President Trump has long made it clear that he believes the North American Free Trade Agreement (NAFTA) is a bad deal that hurts American workers and in recent weeks, the chances of the US pulling out of the 24-year-old trade pact have risen.

Later this month, the 1994 treaty members are set to meet in Montreal for a new round of trade talks. The outcome of these talks is far from clear. Reuters has reported that Canada is increasingly convinced that Trump will soon announce the United States intends to pull out, which would also result in Mexico walking away.

Trump's negotiating team has put forward some demanding proposals ahead of the Montreal meeting including establishing rules of origin for NAFTA goods that would set minimum levels of US content for autos.

If the US does decide to pull out of NAFTA, tariffs on imports/exports will spike as high as 150% in some cases shaking up supply chains across North America. Even if the countries fell back on WTO trade rules, they would still face substantially higher taxes than they do today. As the New York Times described in an article last year:

"Tariffs on agricultural exports to Mexico are particularly costly, including a 15% tariff on wheat, a 25% on beef and a 75% tariff on chicken and potatoes. But goods like soap, fireworks, handbags and many articles of clothing face tariffs of 15 to 20%. Mexican goods would, in turn, face an average United States tariff of 3.5%...United States exporters would face an average WTO tariff in Canada of 4.2%, again with much higher rates on some goods, including 27% for beef and 18% for most apparel."

Such large changes would undoubtedly have a significant impact on all importers/exporters in all three countries. However, not all analysts believe that this would be a disaster.

Is a NAFTA exit a good idea?

Analysts at investment bank Jefferies have this week published a research note claiming that a NAFTA exit could be good news for US industry when coupled with Trump's tax cuts. Specifically, the analysts note that the NAFTA agreement " encouraged ‘off-shoring’ or the placement of US manufacturing in its neighbors due to better labor laws, cheaper exchange rates and/or lower wages." These advantages are starting to diminish, and the US is becoming more competitive:

"While the corporate sector is obviously euphoric over the tax changes, it is not often highlighted that it has improved US’s competitive position. Although the tax changes are designed to encourage company investment, the lowering of the headline tax rate is equally an incentive for foreign companies to base their operations in the US."

When lower taxes are combined with record profits and a weak dollar, this is the perfect cocktail of tailwinds for US industrials:

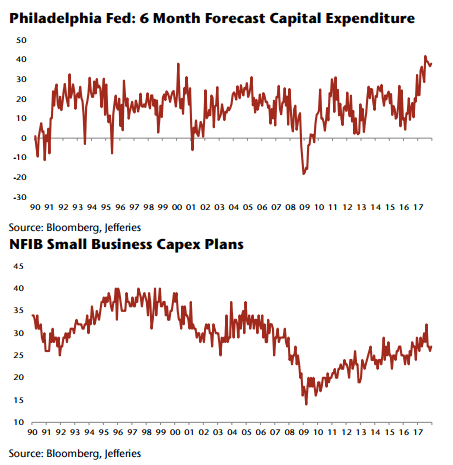

"With the US considering to leave NAFTA, new tax incentives to repatriate profits in place and the dollar weak, the ingredients for a domestic investment boom are in place. Capex intentions are strong. This should be good news for the materials sector (steel) and some lateral plays in the industrials sector."