How investors compare is the topic of Michael J. Mauboussin’s latest research offering.

Comparing is a vital part of investing and life. Most investors will, at some point, have had to choose between two different companies or funds by comparison. Comparing a business to the rest of the sector is another possible scenario. In the perfect world, these comparisons would be completely objective, and a conclusion would emerge based entirely on the figures presented. However, the world is not ideal, and there will always be outside factors that impact your decision.

We must also make comparisons outside of the investing world. One example Mauboussin gives in his paper is the choice between spending and saving, where the basis of comparison is "current versus future utility."

Within the paper, Mauboussin explores the methods of comparison investors most commonly use as well as their drawbacks and limitations. He also suggests a method to help improve your company analysis and select securities.

Pitfalls Of Comparison Investors Fail To Understand

The most common mechanism we use to compare according to cognitive scientists is analogy, an "inference that if two or more things agree with one another in some respects, they will probably agree in others.” Using this mechanism requires four steps: Selecting a source for the basis of comparison; map the source to the target to generate inferences by looking for similarities; assess and modify these inferences to reflect the differences between the source and the target and finally; learn from the success or failure of the analogy.

At each of these four steps, there is scope for significant mistakes to be made. For example, at step one, Mauboussin points out that most people rely on their memory to recall analogies, but because our memories and experiences are limited, "we fail to identify proper analogies." This is the first of several failures. The second failure is "relying on superficial similarities that cause us to make faulty inferences." Put simply; this mistake stems from using incomplete analogies that lead us to draw conclusions based on correlations without understanding causality. The third failure is based on the conclusions we draw based on "whether we focus on the similarities or the dissimilarities between the source analog and the target." Researchers have found that people will select different answers from the same set of simple questions based on what we pay attention to. Just by presenting the same question in a different way can yield a different answer.

The investing world is filled full of these traps just waiting for investors to fall into. One example Mauboussin gives is the classic turnaround play:

"Say you are analyzing a company as a potential turnaround candidate. One natural way to assess the likelihood of success is to scan your memory for prior turnarounds, either successful or failed, that are in the same industry. From there, whether you focus on the similarities or the differences between your source turnaround and the target case you are analyzing can lead to disparate conclusions."

Another factor to consider and its impact on making decisions is the framing effect. Broad framing is described by psychologists as considering a risky situation in the context of your total portfolio risk. Narrow framing, on the other hand, says that we dwell in the individual risk in isolation. Narrow framing can lead to biases such as loss avoidance.

As well as an analogy, intuition is another common and rapid way to make decisions, but should not be used by investors "because few elements of business or markets are stable and linear, our intuitions are not very useful" as Mauboussin points out.

"Choose now, rationalize later" as well as "coherent arbitrariness" also both factor into decision making. I'm willing to bet that most investors, at some point or another have used one of these decisions making tactics. Choose now, rationalize later, is based on humans' tendency to make a choice today and seek evidence to support the decision later. Ultimately, this leads us to seek out information to confirm our choices as our minds seek to be consistent. This fault links with coherent arbitrariness which says "we are not very good at understanding the absolute values of things but are good at figuring out the relative differences." A great example of this is comparable company analysis where investors focus on relative value among securities rather than considering whether or not securities are trading at or near fundamental values.

Finding a Solution

The question is, what is the best way to make sure you avoid these comparison pitfalls?

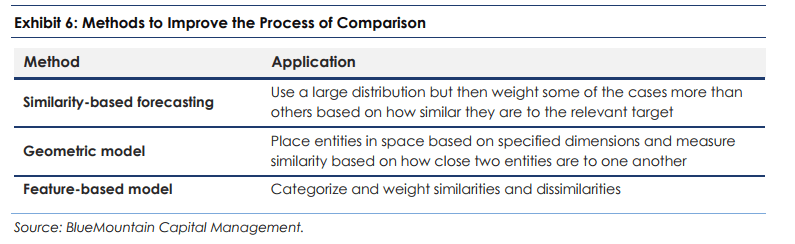

Mauboussin suggests the use of "similarity scores," which allows for the comparison of companies of all shapes and sizes effectively. Recent research shows that an approach based on similarity provides “significantly more accurate valuation estimates than industry classification approaches.”

Source: How Well Do You Compare