signal better times for the currency in the near future, the fact remains that the Ripple price is susceptible to huge fluctuations due to its inherent design.

A Different Take On Cryptocurrency

While the Ripple price does suffer due to a lot of the same reasons other cryptocurrencies deal with, it is rather unique in that the currency is controlled by a corporation. While Bitcoin has no clear originator, the path of Ripple is largely influenced by its parent company. Ripple has already expressed interest in working with banks and financial institutions, which may pay off for the Ripple price long term. With governments and financial regulators introducing policies that have negatively impacted the majority of cryptocurrencies due to increased restrictions, Ripple’s willingness to play ball with the established financial world may set it apart from other cryptos.

Despite these differences, it’s still very difficult to anticipate the trajectory of the Ripple price. The currency has seen immense growth over the past year and could very well continue to skyrocket in price moving forward, but the cryptocurrency scene is changing and not necessarily for the better. The inclusion on an African and Middle Eastern exchange is good news for the world’s third largest cryptocurrency, but whether this will have any sort of long term impact on Ripple price remains to be seen.