This year’s EY Global Private Equity Survey found that CFOs at PE firms are taking varied paths to achieve operational excellence. While some of the larger firms (AUM over $2.5 bn) are focusing on talent management and innovating their technology, many smaller firms are relying on outsourcing some of their functions.

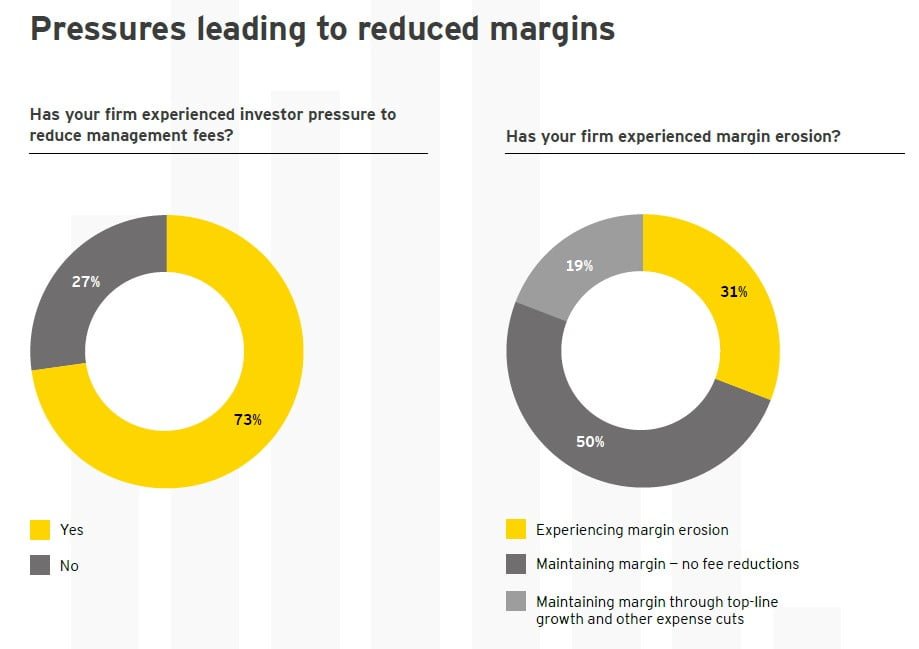

- Growing investor pressure: 73% of PE firms have experienced significant pressure from investors to reduce management fees; 31% of CFOs report they have experienced some form of margin erosion.

- Uptick in tech: 66% of CFOs said they currently invest or plan to invest in next gen technology, citing digital data delivery (37%) and advanced analytics (20%) as the main areas of focus (robotics is also poised to grow in importance)

- Tipping the talent scale: While 76% of CFOs are confident in the future leaders on the investment side, only 54% are confident in the next generation of finance professional leaders.

- Outsourcing key functions: Smaller firms (AUM under $2.5 bn) stand to remain competitive by outsourcing tactical functions without having to make significant investments in tech or talent.

- Dodging cyber threats: 58% of firms that had a cybersecurity breach said it was at least moderately serious

Executive summary

Thanks in large part to the high returns generated by most private equity asset classes, the private equity industry continued to raise capital at record levels in 2017, bringing in more than $640b in new commitments. Dealing with the increased asset levels has come with certain challenges for CFOs. Investors’ demands for higher returns at lower fees, internal and external requests for more customized portfolio analysis, and dealing with increased regulatory and compliance demands have required CFOs to re-evaluate their finance functions to manage these increased demands. In fact, the demands are only likely to intensify in coming years as the competition for private equity capital continues to grow.

In this, our fifth annual Global Private Equity Survey, we explore the different paths that CFOs are taking to make certain that their firms continue to become even more efficient in their operations as they grow. In last year’s survey, we noted that private equity firms had assembled the raw materials and developed a blueprint to address these operational challenges. Now as CFOs across the board begin taking steps to implement more scalable and efficient operations, it is becoming increasingly clear that private equity firms are seeking operational success via different pathways depending on their specific needs.

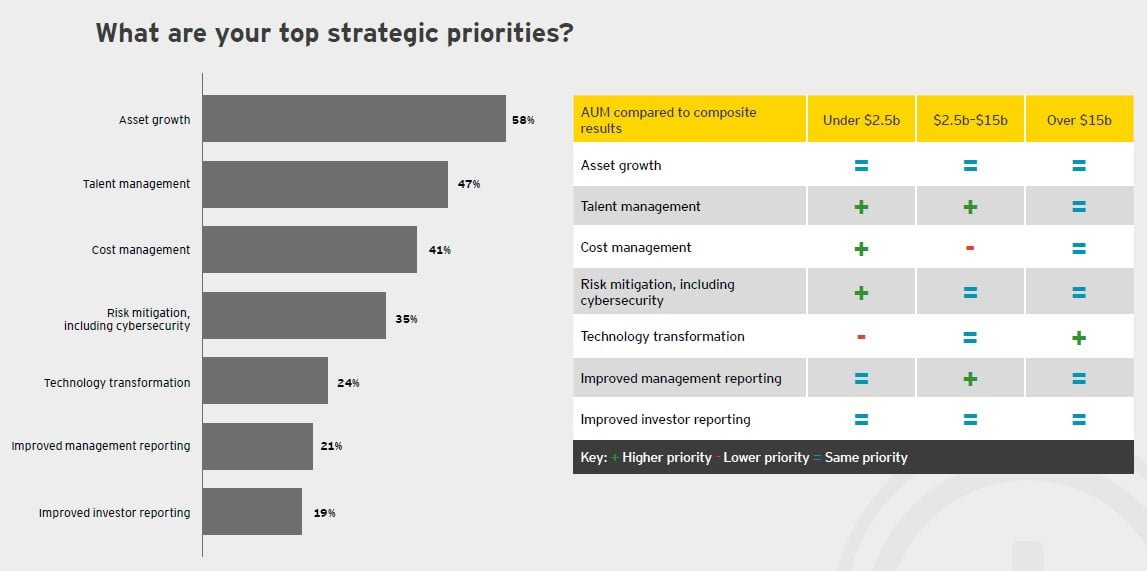

For example, larger private equity firms, those with assets under management (AUM) in excess of $15b, consider technology transformation and talent development as key priorities, while midsized firms are investing in technology where they can but are taking

on the increased workload with their people if it is deemed to be more cost-efficient. On the other hand, smaller firms, those with AUM of less than $2.5b, are more likely to invest in human capital rather than implement new technology and are more likely to view outsourcing as a viable alternative.

Regardless of size, asset growth remains the number one strategic priority across the private equity industry, with talent management not far behind. However, the relative size of the firm often dictates which path CFOs take to achieve their desired growth while trying to keep costs inline. As CFOs keep a close eye on the operational success of their organization, they largely focus their efforts in three broad categories: technology transformation, talent management and outsourcing.

Technology transformation

Admittedly, the technology infrastructure of many private equity firms lags that of their peers within the financial services industry (banks, diversified asset managers, etc.). Although larger firms are often further along the continuum in terms of planning for and implementing leading class technology, few are satisfied with where they are versus where they need to be. Even so, these larger firms are embracing the need to upgrade legacy systems while also taking the first steps to understand and invest in next-generation technology (digital data delivery, advanced analytics and robotics). Taking these steps will help private equity firms effectively leverage their talent to meet investor demands for higher returns and do so in a cost-efficient manner. On the opposite end of the spectrum, many smaller firms lack the necessary resources to implement major technology projects, so they continue to deal with the increased demands with high-performing people or through outsourced technologies.

Talent management

Most firms reaffirmed that talent management remains their top priority. As a comfort with advanced technology and quantitative skills becomes increasingly important, some firms are starting to compete for talent for particular finance roles not only with other private equity firms, but also from hedge funds, FinTech firms and even firms within the broader technology ecosystem. In response to this pressure, CFOs are focused not only on compensation, but also on building the infrastructure to provide a more structured path for retaining and promoting high performers. For example, many firms have instituted rotational opportunities within their firm, implemented formal career development planning for employees and recognized work-life balance as a critical component of talent management. Nevertheless, the overall competition for talent shows no signs of abating, and private equity firms will need to continue to employ, and continually improve, robust talent management strategies.

Outsourcing

The final path that CFOs are contemplating to provide operational success is outsourcing functions. Full-scope outsourcing is largely confined to smaller firms that lack the scale to insource key business functions. Outsourcing enables smaller firms to gain operational efficiency and remain competitive without having to make significant up-front investments in technology or talent. Our survey shows that although larger firms are outsourcing at least some fund accounting and tax functions, outsourcing has not proven yet to be a panacea, and many are not satisfied with the current solutions available to them (despite seeing the potential benefits of outsourcing). As a result, larger firms are hesitant to trust critical functions with third-party providers. As private equity firms approach larger sizes, they are beginning to think about their operating model as it relates to outsourcing for certain finance functions. In doing so, they are starting to weigh the continued investment in technology versus onboarding data to an external administrator and allowing a third party to control their valuable information. In the coming years, third-party service providers will be challenged to meet the expectations of larger firms that are, by their nature, more complex and place significant demands on their providers.

Importance of operational efficiency

Approximately three out of four private equity firms surveyed indicated that they have experienced significant pressure from investors to reduce management fees. This tracks with trends in the asset management industry as a whole. In turn, about one out of every three private equity managers has experienced margin reductions as a result of those pressures on fees. For now, half of the private equity firms have been able to stave off these fee reduction pressures either by demonstrating the value of their unique strategy or through strong historical investment performance. Although many private equity firms have maintained their current fee levels, many also reported that they are facing increasing pressure on margins due to the costs of increased regulation, limited partner information requests, asset growth and additional market information. Although half of the CFOs surveyed have reported that their firm has maintained their margins so far, 31% of CFOs have experienced some form of margin erosion and the remaining 19% have had their margins threatened but offset the pressure by strategically cutting expenses or rapidly growing top-line revenue.

Private equity fundraising reached a record in 2017, with more than 900 separate vehicles closing on an aggregate $637b in commitments, up 5% from last year, and exceeding the 2007—08 prior market peak. As a result, it is not surprising that, consistent with the prior survey results, 55% of CFOs surveyed expect to raise a new fund in 2018. Of the private equity firms that reported expecting to raise a fund in 2018, 60% expect the fund to be larger than the last fund raised.

The outlook for fundraising remains strong. Private equity investors plan to allocate more money to more managers. Over the next three years investors plan to increase the average size of private equity commitments and plan to increase their private equity manager count.

As fundraising continues at record rates, CFOs will need to address their finance functions for this record growth by evaluating the various strategies to achieve the goal of becoming operationally efficient and scalable.

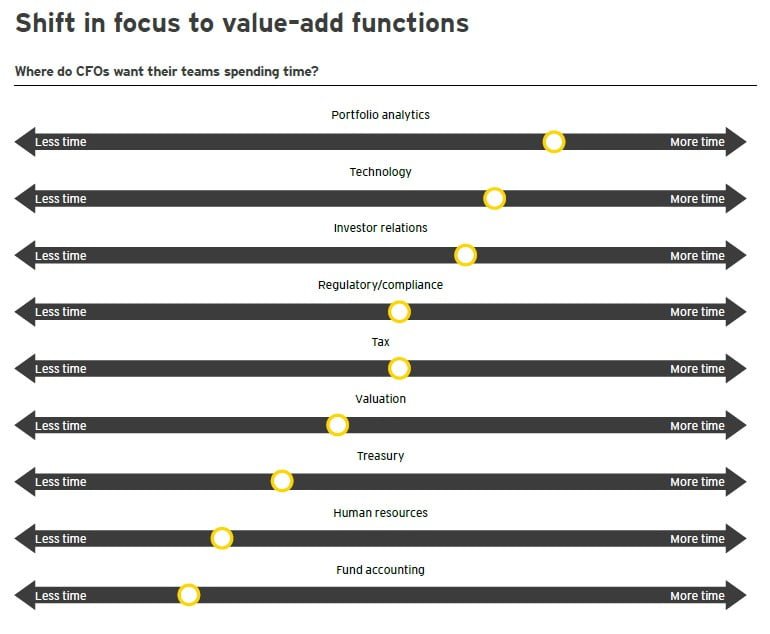

With private equity firms seeking to achieve operational efficiency through some combination of technology transformation, talent management and outsourcing, industry CFOs, no matter how large their firm, tend to agree that they and their teams would be better off spending more time on strategic, value-added activities rather than on more routine areas (that are generally viewed as cost centers). CFOs would rather have their teams focus on investment portfolio analytics and investor relations because these areas are viewed as more accretive to revenue growth and more forward looking. Routine areas such as fund accounting, treasury and human resources rarely have a direct impact on front office or value creation and tend to cover more routine, less strategic activities.

Article by EY